Disliked{quote} Hello Edensgarden Thank you for sharing your trade with us here. I have some thoughts for you and all of us to consider. I would like to suggest you consider your reaction to having an expense in your trading business. Of course no-one likes to lose but guaranteed, we all will. Just like no-one likes to die but guaranteed, we all will. As i commented on twitter today, Epictetus, the Greek philosopher said, "it is not what happens to you but how you react to it", that is what matters. Posting a loss here or a win here makes no difference...Ignored

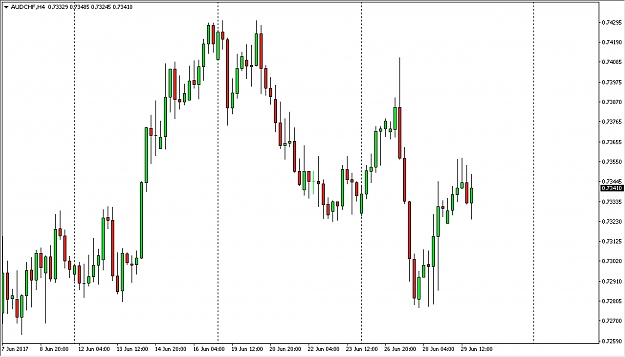

So i mainly wanted to know if you think I took the right steps by shorting.

I have been applying SAD to my trading for 8 months now, the first 4 months with tremendous success (>75% win rate on 1:1 RR) but the last 4 months BE or with slight losses.

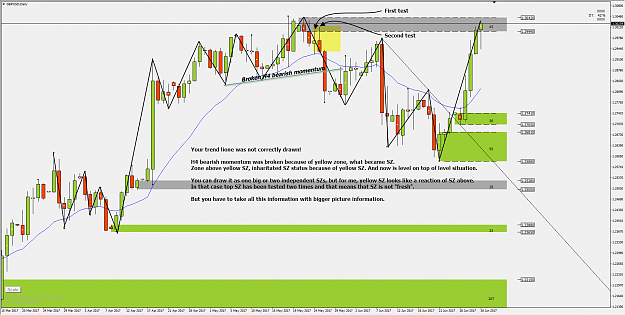

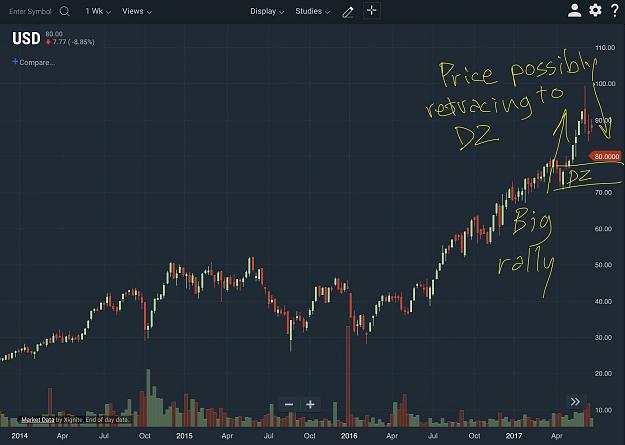

My opinion is that the trend on a lot of pairs is changing...where before most of them were trending downwards and I was shoring them, now they are going upwards and I am still shorting them...

Maybe the lesson here is that even if we take each pair apart and analyse them on different timeframes , we should not forget the keep in mind the broader trend on weekly/monthly charts and the slow evolution they are going through.

Br

Edensgarden