Disliked{quote} I think there are 3 separate questions there: 1/ armed insurrection - have You considered gun ownership laws in US states? AFAIK, most gun-unfriendly states are D and gun-friendly are R. Hence, Antifa with baseball bats and bricks stands no chance against 1-2 men with AR-15, enough ammo, knowledge and willingness to use it. Cue Indonesia civil war or even Cambodia 1975 where a small minority with guns and willingness to use it massacred 100s of thousands. 2/ Martin Armstrong predicts a US stock market slingshot fairly soon, just because...Ignored

1. "politicides" that took place in Indonesia and Cambodia are not good examples in our case... totally different backgrounds and situations, from my point of view... though, if to consider gun ownership only, then it seems that R side is likely to win easily... but because it's gonna be a war between the nationalistic R-part and the globalist D-part it's likely that some other countries will also get involved into it by supporting D-side in lots of different ways... therefore the victory for either one is not guaranteed...

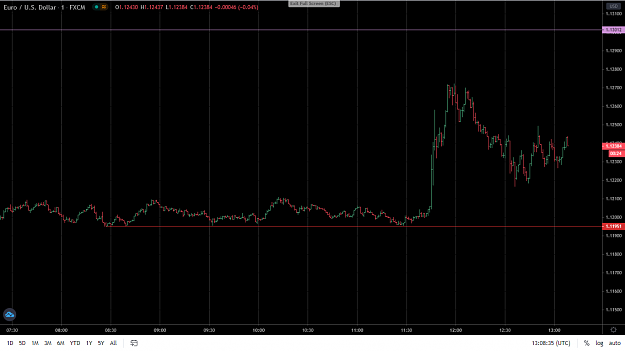

2. I do respect Martin and his views but disagree with him in regards to this very issue because of some purely technical reasons...

3. as always, the devil is in details... I'm actually not expecting that the stock market will completely disappear once and for all... though the drop to under 2008-9 levels seems to me more than likely just for purely technical reasons mentioned above... besides back then in the 19-th century all the market's conditions were totally different and the share of the financial capital in the economy did not exceed even 5%... nowadays it's over 50% and this part of the capital is no longer able to reproduce itself... so, the reason for the drop is not going to be political... it's purely economical and politics may just contribute to it...