Disliked{quote} You and me both. Like I always say, don't make trades based on indicators, but don't trade against them either. In other words, you don't want to go long just because price closed above the MA. And yet, you shouldn't go long while price is below the MA. If you're willing to go long when price is below the MA, why have the MA on the chart in the first place? If you're new to this thread, Pres78 does this a lot: he shows up every now and then, and spits mad wisdom then disappears into the ether. Take advantage of the times he is here....

Ignored

Allow me to disagree and at least explain my perspective

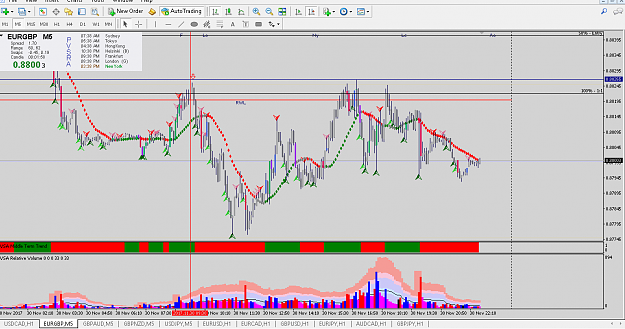

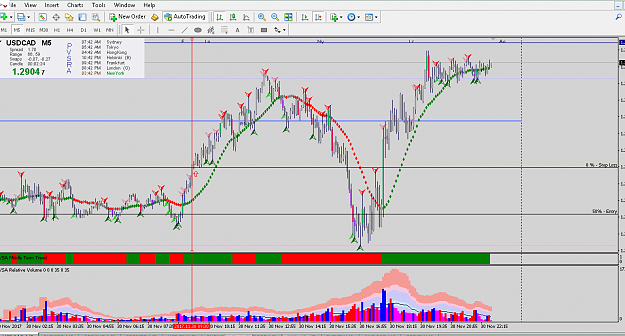

I do have 14 and 50 ema there and I frequently trade against them, because they don't serve for trade identification nor initiation, not the 1st trade at least,

their purpose is for after the treds establish then I trade their bouncy bouncy moves like a normal ma system. hope it helps. so in conclusion in my charts I dont look at them I completely ignore them until

1 - I have identified correctly a reverse and entered against the EMA

2 - I missed the reversal for whatever reason and then I use them to trade intra trend on the bounces along side other check boxes, the bounce alone is not enough for I to open a trend trade.

Peace out

Zwara.

1