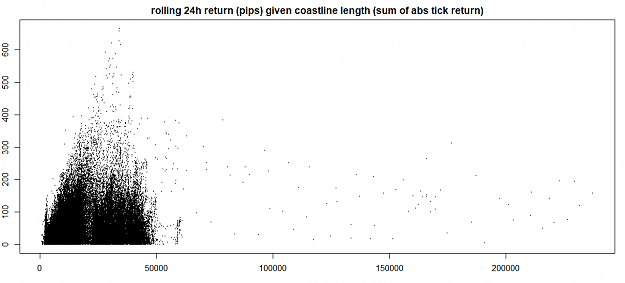

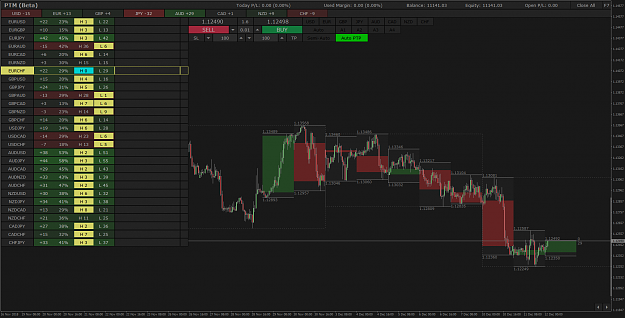

DislikedNow, here comes the real question! Where the total length of price movement is longer? During range, or during trend? And why this even matters? What happens when you know precisely the total length of price movement for all time frames and all markets all the time?Ignored

What happens? I'm not sure...

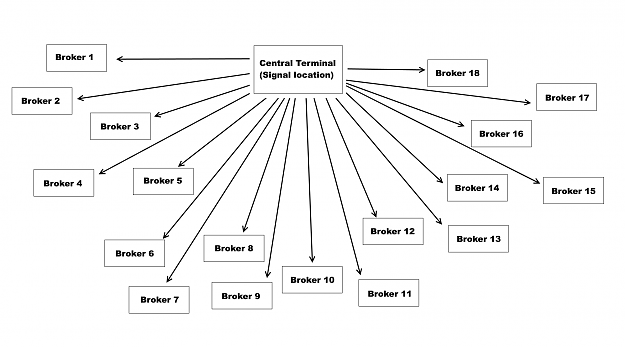

Total length will increase if you go into smaller timeframes, but if you calculate this for all markets and all timeframes what happens?

Your CPU will be busy, but that's not the correct answer i guess.. I'm in the blind here, I don't know what happens.

Persistence will get it. Consistency will keep it.

1