update

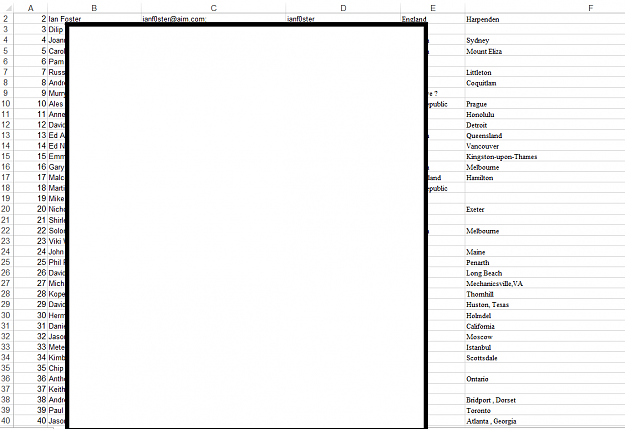

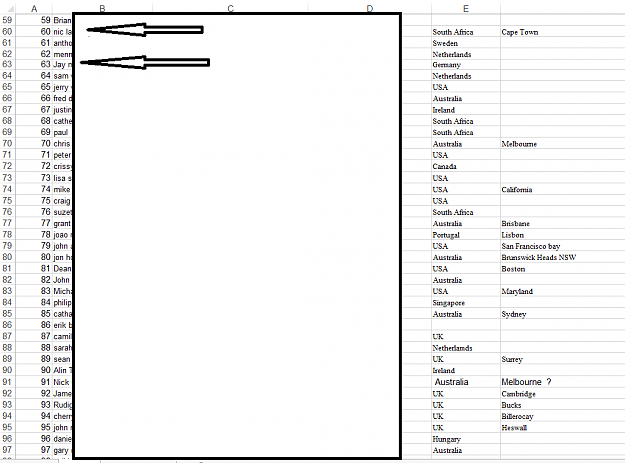

been burning the candle on getting the formula done for the base indexes which is comprised of the following indicators and aggregated into groups

consumer

been burning the candle on getting the formula done for the base indexes which is comprised of the following indicators and aggregated into groups

consumer

- unemployment

- job numbers

- housing (starts, new builds etc)

- sentiment

- retail sales

business

- sentiment

- service and manufacturing PMI (ism also for the U.S.)

- inventories

- productivity

- industrial production

inflation

- base inflation

- core inflation

- producer prices

- expectations

interest rates

central bank balance sheet

here is a breakdown of the formula with each of these on its own series. Eventually, it will have central bank sentiment and news sentiment added.

1