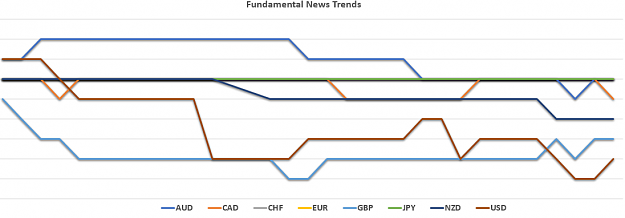

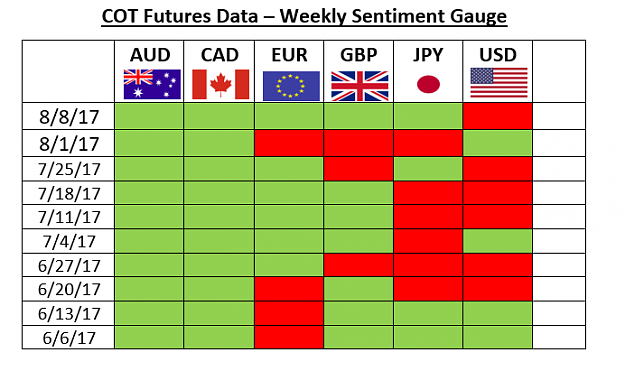

DislikedFundamentals do not drive markets, it is sentiment of larger players, however it can be the catalyst to start something. Buyers and sellers move prices. Utilizing a blend of Fundamental, Sentiment and Technical analysis will help ensure success and longevity.Ignored

- | Membership Revoked | Joined Nov 2012 | 3,392 Posts

GUYS BE AWARE FROM HUNTING YOUR STOP LOSSES BY YOUR BROKER & BY "GHOSTS"

- | Membership Revoked | Joined Nov 2012 | 3,392 Posts

GUYS BE AWARE FROM HUNTING YOUR STOP LOSSES BY YOUR BROKER & BY "GHOSTS"

- Joined Dec 2015 | Status: Member | 7,892 Posts

Do your homework, follow the footprints of smart money