Hi,

Here's a review of trades I did over four sessions

Session 1

10 pending orders placed

2 wins, 3 losses, 5 pending (deleted)

Net 80 pips

Risk to reward 1:4 and 1:5

Session 2

9 pending orders placed

4 wins, 1 loss, 4 pending (deleted)

Net 114 pips

Risk to reward 1:3

Session 3

6 pending orders placed

3 wins, 2 losses, 1 pending (deleted)

Net 152.4 pips.

Note: One trade did 90 pips on a 1:2 so lower lots

Session 4

9 orders placed

5 wins, 1 loss, 3 pending (deleted)

Net 407.6 pips

Note: DOW trade left to run, three trades at 1:3 one trade at 1:4

Comments:

Total pips 754

Start looking for trades after London open

I spend an hour placing trades then close computer down and do something else

Check trades the next day

Clarification:

The sessions above were all this past week looking for trades after the London open

754 pips is exceptional, I had two trades on the US30 (DOW).

When the DOW gets a direction, it can run hundreds of points in a matter of hours

The two DOW trades were taken off the M15, targets were set off the H4

The balance of trades were currency pairs on various time frames

I usually place from 5 to 12 pending orders a session, all trades are "set and Forget"

Some things to consider, positive expectancy, risk to reward and it's a numbers game

Example:

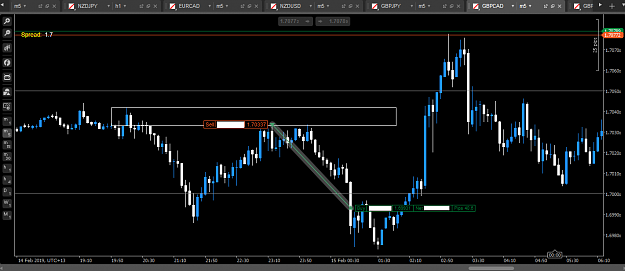

I'll share a screen shot for what it's worth, GBP/CAD on M5 risk to reward is 1:4 (set and forget)

All the best

D...

Here's a review of trades I did over four sessions

Session 1

10 pending orders placed

2 wins, 3 losses, 5 pending (deleted)

Net 80 pips

Risk to reward 1:4 and 1:5

Session 2

9 pending orders placed

4 wins, 1 loss, 4 pending (deleted)

Net 114 pips

Risk to reward 1:3

Session 3

6 pending orders placed

3 wins, 2 losses, 1 pending (deleted)

Net 152.4 pips.

Note: One trade did 90 pips on a 1:2 so lower lots

Session 4

9 orders placed

5 wins, 1 loss, 3 pending (deleted)

Net 407.6 pips

Note: DOW trade left to run, three trades at 1:3 one trade at 1:4

Comments:

Total pips 754

Start looking for trades after London open

I spend an hour placing trades then close computer down and do something else

Check trades the next day

Clarification:

The sessions above were all this past week looking for trades after the London open

754 pips is exceptional, I had two trades on the US30 (DOW).

When the DOW gets a direction, it can run hundreds of points in a matter of hours

The two DOW trades were taken off the M15, targets were set off the H4

The balance of trades were currency pairs on various time frames

I usually place from 5 to 12 pending orders a session, all trades are "set and Forget"

Some things to consider, positive expectancy, risk to reward and it's a numbers game

Example:

I'll share a screen shot for what it's worth, GBP/CAD on M5 risk to reward is 1:4 (set and forget)

All the best

D...

22