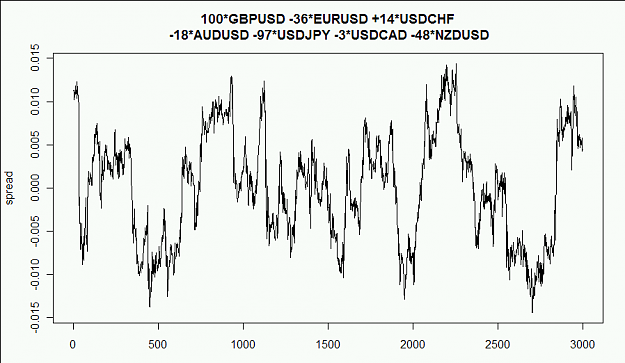

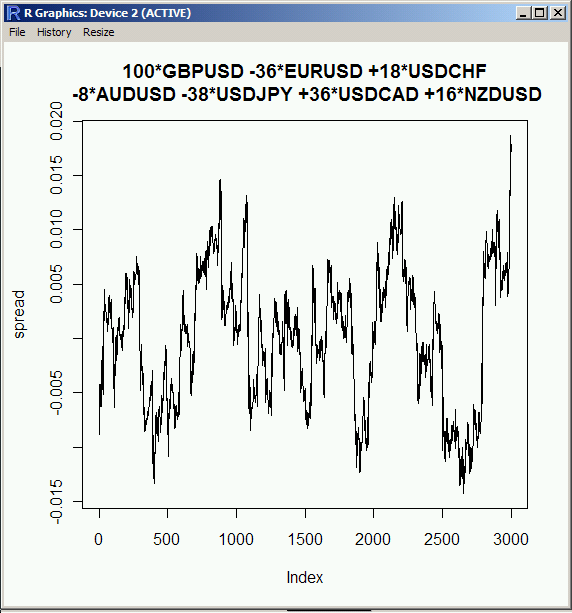

Has anybody successfully (with profit) tried to trade things like this:

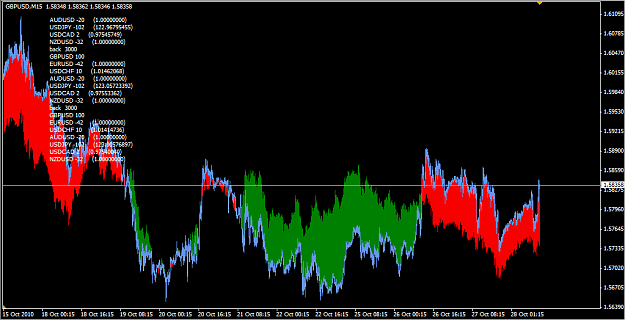

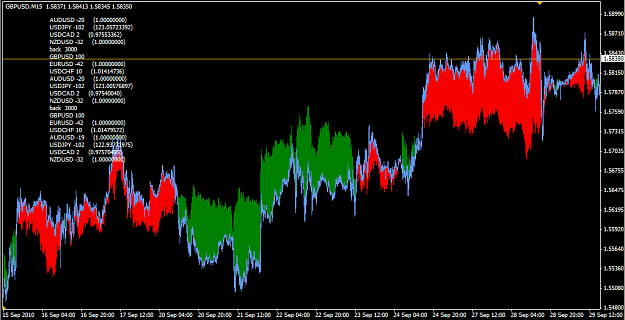

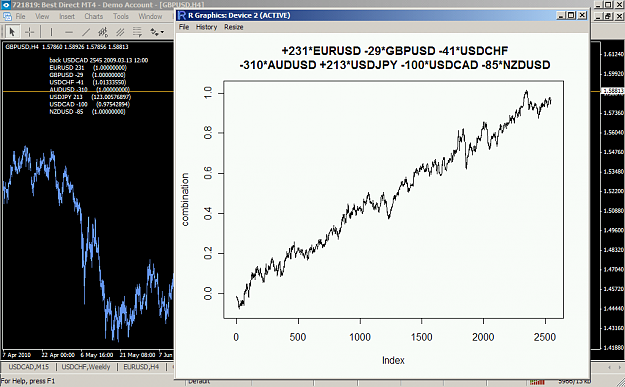

I have opened a demo short on the above synthetic instrument (each point is an M15 candle, the numbers should 1:1 translate to oanda units if I didn't get the calculation wrong!¹) to see how this behaves. It seems I can always find such nicely ranging combinations with a simple linear regression. The question is only: will it move through the range one more time or will it explode now because I have seen it?

______

¹) [edit:] The numbers are indeed wrong.

I have opened a demo short on the above synthetic instrument (each point is an M15 candle, the numbers should 1:1 translate to oanda units if I didn't get the calculation wrong!¹) to see how this behaves. It seems I can always find such nicely ranging combinations with a simple linear regression. The question is only: will it move through the range one more time or will it explode now because I have seen it?

______

¹) [edit:] The numbers are indeed wrong.