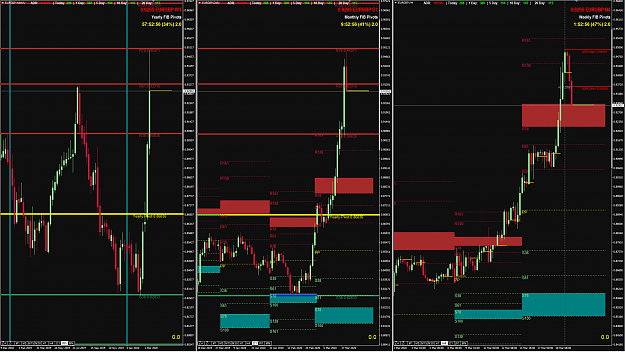

I'd like to share my reflections trading weekly pivots on the last period and and listen to your comments.

Weekly Pivot strategy has worked well for me in the last two years.

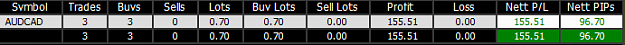

In the latest months I suffered big losses making me doubt the strategy in itself.

I've come to the conclusion that the strategy works very well when in the markets there is a "normal" volatility and conditions.

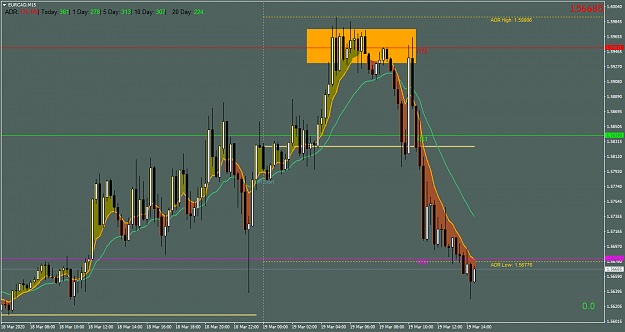

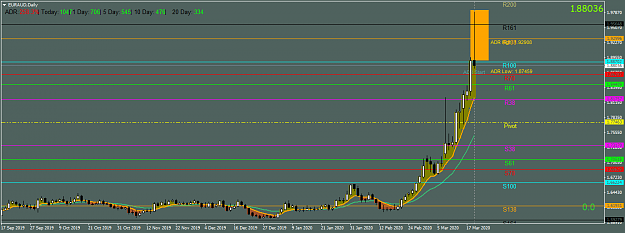

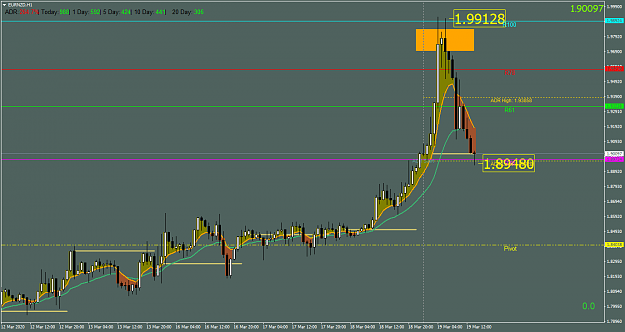

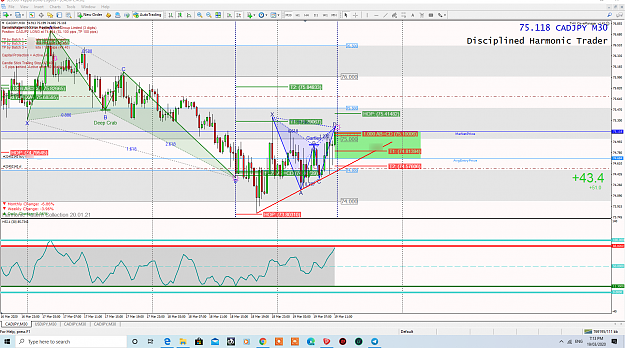

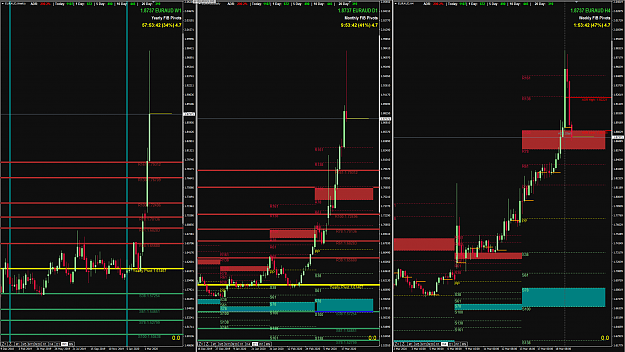

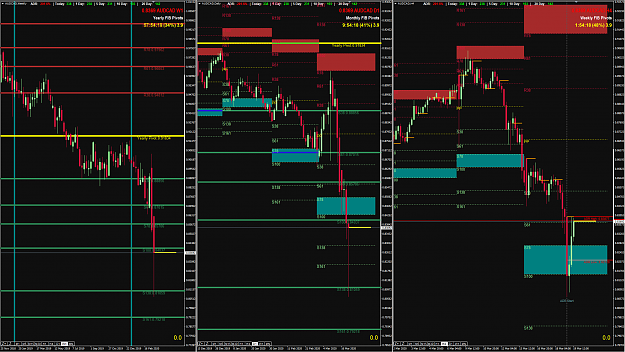

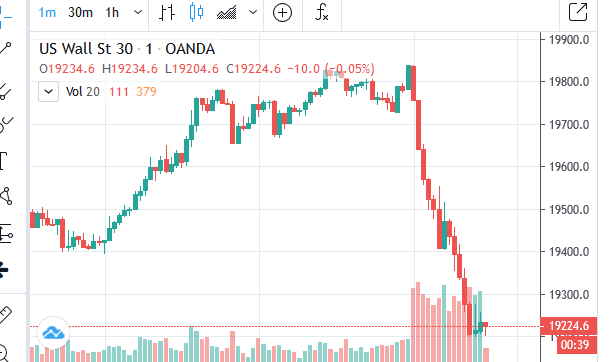

In exceptional periods like this one when there's no mean reversion at all for a prolonged time, when we see 600-700 pips candles on H4 TF for EA and more than 1,000 pips on daily for the same pair, when we have a global average daily volatility calculated on the major 28 pairs amounting to 300 pips the method is suffering big. Even applying EMAs filters I find it risky and dangerous.

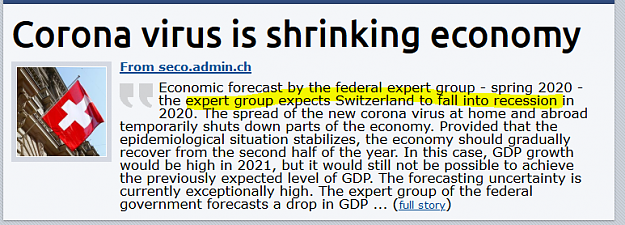

All reasonable assumptions based on fundamentals no longer work and markets are driven by other irrational forces we cannot nor foresee neither control.

The 80-20 rule says markets trend about 20% of the time and spends the other 80% grinding through trading ranges, therefore my view is that in times like the one we are living we should stop trading this method or as Davit and others already suggested lowering lot sizes and # of positions reducing activity to the minimum.

As for myself I'll reduce trading weekly pivots to the bare minimum if not abstain totally until a sort of normality will be restored.

Now is the time to pray and think of other values such as one's own health and that of the whole planet, I assure you that I live in Italy the situation is dramatic and constantly worsening.

