My premise:

there is no best company, only the company that suits you.

This post shouldn't be an excuse, to discuss and compare different companies here.

This is The5%ers thread.

If you want to compare and discuss, there are threads created especially for this.

There was an interesting exchange of comments today.

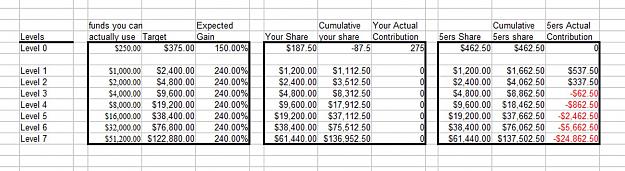

A person stopped to do the math, objectively comparing the earnings (with the same % realized and initial investment) between The5%ers and FTMO.

This post is just to divulge these calculations. Stop.

Complete and uncut comment:

"The wording makes this not a fair comparison. A more fair comparison would be the closer priced 3rd option rather than the 4th from 5% ers vs the 100k account from FTMO. FTMO requires you to gain 10% and then an additional 5%. the compounding adjusted total gain requirement for FTMO is 15.5% gain but you need to make more than 10% and 5% so because there's an extra step and it's unlikely you'll gain the exact amount required to pass FTMO. It's fair to say their total effective adjusted gain requirement is 16%.

If you use the 3rd 5%ers option your total cost is $565 but after the special gift in this video is only $508.5+tax where FTMO is $640ish (changes based off fiat rates). If you gain 16% on that same account you would be at level 3 with a 5%ers account and already secured $3055 of profit. (6% for level two and 10% more for level 3) and you would have a $104,000 funded account vs first month $100k account with still no payout yet from FTMO.

I lets say you make 10% more than 16% on both accounts so you receive your fist FTMO payout and challenge fee back. You now would gain an additional $5,200 from 5%ers and be at level 4 which is now a $208,000 live account. For a grand total of $8,255 gain so far for 26% total gain on account. The first FTMO check for 10% gain would be 7k and also receive the $640 back for a grand total of $7,640 gain with FTMO for 26% total gain.

Every further 10% would result in a doubling of account with 5%ers while you'd receive $7k each 10% from FTMO and your FTMO account would be increased by 25% every 4 months (if your consistent). If we go 3 more months out to the point where you'd increase your FTMO account (using 10% per month rate) It'd be as follows: 2nd FTMO funded month FTMO + $7k total: $14,640. 5ers + $10,400 total: $18,655. 3rd FTMO funded month + $7k total: $21,640. 5ers + $20,800 total: $ 39,455. 4th month FTMO + $ 7k. 5% ers + $ 41,600.

Grand total FTMO after 56% total gain (4 Funded months / 6 steps): $ 28,640 and $ 125,000 funded account [$ 640 initial investment]

Grand total 5% ers after 56% total gain (6 steps) $ 81,055 and $ 1,280,000 funded account [$ 508.5 + Tax initial investment].

Conclusion: FTMO and 5% ers are both great and they have other aspects that make them both #1 prop firm but for different categories such as leverage, trading rules, instruments, platforms ect. I'm not sure which one is best overall."

Source:

youtu.be/yUZ4fHE8HE4

there is no best company, only the company that suits you.

This post shouldn't be an excuse, to discuss and compare different companies here.

This is The5%ers thread.

If you want to compare and discuss, there are threads created especially for this.

There was an interesting exchange of comments today.

A person stopped to do the math, objectively comparing the earnings (with the same % realized and initial investment) between The5%ers and FTMO.

This post is just to divulge these calculations. Stop.

Complete and uncut comment:

"The wording makes this not a fair comparison. A more fair comparison would be the closer priced 3rd option rather than the 4th from 5% ers vs the 100k account from FTMO. FTMO requires you to gain 10% and then an additional 5%. the compounding adjusted total gain requirement for FTMO is 15.5% gain but you need to make more than 10% and 5% so because there's an extra step and it's unlikely you'll gain the exact amount required to pass FTMO. It's fair to say their total effective adjusted gain requirement is 16%.

If you use the 3rd 5%ers option your total cost is $565 but after the special gift in this video is only $508.5+tax where FTMO is $640ish (changes based off fiat rates). If you gain 16% on that same account you would be at level 3 with a 5%ers account and already secured $3055 of profit. (6% for level two and 10% more for level 3) and you would have a $104,000 funded account vs first month $100k account with still no payout yet from FTMO.

I lets say you make 10% more than 16% on both accounts so you receive your fist FTMO payout and challenge fee back. You now would gain an additional $5,200 from 5%ers and be at level 4 which is now a $208,000 live account. For a grand total of $8,255 gain so far for 26% total gain on account. The first FTMO check for 10% gain would be 7k and also receive the $640 back for a grand total of $7,640 gain with FTMO for 26% total gain.

Every further 10% would result in a doubling of account with 5%ers while you'd receive $7k each 10% from FTMO and your FTMO account would be increased by 25% every 4 months (if your consistent). If we go 3 more months out to the point where you'd increase your FTMO account (using 10% per month rate) It'd be as follows: 2nd FTMO funded month FTMO + $7k total: $14,640. 5ers + $10,400 total: $18,655. 3rd FTMO funded month + $7k total: $21,640. 5ers + $20,800 total: $ 39,455. 4th month FTMO + $ 7k. 5% ers + $ 41,600.

Grand total FTMO after 56% total gain (4 Funded months / 6 steps): $ 28,640 and $ 125,000 funded account [$ 640 initial investment]

Grand total 5% ers after 56% total gain (6 steps) $ 81,055 and $ 1,280,000 funded account [$ 508.5 + Tax initial investment].

Conclusion: FTMO and 5% ers are both great and they have other aspects that make them both #1 prop firm but for different categories such as leverage, trading rules, instruments, platforms ect. I'm not sure which one is best overall."

Source:

youtu.be/yUZ4fHE8HE4

I've seen things you people wouldn't believe

1

4