those who can, do. those who cant, talk about those who can

- Post #39,901

- Quote

- Aug 23, 2019 2:43pm Aug 23, 2019 2:43pm

- Joined Oct 2008 | Status: sideline is a position | 97,250 Posts

- Post #39,902

- Quote

- Aug 23, 2019 2:47pm Aug 23, 2019 2:47pm

- Joined Jun 2015 | Status: Quo | 1,587 Posts

- Post #39,903

- Quote

- Aug 23, 2019 2:49pm Aug 23, 2019 2:49pm

- Joined Oct 2008 | Status: sideline is a position | 97,250 Posts

those who can, do. those who cant, talk about those who can

- Post #39,904

- Quote

- Aug 23, 2019 2:56pm Aug 23, 2019 2:56pm

- Joined Jun 2015 | Status: Quo | 1,587 Posts

- Post #39,905

- Quote

- Aug 23, 2019 2:57pm Aug 23, 2019 2:57pm

- Joined Jul 2014 | Status: Member | 26,344 Posts

- Post #39,906

- Quote

- Aug 23, 2019 3:07pm Aug 23, 2019 3:07pm

- Joined Oct 2008 | Status: sideline is a position | 97,250 Posts

those who can, do. those who cant, talk about those who can

- Post #39,907

- Quote

- Aug 23, 2019 3:54pm Aug 23, 2019 3:54pm

- Joined Oct 2008 | Status: sideline is a position | 97,250 Posts

those who can, do. those who cant, talk about those who can

- Post #39,908

- Quote

- Aug 23, 2019 4:04pm Aug 23, 2019 4:04pm

- Joined Jul 2014 | Status: Member | 26,344 Posts

- Post #39,909

- Quote

- Aug 23, 2019 4:11pm Aug 23, 2019 4:11pm

- Joined Sep 2017 | Status: Member | 8,899 Posts

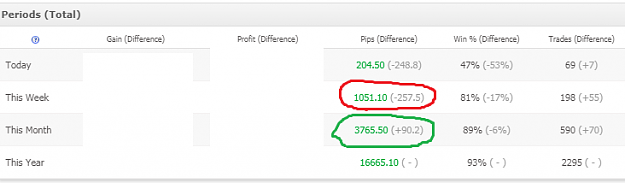

https://www.myfxbook.com/members/mitiblotch/mt5-10567385/9464692

- Post #39,910

- Quote

- Aug 23, 2019 4:30pm Aug 23, 2019 4:30pm

- Joined Oct 2008 | Status: sideline is a position | 97,250 Posts

those who can, do. those who cant, talk about those who can

- Post #39,911

- Quote

- Aug 23, 2019 4:30pm Aug 23, 2019 4:30pm

- Joined Jul 2014 | Status: Member | 26,344 Posts

- Post #39,912

- Quote

- Aug 23, 2019 4:34pm Aug 23, 2019 4:34pm

- Joined Jul 2014 | Status: Member | 26,344 Posts

- Post #39,913

- Quote

- Aug 23, 2019 4:34pm Aug 23, 2019 4:34pm

- Joined Oct 2008 | Status: sideline is a position | 97,250 Posts

those who can, do. those who cant, talk about those who can

- Post #39,914

- Quote

- Aug 23, 2019 4:36pm Aug 23, 2019 4:36pm

- Joined Oct 2008 | Status: sideline is a position | 97,250 Posts

those who can, do. those who cant, talk about those who can

- Post #39,915

- Quote

- Aug 23, 2019 4:42pm Aug 23, 2019 4:42pm

- | Joined Feb 2013 | Status: Member | 657 Posts

- Post #39,916

- Quote

- Edited 7:51pm Aug 23, 2019 4:43pm | Edited 7:51pm

- Joined Jul 2014 | Status: Member | 26,344 Posts

- Post #39,917

- Quote

- Aug 23, 2019 4:44pm Aug 23, 2019 4:44pm

- Joined Oct 2008 | Status: sideline is a position | 97,250 Posts

those who can, do. those who cant, talk about those who can

- Post #39,918

- Quote

- Aug 23, 2019 5:04pm Aug 23, 2019 5:04pm

- Joined Oct 2008 | Status: sideline is a position | 97,250 Posts

those who can, do. those who cant, talk about those who can

- Post #39,919

- Quote

- Aug 23, 2019 5:08pm Aug 23, 2019 5:08pm

- Joined Jul 2014 | Status: Member | 26,344 Posts

- Post #39,920

- Quote

- Aug 23, 2019 5:18pm Aug 23, 2019 5:18pm

- | Joined Jul 2019 | Status: Member | 26 Posts