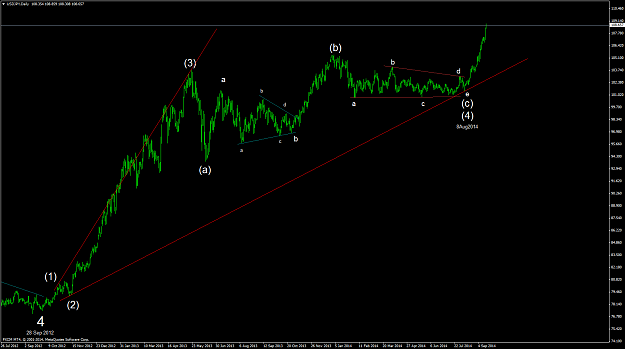

It is important where one starts a wave count. And when an impulse wave is in progress, apply alternation and use channeling to double check.

Correctly marked channel lines is so useful in EW that it does not only confirm wave counts, it also provide target zones for retracement.

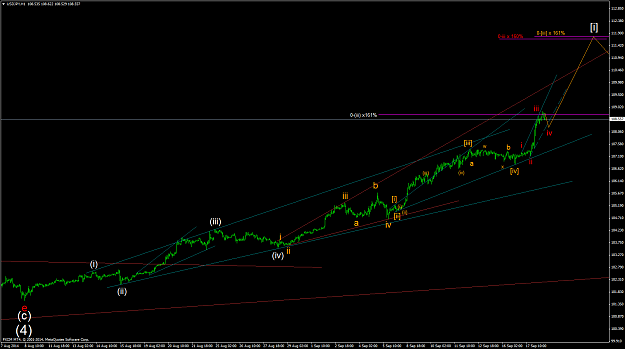

Present USDJPY is a good example of that, with wave count intact aiming for a possible target of 0-(iii) x 161%.

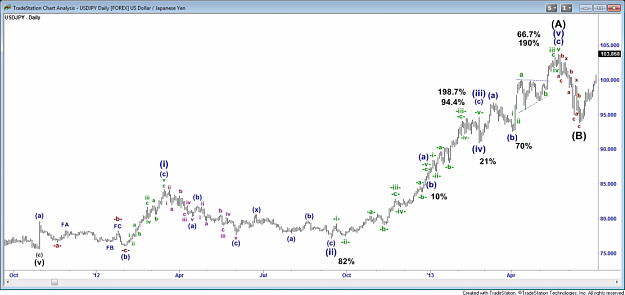

Correctly marked channel lines is so useful in EW that it does not only confirm wave counts, it also provide target zones for retracement.

Present USDJPY is a good example of that, with wave count intact aiming for a possible target of 0-(iii) x 161%.

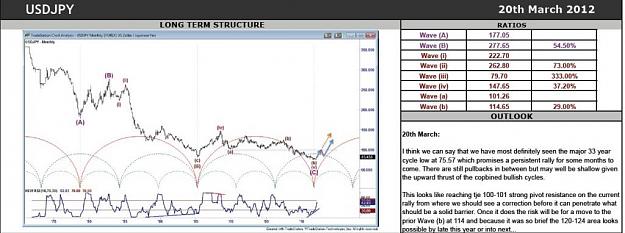

Elliott Wave for optimum entry, exit and risk management of trades