Disliked{quote} I have read the whole thread. You are right, I do not have a way to accurately measure the max daily negative/ positive excursion on backtesting, but paper backtesting is still the best option. 30 pips stop anyway is absolutely unbelievable, and for a 5 minutes TF?! For a 1:1 r:r ratio the price will have to go down 50 to 100% for most major currencies while being it counter trend. A high ADR mostly means that the pair has finally broke through and is trading higher/lower. It is therefore total nonsense to aim for such huge counter excursions...Ignored

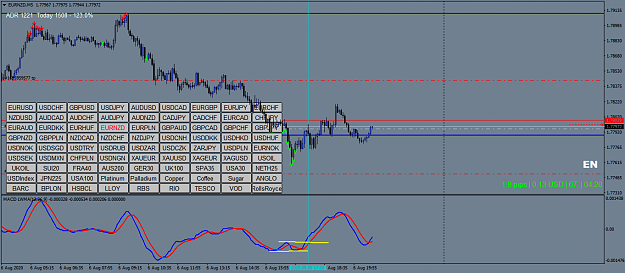

"Cut your loses short and let the winners Run"