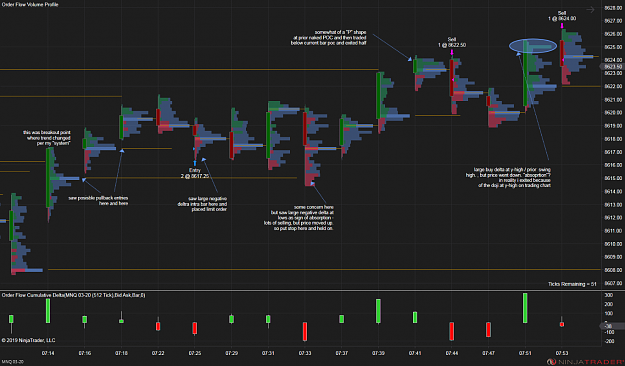

Thank you for the reply. I too am discretionary in my entries and exits, but have "situations" that occur, currently based solely on price movement, that result in a direction bias, and then I rely on candles to enter. Today I attempted to combine what I already do with using the profile bars and could see confirmation of my price-based decisions. My best entry was actually using the profile bars (whether correctly or incorrectly, I do not know) to limit into a trade as opposed to my usual entry of stop orders above the market. Essentially, the decision was made to participate long, and the entry location confirmed with the profile bars. Below is the chart with comments; again no idea if my read of these bars was at all correct....

I am also interested in your comments regarding the daily goal. I too have been focusing on a daily goal as opposed to continue to take every "setup". I have found more consistency and positive account growth with this mindset that continuing to trade.

I am also interested in your comments regarding the daily goal. I too have been focusing on a daily goal as opposed to continue to take every "setup". I have found more consistency and positive account growth with this mindset that continuing to trade.

Small disciplines repeated with consistency lead to great achievements.