Disliked{quote} Yes Master FXCyborg... How many cycles of pattern within pattern should one must apply? Example: Case 1: If we are trading 4HR Charts, we switch to hourly and if we find the same pattern on hourly, we trade{of course-fine tuning by still going down to 15 Min etc..} Case 2: If we are trading 4HR Charts, we switch to hourly and if find the same pattern on hourly, now switch to 15 Min TF, if on 15 Min TF we do not find the pattern, do we scrap the trade? Is it case 1 or case 2? ThanksIgnored

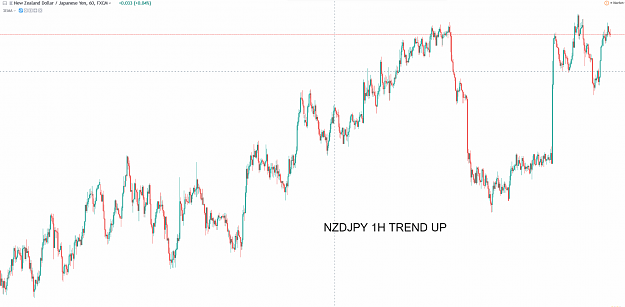

"find the setup within the setup"

Advanced Price Action Trader -MY STUFF IS FREE! JOIN ME!

2