DislikedHi how would the Money management be on Forex if you have an 10000 dollar account ? also 22 percent in drawdown isnt that Little high if one likes a good night sleepBest regards

Ignored

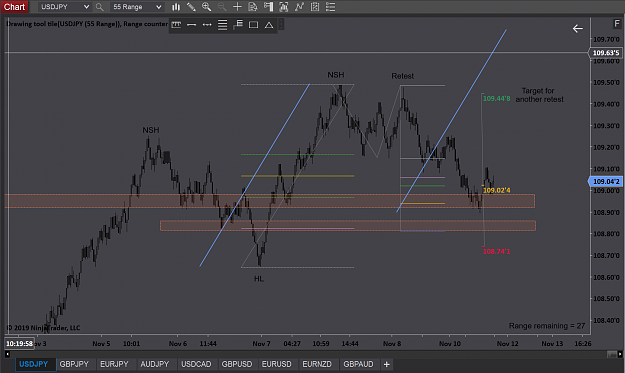

The second piece is your trade plan. If you have confidence (through testing and live trading) that over a large number of trades your plan has a positive expectancy with favorable risk:reward, a loss or drawdown does not affect you. We are dealing with an open market, where there are no guarantees that any trade will be a winner. I am sure I am going to have a string of losers following my plan exactly, as well as a string of winners. Same concept as the roulette wheel. I have seen many times where there are a string of 8 red numbers in a row. But over the course of 200 spins, we know it will be around 47.4%. As I reviewed, if I can have a 62% win rate (which was the EUR/USD example) with 1:1.5 RR, then a loss or drawdown does not matter and let's one sleep at night.

Also, if a trader is starting out, they should start small. If one can develop their trade plan (and execute it live) to earn 20 pips per day, consistently, it does not matter the size of ones starting account. A trader will be able to quickly grow it and make plenty of money trading with that performance. This is what I hope to accomplish with this Forex plan. I hope that helps...

Good work is the key to good fortune

2