Some are; others aren't.

People who are successfully making their livings through their trading tend to be extra-cautious at the start of a trend.

The great majority of retail traders tend to be less cautious.

This is a counter-intuitive and complicated probability issue.

The reality is that the more recently a trend has become established, the less likely it is to continue. Intuition suggests the opposite. It's easy to misunderstand.

The more established a trend is, the more likely it is to continue. Perhaps "paradoxically", given one's awareness that everything has to come to an end at some point and one's instinctive feeling that, "therefore", the longer a trend has lasted, the more likely it is to end.

Someone who studies statistics and probability, such as an actuary, will understand it more easily: the older people are, the more likely they are to live for longer. "Strange but true".

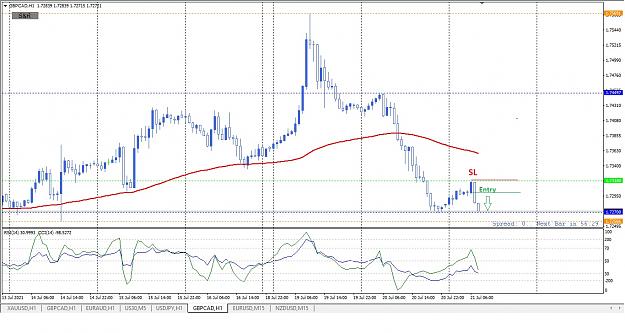

The potential entry posted above by Jandelichte is a very good one, and one I'd have taken with no hesitation, if trading this method.

The "trend-line" shown above isn't one I'd have drawn there, nor would it have put me off the trade at all.

Our reactions in response to such niceties usually make the difference between deriving overall profit or overall loss from sound methods like this one.