Trade the value

- Post #1,561

- Quote

- Jan 28, 2020 10:28am Jan 28, 2020 10:28am

- Joined Jan 2020 | Status: Member | 2,281 Posts

- Post #1,562

- Quote

- Jan 28, 2020 10:58am Jan 28, 2020 10:58am

- Joined Oct 2017 | Status: Member | 11,534 Posts

- Post #1,563

- Quote

- Jan 28, 2020 11:02am Jan 28, 2020 11:02am

- Joined Jan 2020 | Status: Member | 2,281 Posts

Trade the value

- Post #1,565

- Quote

- Jan 28, 2020 2:17pm Jan 28, 2020 2:17pm

- Joined Jun 2018 | Status: Member | 866 Posts

You NEVER will be the person you could be, without pressure & discipline

- Post #1,567

- Quote

- Jan 28, 2020 4:04pm Jan 28, 2020 4:04pm

- Joined Jun 2018 | Status: Member | 866 Posts

You NEVER will be the person you could be, without pressure & discipline

- Post #1,568

- Quote

- Jan 28, 2020 4:22pm Jan 28, 2020 4:22pm

- Joined Oct 2017 | Status: Member | 11,534 Posts

- Post #1,570

- Quote

- Jan 28, 2020 5:33pm Jan 28, 2020 5:33pm

- Joined May 2018 | Status: Member | 483 Posts

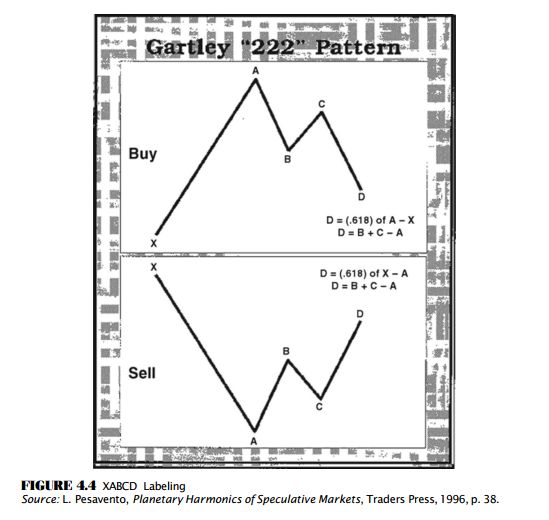

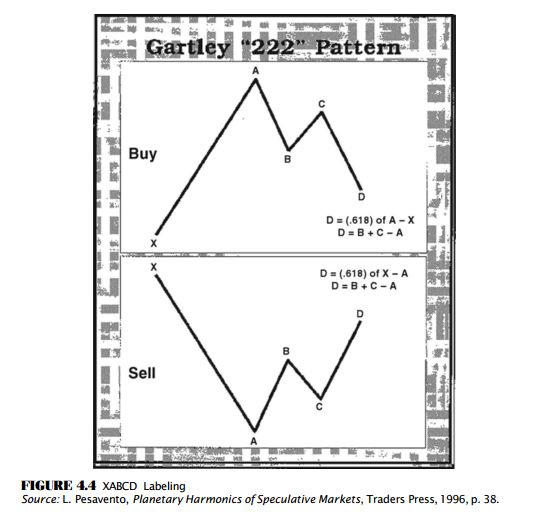

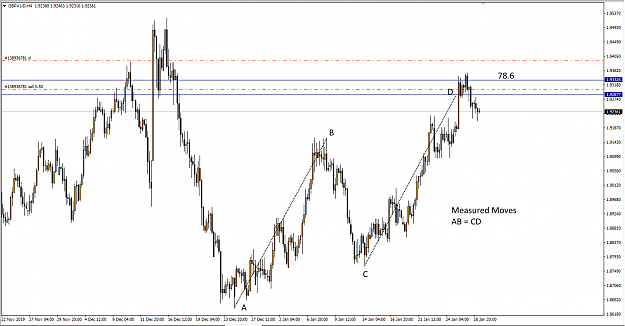

Fib Traders get it right 61.8% to 78.6% of the time. NR

- Post #1,571

- Quote

- Jan 28, 2020 7:40pm Jan 28, 2020 7:40pm

- Joined Jun 2018 | Status: Member | 866 Posts

You NEVER will be the person you could be, without pressure & discipline

- Post #1,572

- Quote

- Jan 28, 2020 7:59pm Jan 28, 2020 7:59pm

- Joined Oct 2017 | Status: Member | 11,534 Posts

- Post #1,573

- Quote

- Jan 28, 2020 8:15pm Jan 28, 2020 8:15pm

- Joined Oct 2017 | Status: Member | 11,534 Posts

- Post #1,574

- Quote

- Jan 28, 2020 8:59pm Jan 28, 2020 8:59pm

- Joined Oct 2017 | Status: Member | 11,534 Posts

- Post #1,575

- Quote

- Edited 9:45pm Jan 28, 2020 9:23pm | Edited 9:45pm

- Joined Jan 2020 | Status: Member | 2,281 Posts

Trade the value

- Post #1,576

- Quote

- Jan 28, 2020 9:41pm Jan 28, 2020 9:41pm

- Joined Oct 2017 | Status: Member | 11,534 Posts

- Post #1,578

- Quote

- Jan 29, 2020 1:49am Jan 29, 2020 1:49am

"Greed takes away the life of its owners. "

- Post #1,579

- Quote

- Jan 29, 2020 2:08am Jan 29, 2020 2:08am

- Joined May 2017 | Status: Member | 124 Posts

- Post #1,580

- Quote

- Jan 29, 2020 2:21am Jan 29, 2020 2:21am

- Joined May 2017 | Status: Member | 124 Posts