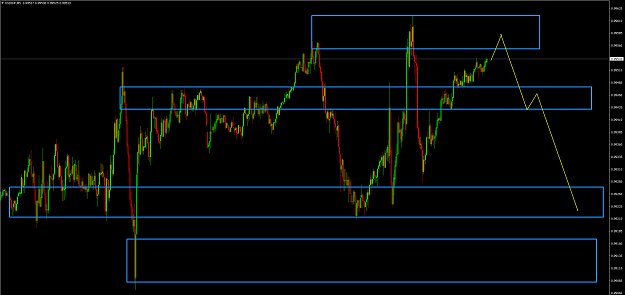

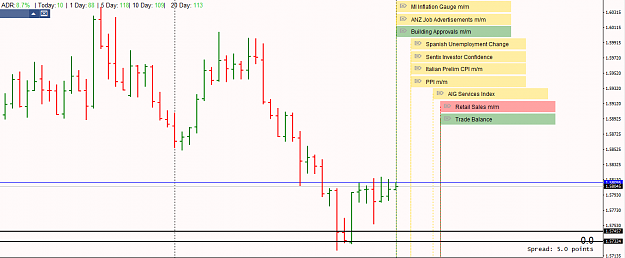

Possible move on USDCHF. If it breaks and goes above 0.9963, we wait for the pullback and will be looking for buy opportunity. As for now I am looking at that level, and if it goes back down im selling.

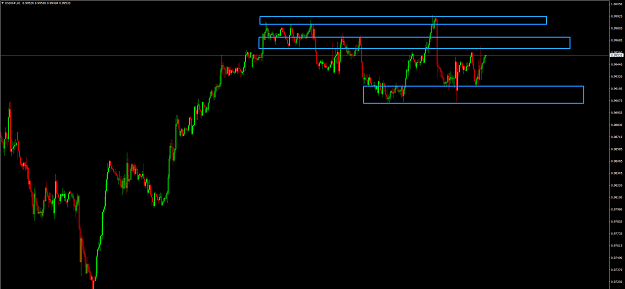

EURUSD chart also on here.

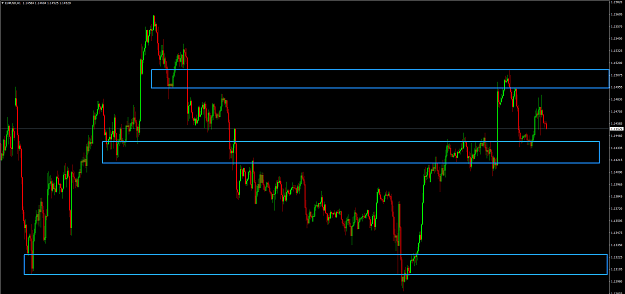

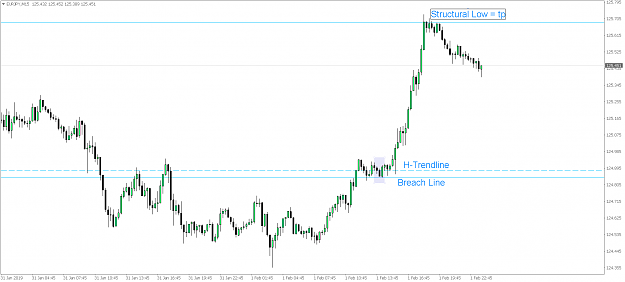

EURAUD.

EURUSD chart also on here.

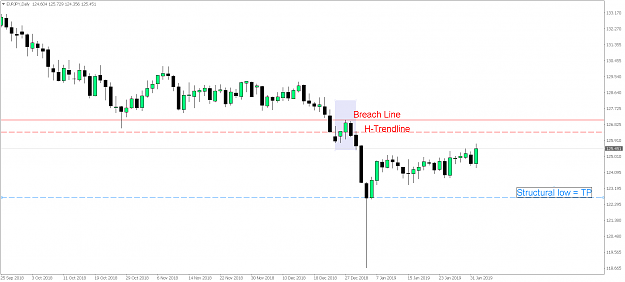

EURAUD.

2

3