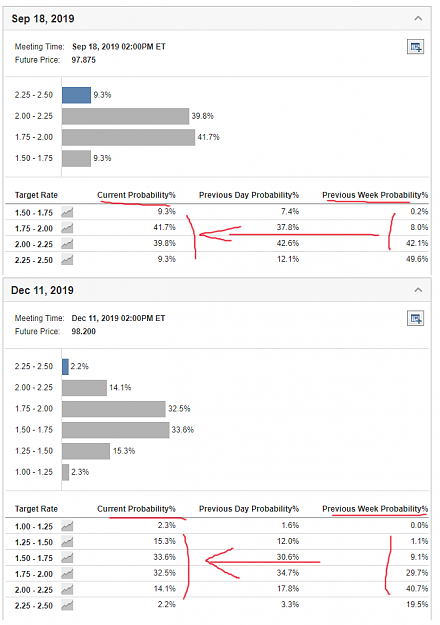

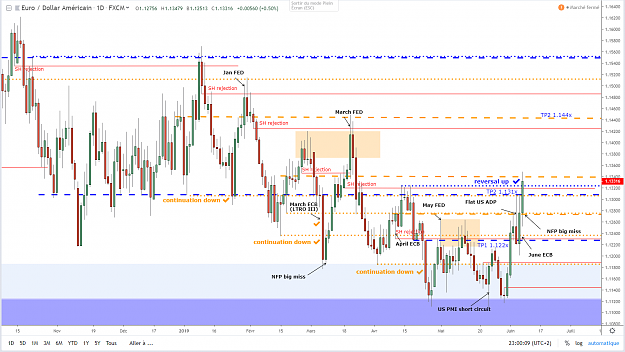

US Rates cut expectations keep rising

Probability at least 25 bp cut at Sept FOMC = 90.8%

Probability at least 25 bp cut in 2019 = 97.8%

Probability at least 50 bp cut in 2019 = 83.7%

(from https://www.investing.com/central-ba...d-rate-monitor)

Probability at least 25 bp cut at Sept FOMC = 90.8%

Probability at least 25 bp cut in 2019 = 97.8%

Probability at least 50 bp cut in 2019 = 83.7%

(from https://www.investing.com/central-ba...d-rate-monitor)