Hello,

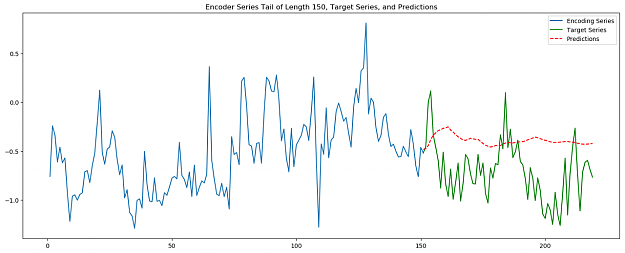

I built a deep learning model to predict forex prices. And it gave surprisingly good results at predicting the direction of the next bar mean compared to the last bar mean.

Deep learning models are able to find patterns in large datasets with multiple features. I not only gave the model the price but generated lots of features from the tick and economic news data.

The model description can be seen here:

https://medium.com/analytics-vidhya/...5ff2e0e2e966e5

The data preparation manual here:

https://github.com/sinusgamma/probab...preparation.md

If you have any questions, suggestions, please write.

I used different output forms, direct and probabilistic as well. The image below shows some probabilistic forecast steps:

(The blue and orange are forecasts of different models, and the red vertical line is the true JPY/USD (yes, not USD/JPY) price.)

https://miro.medium.com/max/618/1*GN...P3kp9Ikng.jpeg

Update:

As PipMeUp pointed out this prediction can be considered as a kind of indicator and not a trading strategy. I didn't want to state more. Building a strategy on it requires more work, and I can't claim that it will be a profitable strategy, as I didn't make one so far.

But I hope you find the approach and the "indicator" inspiring.

Thanks

I built a deep learning model to predict forex prices. And it gave surprisingly good results at predicting the direction of the next bar mean compared to the last bar mean.

Deep learning models are able to find patterns in large datasets with multiple features. I not only gave the model the price but generated lots of features from the tick and economic news data.

The model description can be seen here:

https://medium.com/analytics-vidhya/...5ff2e0e2e966e5

The data preparation manual here:

https://github.com/sinusgamma/probab...preparation.md

If you have any questions, suggestions, please write.

I used different output forms, direct and probabilistic as well. The image below shows some probabilistic forecast steps:

(The blue and orange are forecasts of different models, and the red vertical line is the true JPY/USD (yes, not USD/JPY) price.)

https://miro.medium.com/max/618/1*GN...P3kp9Ikng.jpeg

Update:

As PipMeUp pointed out this prediction can be considered as a kind of indicator and not a trading strategy. I didn't want to state more. Building a strategy on it requires more work, and I can't claim that it will be a profitable strategy, as I didn't make one so far.

But I hope you find the approach and the "indicator" inspiring.

Thanks

Only my scepticism keep me from being an atheist. Be sceptic ever.