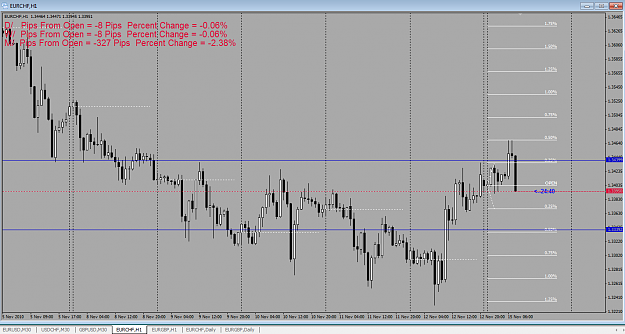

DislikedThe current system assumes that if there is +0.25% deviation on EURCHF then their will be a negative retrace on EURUSD and USDCHF. Likewise if there is a -0.25% deviation on EURCHF then there will be a positive retrace on EURUSD and USDCHF.

However, this does not always work if there is a strong trend on EURCHF in either direction. If your lucky then it works but if you happen to be on the wrong side then you will get serious DD.

Also, USDCHF does move slower than EURUSD but there are times in the market when USDCHF will out perform EURUSD...Ignored

Any price movement is determined by the value of euro vs swiss-franc.

regards

daytrading

Enter Signature