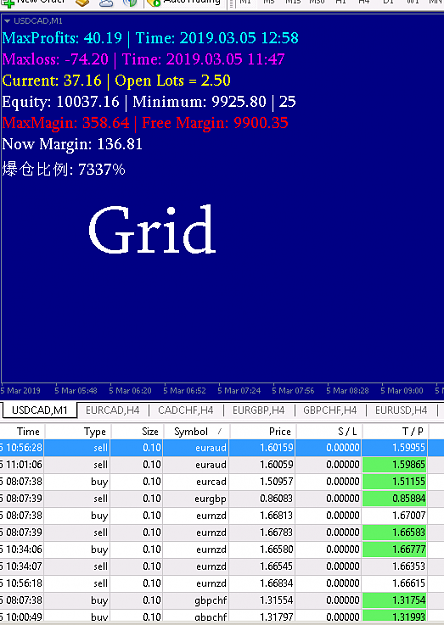

Disliked{quote} ... i said it many times now, you must be able to have a ENOUGH MONEY in your account to trade this system. Please share your result using this method! If you can not doing it, please stop posting here. Next time i will you set to ignore. It is not my problem if some can think to trade this with 1% every single trade. I gave the hint many times now. For all who now came up with the same, i will block you from now on.Ignored

My comments were not to demotivate anyone, but was sharing just my experience. It is possible that may be my method of trading was wrong in some way. I appreciate your efforts... and your intentions. Best wishes.... on your trades.

3