Forex 10 Bar Strategy Test

Currencies traded

USD EUR GBP JPY CAD AUD NZD

Number of pairs traded: 21 Timeframe: hourly

Test Results:

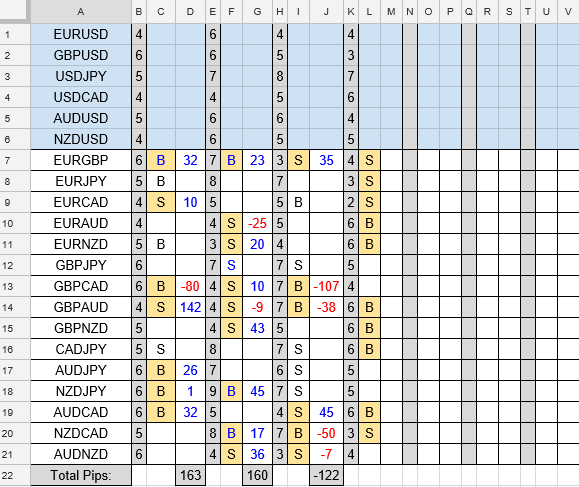

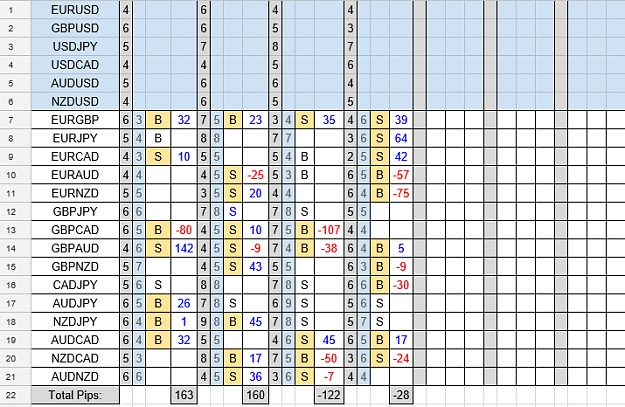

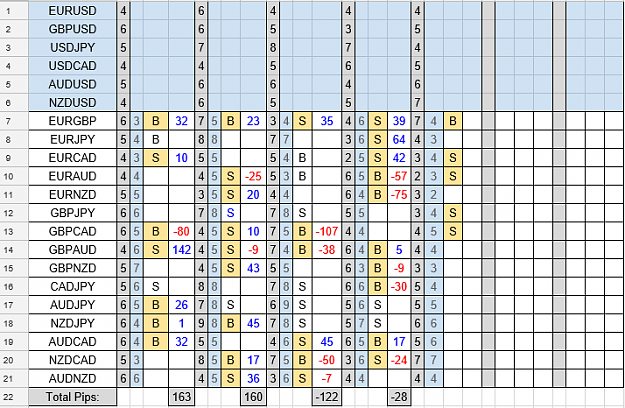

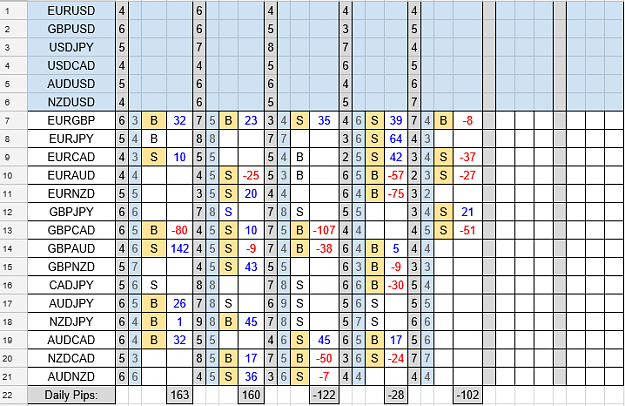

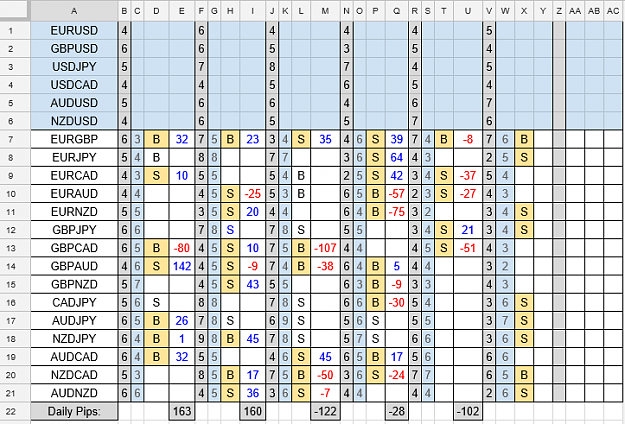

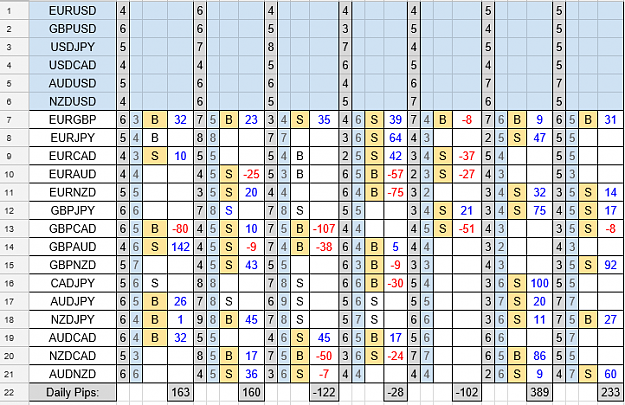

Monday 8th Jan 2018

10 pairs traded

5 win 5 loss

Trades closed at end of trading day

Total pips -28

Tuesday 9th Jan 2018

5 pairs traded

1 win 4 loss

Trades closed at the end of trading day

Total pips -102

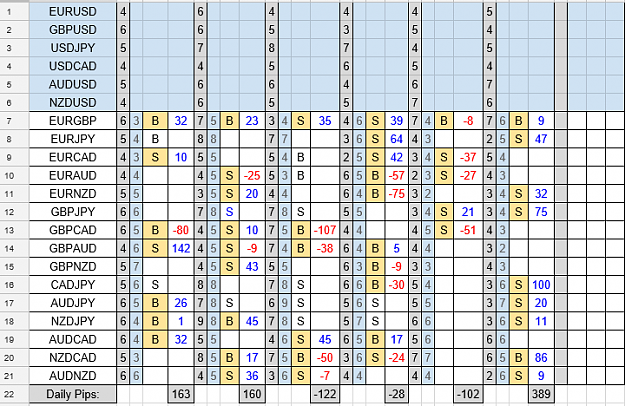

Wednesday 10th Jan 2018

9 pairs traded

9 win 0 loss

Trades closed at the end of trading day

Total pips 389

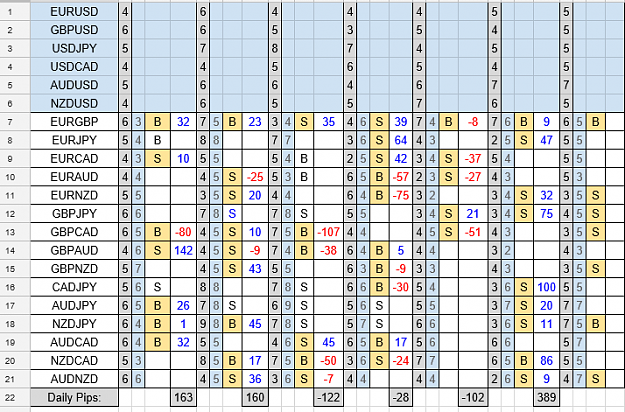

Thursday 11th Jan 2018

7 pairs traded

6 win 1 loss

Trades closed at the end of trading day

Total pips 233

Weekly Total: 492 pips

No test from Fri 12th to Friday 19th Jan 2018 as I was away and had no computer

Monday 22nd Jan 2018

6 pairs traded

6 wins 0 loss

Trades closed at the end of trading day

Total pips 375

Tuesday 23rd Jan 2018

3 pairs traded

1 win 2 loss

Trades closed at the end of trading day

Total pips -43

Wednesday 24th Jan 2018

6 pairs traded

4 win 2 loss

Trades closed at the end of trading day

Total pips 138

Thursday 25th Jan 2018

4 pairs traded

3 win 1 loss

Trades closed at the end of trading day

Total pips 67

Friday 26th Jan 2018

1 pair traded

0 win 1 loss

Trade closed at the end of trading day

Total pips -37

Weekly Total: 500 pips

Monday 29th Jan 2018

4 pairs traded

2 win 2 loss

Trade closed at the end of trading day

Total pips -100

Tuesday 30th Jan 2018

5 pairs traded

0 win 5 loss

Trade closed at the end of trading day