The world has always managed to overcome these difficulties and I am sure that it will succeed even this time even if the battle promises to be very hard.

Best regards,

Bubincka

Weekly Pivot strategy has worked well for me in the last two years.

In the latest months I suffered big losses making me doubt the strategy in itself.

I've come to the conclusion that the strategy works very well when in the markets there is a "normal" volatility and conditions.

In exceptional periods like this one when there's no mean reversion at all for a prolonged time, when we see 600-700 pips candles on H4 TF for EA and more than 1,000 pips on daily for the same pair, when we have a global average daily volatility calculated on the major 28 pairs amounting to 300 pips the method is suffering big. Even applying EMAs filters I find it risky and dangerous.

All reasonable assumptions based on fundamentals no longer work and markets are driven by other irrational forces we cannot nor foresee neither control.

The 80-20 rule says markets trend about 20% of the time and spends the other 80% grinding through trading ranges, therefore my view is that in times like the one we are living we should stop trading this method or as Davit and others already suggested lowering lot sizes and # of positions reducing activity to the minimum.

As for myself I'll reduce trading weekly pivots to the bare minimum if not abstain totally until a sort of normality will be restored.

Now is the time to pray and think of other values such as one's own health and that of the whole planet, I assure you that I live in Italy the situation is dramatic and constantly worsening.

The world has always managed to overcome these difficulties and I am sure that it will succeed even this time even if the battle promises to be very hard.

Best regards,

Bubincka

Porta itineris dicitur longissima esse

18

![Click to Enlarge

Name: 2020-03-19 16_42_46-393812_ FxPro.com-Real03 - [GBPUSD,Daily]_open_long_5.png

Size: 49 KB](/attachment/image/3583579/thumbnail?d=1584632666)