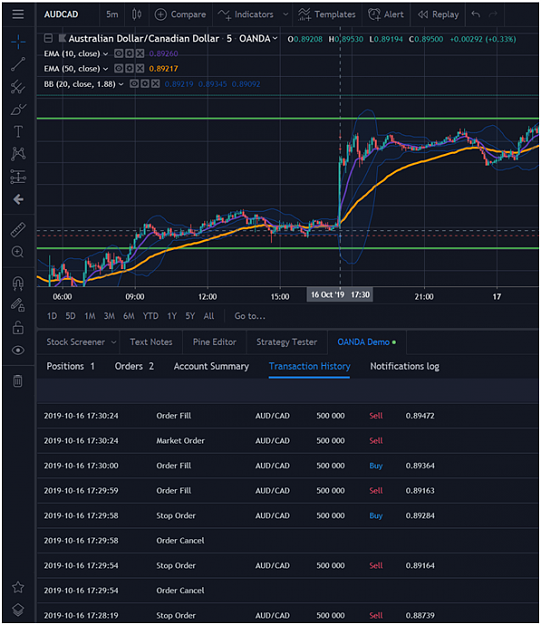

Disliked{quote} Spreads widening reactionary to events is a basic nuance. If you read the posts or actually seen the price it was the fact that the spread was LOCKED that wide for over an hour. That is in itself is extraordinary and blatant manipulation. That's why it's questionable and in terms of price offerings on a regulatory level. Did forex.com do this? They are a different type of broker, regardless doesn't make a difference what type of liquidity provided.Ignored

If they fail to widen spread, limit positions etc... at very high volatility or very low volume with spikes... they can be wiped out... It is very hard to make market with HFs... where nanoseconds are the norm... and you have legal-binding multi-million positions opened...

But if you find some real manipulation, you can always report and claim money... Also.. I do not think there were many situations like those... and for those, you can use other broker or use some other option with oanda.. they provide commission option and I am sure you can negotiate some deal at certain volume

https://www1.oanda.com/register/docs...rice_sheet.pdf

Let me say that those kinds of problems are SWEET problems

Can you afford to take that chance?