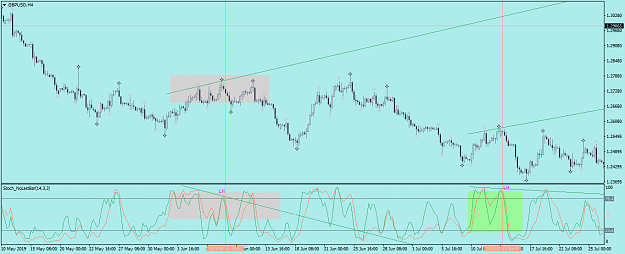

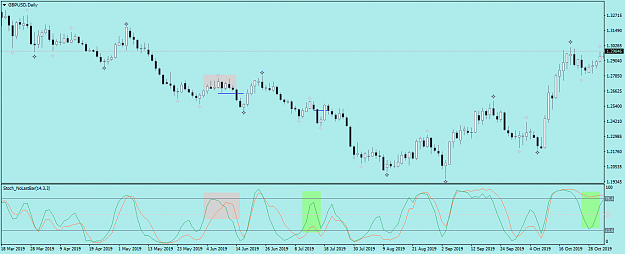

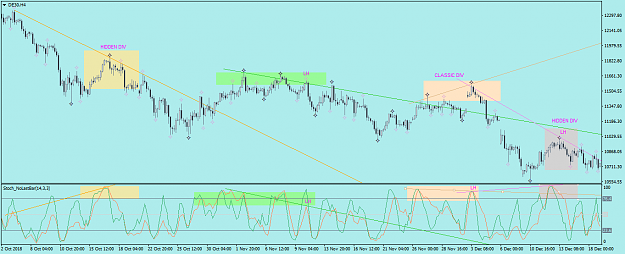

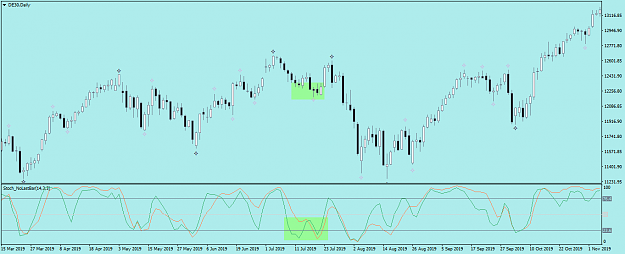

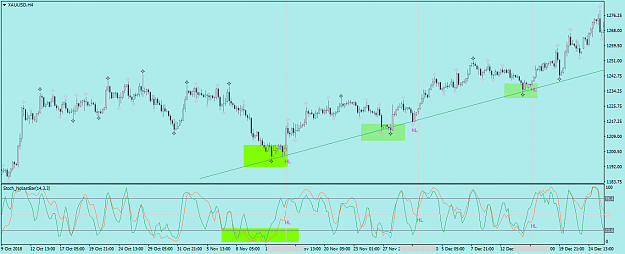

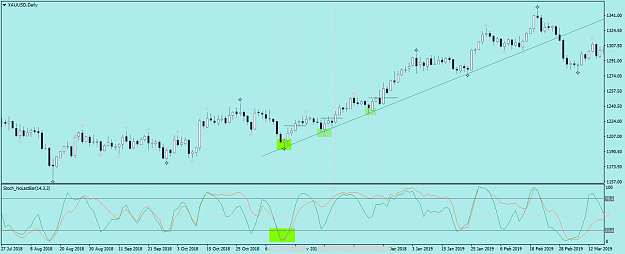

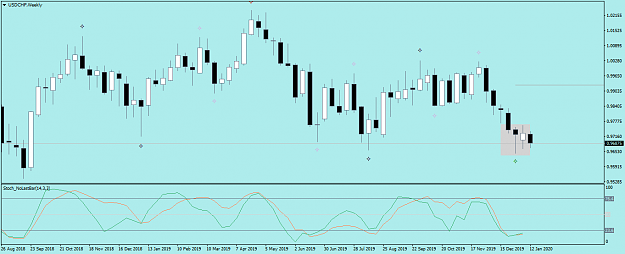

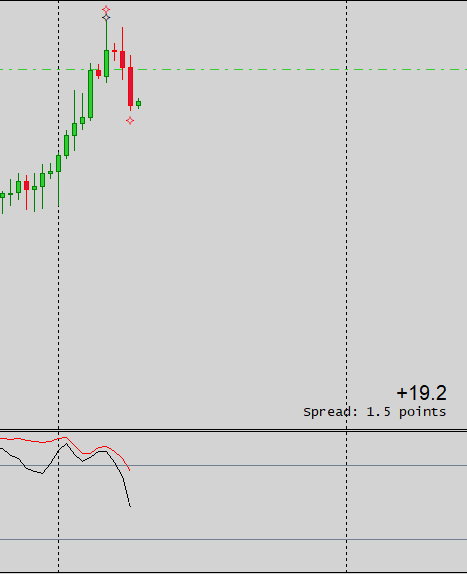

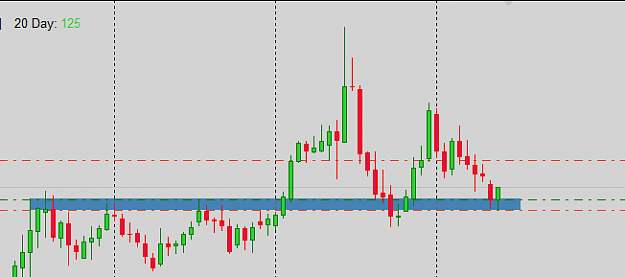

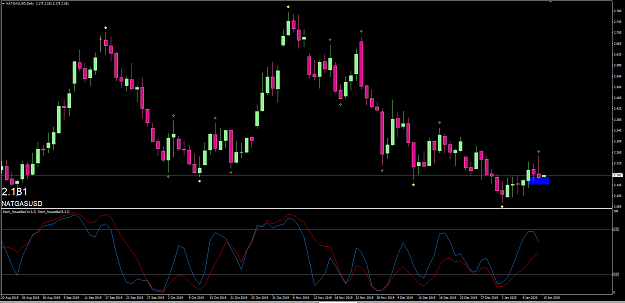

DislikedWaiting setup for gold. as you can see elasticity develops on D1 while H4 stoch is making HL so indicates price will reverse sooon. I'll wait for my V shape on D1 while looking for uptrend signs on H4 for confirmation {image} {image}Ignored

Tomorrow signing of the phase 1 agreement between China and the USA.

https://www.cnbc.com/2020/01/13/here...this-week.html