Total pips -318

Wednesday 31st Jan 2018

8 pairs traded

3 win 5 loss

Trade closed at the end of trading day

Total pips -169

Thursday 1st Feb 2018

3 pairs traded

3 win 0 loss

Trade closed at the end of trading day

Total pips 153

Friday 2nd Feb 2018

4 pairs traded

3 win 1 loss

Trade closed at the end of trading day

Total pips 176

Weekly Total: -258 pips

Monday 5th Feb 2018

5 pairs traded

4 win 1 loss

Trade closed at the end of trading day

Total pips 499

Trade Explorer started Monday 5th Feb 2018

*Dashboard EAX with jagzuk PIN*

Dashboard closed trades early due to a wrong setting by me

Total pips 168

Tuesday 6th Feb 2018

3 pairs traded

3 win 0 loss

Trade closed at the end of trading day

Total pips 260

Trade Explorer

*Dashboard EAX with jagzuk PIN*

Dashboard manually closed due to computer shutting off and missing TP (also opened 3 trades due to wrong setting by me)

Total pips 68.5

Wednesday 7th Feb 2018

6 pairs traded

6 win 0 loss

Trade closed at the end of trading day

Total pips 265

Trade Explorer

*Dashboard EAX with jagzuk PIN*

Dashboard manually closed an hour or so before NZD central bank rate

Total pips 168.8

Thursday 8th Feb 2018

2 pairs traded

0 win 2 loss

Trade closed at the end of trading day

Total pips -195

Trade Explorer

*Dashboard EAX with jagzuk PIN*

Dashboard set with basket SL however computer turned off and SL did not happen

Total pips -199

Friday 9th Feb 2018

4 pairs traded

1 win 3 loss

Trade closed at the end of trading day

Total pips -36

Trade Explorer

*Dashboard EAX with jagzuk PIN*

Dashboard set with basket SL however computer again turned off and SL did not happen - trades closed a few hours before end of trading day

Total pips -278.7

Weekly Total: 793 pips

Dashboard Weekly Total: -72.4 pips