Hi, FXCyborg..!

I would like to thank you for putting your working in FF for everyone at free of cost and giving your precious time to read and answer the questions of traders and helping them to improve their trading.

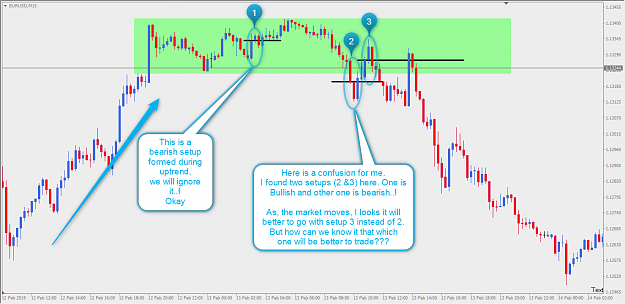

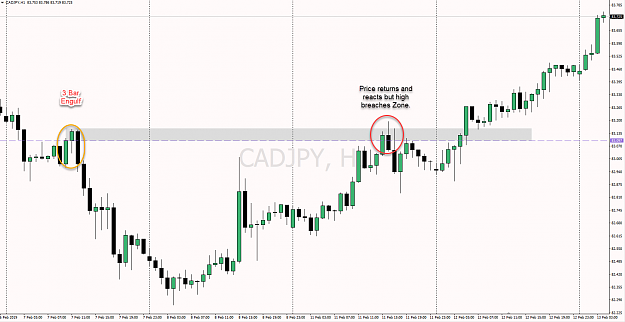

So, here I came with a question/problem, that I feel when I was observing the setups in history. Question is at the chart below

I hope you had understand that what I want to ask...!

Also, I had one more question, you are saying to trade only in the direction of trend. Will it be fruitful to take reversal trades with this setup at the places where the reversal is probable like at supply & demand zones, support & resistances etc.

Thanks again for putting your thread there.

I would like to thank you for putting your working in FF for everyone at free of cost and giving your precious time to read and answer the questions of traders and helping them to improve their trading.

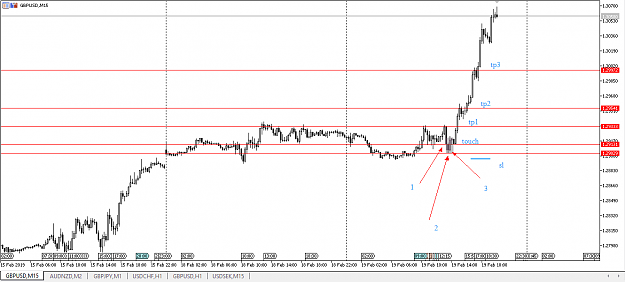

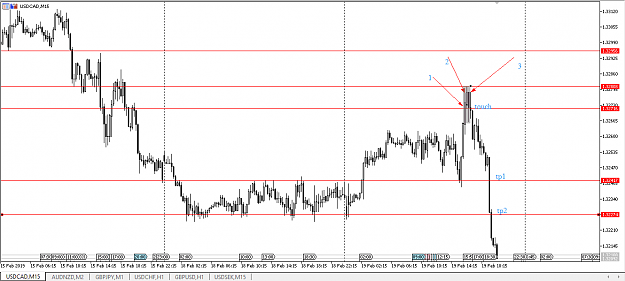

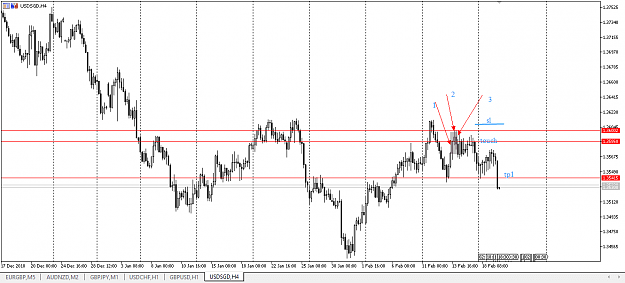

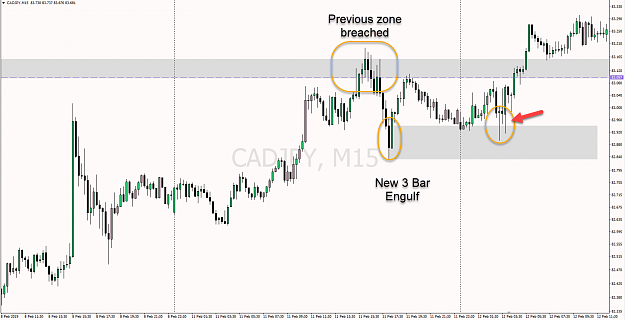

So, here I came with a question/problem, that I feel when I was observing the setups in history. Question is at the chart below

I hope you had understand that what I want to ask...!

Also, I had one more question, you are saying to trade only in the direction of trend. Will it be fruitful to take reversal trades with this setup at the places where the reversal is probable like at supply & demand zones, support & resistances etc.

Thanks again for putting your thread there.

Ahmad Hassan

2