Disliked{quote} Thanks for the support, 40PipsAlan. I am really trying hard to get people to focus on the 20% of things that give 80% of the results. Traders, for whatever reason, are flat out focusing on the wrong aspects of trading and they are consistently losing because of it.Ignored

Small losses with bigger wins. 1R:2R

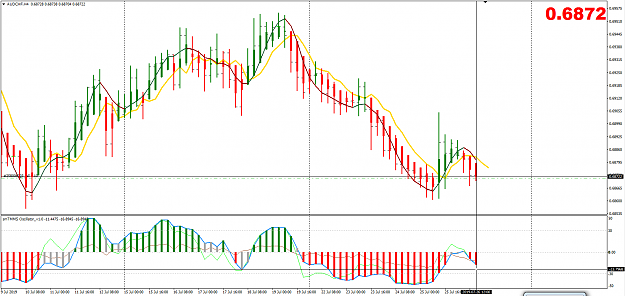

4