Analysis Current 3:04 PM CST

Tomorrow is really going to be akin to walking through a mine field all the way from the London session through New York. There are multiple economic announcements that could seriously move the market.

GBP has CPI y/y being released at 3:30 AM CST. EUR has the German ZEW Economic Sentiment at 4:00 AM CST. The USD has Core Retail Sales m/m, PPI m/m, and Retail Sales m/m being released at 7:30 AM CST and to top it all off, the icing on the cake is Fed Chairman Bernake’s testimony at 9:00 AM CST.

I would not underestimate the market moving potential of a single event listed above. They all have the potential to move the market if there are any surprises. SURPRISE? In Forex? No way man!

Today there was a movement down to the 61.8% retracement of the last major move up on the hourly chart. Price reversed there and has ended up not significantly far away from where it left off on Friday. More or less, I figured price would not accomplish anything significant before the major news releases in the middle of the week. I am still waiting on a news catalyst to bring us to new highs or slam us down where we came from.

It can clearly be seen on the daily chart that we popped up above the upper ascending trend line that was just below 1.6000 when price gapped up on Sunday afternoon.

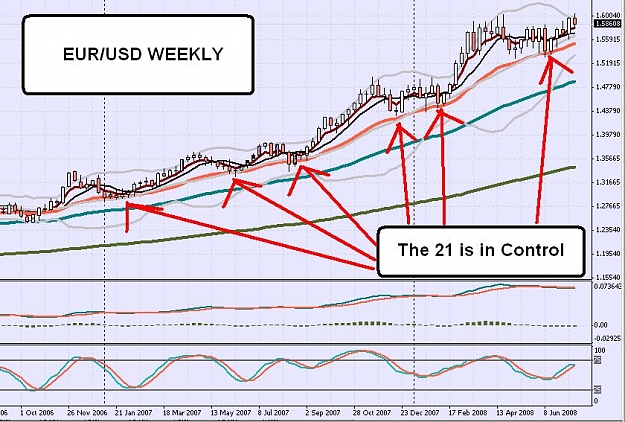

We still have a 21/55 cross to the upside on the hourly chart, price is still above it; however the EMA is starting to flatten out which is much weaker than an EMA screaming up or down. The 1hr 5/8 is threatening to cross down right above the 21. MACD tried to cross to the upside and stochastic is overbought and just starting to cross down. We are overall still above the 200 EMA.

1.5866 is still support to the downside, and of course the 1.6000 level still looms above us. If we can break 1.6000 that will be a new all time high (at least as far back as my charts go), and will pretty much be in uncharted territory. 1.5800 will be the next level after 1.5866 on the way down.

I would submit that the 21 EMA has already lost control of price on the hourly chart and the only hope between here and the 200 will be the 55 which doesn’t usually put up much of a fight for very long. Today the bounce off of that 61.8% level could be considered a bounce off of the hourly 55 as well.

The real question this week is going to be which way are the fundamentals going to take us? What will the Fed say that could impact the Dollar? What about the rest of the news releases? All of this will play a major factor this week. It may be hard to find good technical moves tomorrow and Wednesday. Thursday and Friday have the potential to be big days though in my opinion.

Technically, I have a downward bias; however, it would be crazy to try and pick a direction here at this critical decision point with all of these potentially market moving releases coming up. My official direction is, “Wait and see” again.

If you don't understand the indicators I use or the reasons behind them, visit my blog where they are explained in detail.

Tomorrow is really going to be akin to walking through a mine field all the way from the London session through New York. There are multiple economic announcements that could seriously move the market.

GBP has CPI y/y being released at 3:30 AM CST. EUR has the German ZEW Economic Sentiment at 4:00 AM CST. The USD has Core Retail Sales m/m, PPI m/m, and Retail Sales m/m being released at 7:30 AM CST and to top it all off, the icing on the cake is Fed Chairman Bernake’s testimony at 9:00 AM CST.

I would not underestimate the market moving potential of a single event listed above. They all have the potential to move the market if there are any surprises. SURPRISE? In Forex? No way man!

Today there was a movement down to the 61.8% retracement of the last major move up on the hourly chart. Price reversed there and has ended up not significantly far away from where it left off on Friday. More or less, I figured price would not accomplish anything significant before the major news releases in the middle of the week. I am still waiting on a news catalyst to bring us to new highs or slam us down where we came from.

It can clearly be seen on the daily chart that we popped up above the upper ascending trend line that was just below 1.6000 when price gapped up on Sunday afternoon.

We still have a 21/55 cross to the upside on the hourly chart, price is still above it; however the EMA is starting to flatten out which is much weaker than an EMA screaming up or down. The 1hr 5/8 is threatening to cross down right above the 21. MACD tried to cross to the upside and stochastic is overbought and just starting to cross down. We are overall still above the 200 EMA.

1.5866 is still support to the downside, and of course the 1.6000 level still looms above us. If we can break 1.6000 that will be a new all time high (at least as far back as my charts go), and will pretty much be in uncharted territory. 1.5800 will be the next level after 1.5866 on the way down.

I would submit that the 21 EMA has already lost control of price on the hourly chart and the only hope between here and the 200 will be the 55 which doesn’t usually put up much of a fight for very long. Today the bounce off of that 61.8% level could be considered a bounce off of the hourly 55 as well.

The real question this week is going to be which way are the fundamentals going to take us? What will the Fed say that could impact the Dollar? What about the rest of the news releases? All of this will play a major factor this week. It may be hard to find good technical moves tomorrow and Wednesday. Thursday and Friday have the potential to be big days though in my opinion.

Technically, I have a downward bias; however, it would be crazy to try and pick a direction here at this critical decision point with all of these potentially market moving releases coming up. My official direction is, “Wait and see” again.

If you don't understand the indicators I use or the reasons behind them, visit my blog where they are explained in detail.