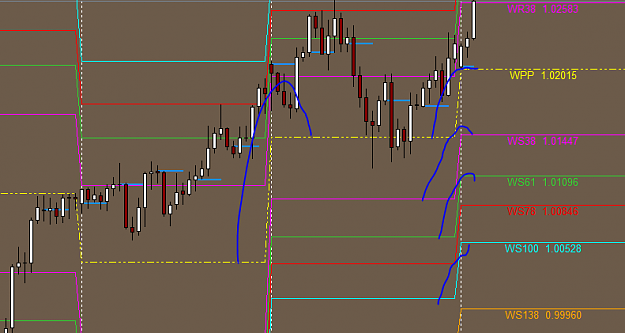

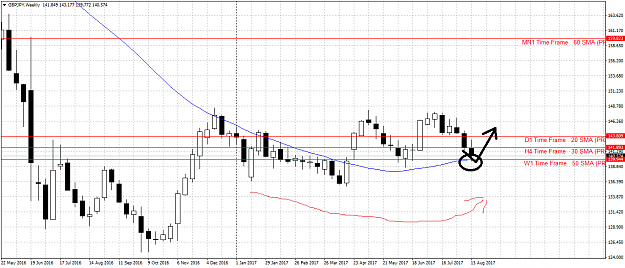

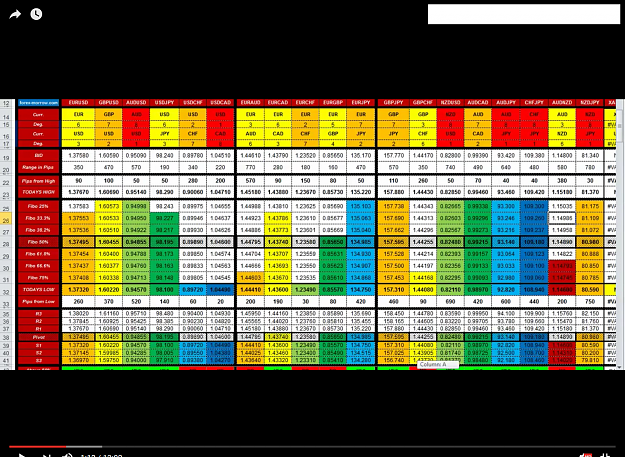

Disliked{quote} trading is easy if you don't complicate it. your first demand is: 1) This strategy must be as simple as possible the only rule in the image below is: trade in the direction of the 100SMA slope. entries and exits using the simple stochastics will not confuse you because you are trading in the slope direction. the bands are pure price action to identify HH and HL or vice versa. hope it help {image} {image}Ignored

Think like an investor, Act as a speculator. Ferid H.