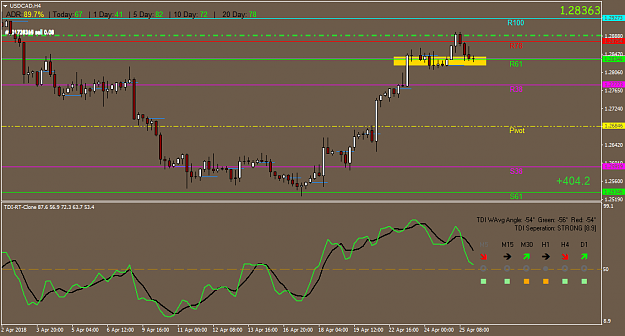

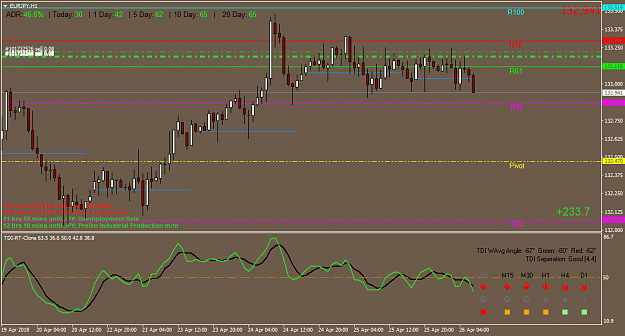

Disliked{quote} Hello Davit - I am a newcomer to your thread, and have been taking time to review the postings and all the information provided (although I haven't been able to get through all 887 postings yet) There definitely appears to be some very good information here which I am still trying to absorb. This one suggestion on tracking EJ was definitely a good one - since shortly after it did reverse short of R100. It seemed to go right past R78 on the way up. If you don't mind me asking, could your share what information led...

Ignored

It does not appear to be good information here there is good information here! After 2 years and after thousands of successful trades the If part is proven.

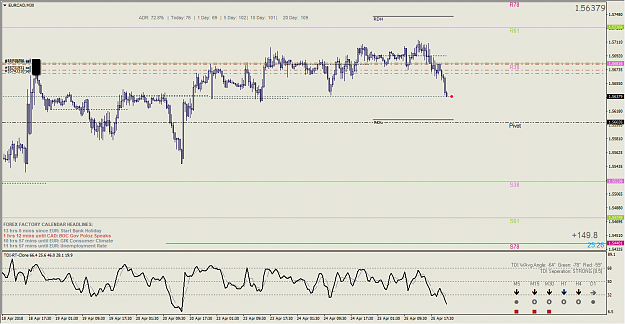

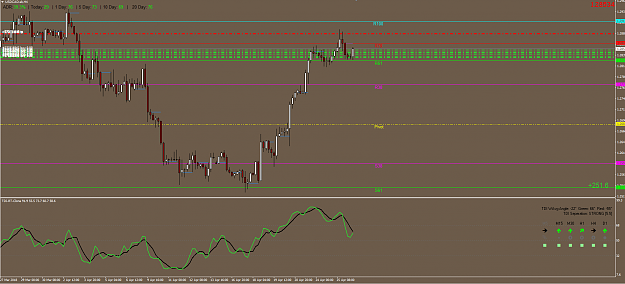

On EJ

normally on this forums some traders fill in lot of BS as though that was a catalyst and fulfilled their analyses.Lot of it is hogwash.

Everything is here on 1st page

Five fundamental truths:

1. Anything can happen.

2. You don’t need to know what is going to happen next in order to make money.

3. There is a random distribution between wins and losses for any given set of variables that

define an edge.

4. An edge is nothing more than an indication of a higher probability of one thing happening

over another.

5. Every moment in the market is unique.

– Mark Douglas

Technical price patterns aren’t designed to tell us what ‘will’ happen next…

Technical methods of any kind, price action included, are not designed to tell us what a market will do next. As Douglas says, they are designed to help us put the ODDS of success in our favor over a SERIES of trades. There are some profound psychological implications that go along with this fact…

The outcome of any particular signal is unique and random. There’s no way to know in advance the outcome of any particular signal or the sequences of wins and losses or over a series of trades. In other words, the nature of trading is random.

Douglas goes onto to describe something that may be a little difficult to understand at first, but that is critical for you to grasp if you want to make consistent money trading:

By accepting the random nature of trading I can produce consistent results…

Now, on the surface, it seems contradictory to say you can produce consistent results from something that is random in nature. However, let’s dig a little deeper…

Technical methods and patterns will give a trader the same advantage a casino has over any individual player. A casino has an “edge” for every game they offer. What a casino knows is that whilst any singular instance of someone playing their game might result in the player winning money or even hitting the “jack pot”, due to the edge they hold, over-time and over enough series of events, the casino will make a profit, and a large one at that. Remembering this point will help you make the transition from thinking in ‘certainties’ as I put it, to thinking in probabilities as Mark describes and as you should be thinking.

If you don’t integrate the randomness principle, you will find trading is the most frustrating endeavor you can undertake. You can only generate consistent returns by understanding that each trade is random and unique, and then taking that information and using it to control yourself after each trade. Do not get hung up on your last trade. Instead, focus on consistently trading your method over and over.

Frustration comes from expecting something our method can’t do. Technical methods find and identify patterns in collective human behavior, the problem is, the outcomes don’t always correspond with the pattern on a trade by trade basis. There doesn’t have to be a relationship with the outcome and pattern. There is no guarantee that this trade will be the exact same result as the last one, even if they look the same. Rather, the method only tells us that IF we use it consistently, then over a series of trades, we should be profitable.

Think in probabilities, not certainties…

Perhaps the point Mark Douglas is most famous for drilling into traders, is that you need to learn to think in probabilities.

We did discuss this a little earlier, but it’s critical to understand that there’s a random distribution of wins and losses over sequence of trades. Traders who learn to think in probabilities do not experience the mental ‘trauma’ like those traders who haven’t learned to think in probabilities because they are not ‘expecting’ a winner on any given trade like those who don’t think in probabilities. Learning to think in probabilities releases your expectations from trades because you are focused on the results of the overall series of trades, not on the result of any given trade.

If you have a weighted coin that will be heads 70% of the time, you still don’t know the sequence of heads and tails, all you know is OVER TIME 70% of the flips will be heads.

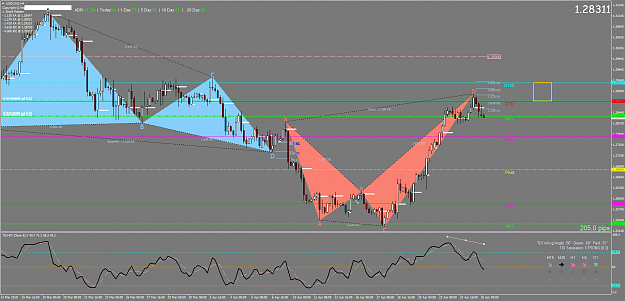

Once you read this take a break drink a coffee then realize the meaninglessness of your question.I only placed a trade that fit my EDGE that's all

Did I know it would be a winner? No

3. There is a random distribution between wins and losses for any given set of variables that

define an edge.

In trading, you have to be defensive and aggressive at the same time

17