- Post #36,726

- Quote

- Nov 30, 2011 7:47am Nov 30, 2011 7:47am

- | Joined Feb 2006 | Status: Spartan Attitude | 1,500 Posts

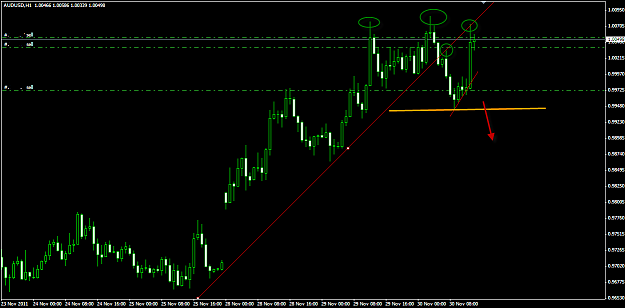

In Charts We Trust!

- Post #36,727

- Quote

- Nov 30, 2011 7:52am Nov 30, 2011 7:52am

- | Joined Feb 2006 | Status: Spartan Attitude | 1,500 Posts

In Charts We Trust!

- Post #36,728

- Quote

- Nov 30, 2011 8:05am Nov 30, 2011 8:05am

- | Joined Feb 2006 | Status: Spartan Attitude | 1,500 Posts

In Charts We Trust!

- Post #36,732

- Quote

- Nov 30, 2011 8:23am Nov 30, 2011 8:23am

- Joined Aug 2011 | Status: Member | 10,724 Posts

Have I got something on my face, SOLDIER?

- Post #36,737

- Quote

- Nov 30, 2011 9:24am Nov 30, 2011 9:24am

- | Joined Oct 2011 | Status: Member | 366 Posts

Buy! Buy! Sell! Sell! Just make sure you have proper MM!

- Post #36,740

- Quote

- Nov 30, 2011 9:54am Nov 30, 2011 9:54am

The Eyes Believe What They See And The Ears Believe What Others Say.