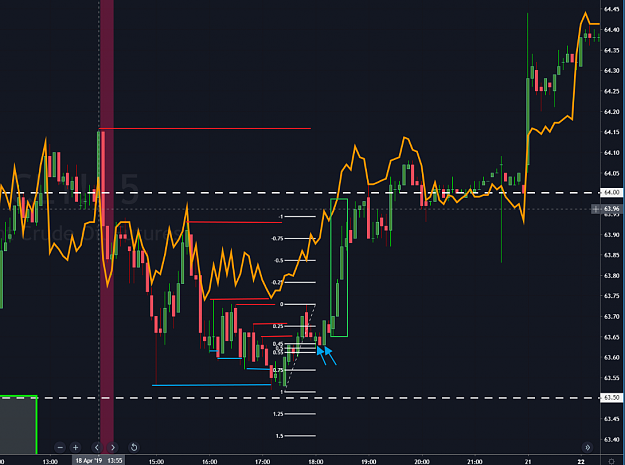

Here is a good example on CL contract

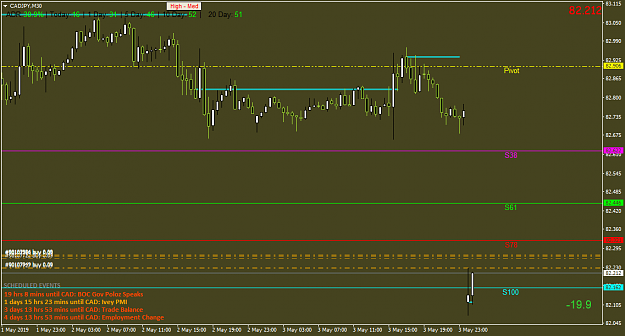

Orange line is value...

Each time price trades below a pivot (blue lines) the liquidity is bought. Look at all the paycheck levels above the market.

Once the MM detects buying above the 50 line they pull their liquidity. You can see it by the long bars, fast money move away from the balance area.

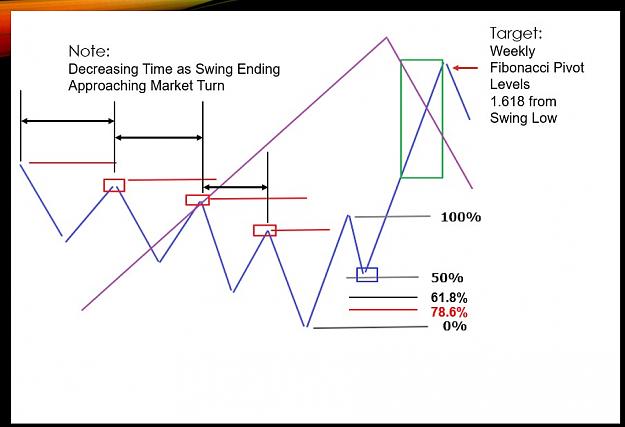

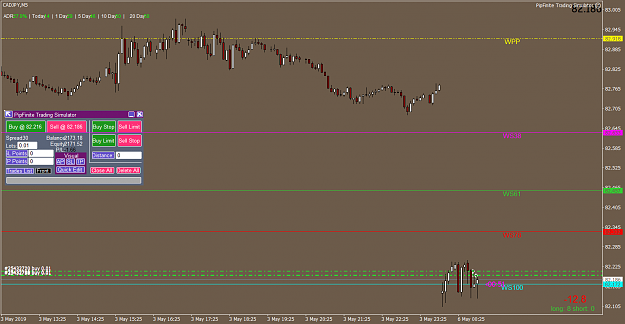

Orange line is value...

Each time price trades below a pivot (blue lines) the liquidity is bought. Look at all the paycheck levels above the market.

Once the MM detects buying above the 50 line they pull their liquidity. You can see it by the long bars, fast money move away from the balance area.

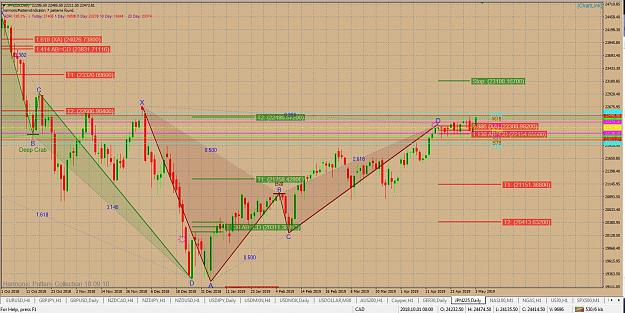

Boxing clever since 76.

11