Welcome to the SentiFX Methodology.

If you've traded the markets for any amount of time, you will likely feel like someone is out there hunting your stops. You may feel like your trades are constantly being targeted.

Guess what - your stops are being hunted. Not just your stops, but all of the over-leveraged retail traders stops as well.

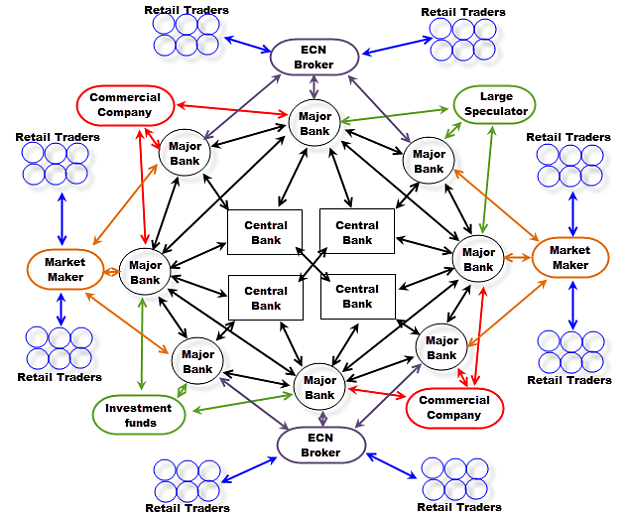

The Markets are Manipulated by those with deep pockets. The Market Makers and Banks have access to the order book. They can see the liquidity at each pip and push price to those levels to exit their trades with huge profit.

You hear that 90-95% of retail traders fail, but have you asked why? Is there something about the way that retail traders think that is causing consistent losses over time? I believe so.

If you're anything like me, you love trading. Trading is your passion, your hobby, your side business. Trading is your life.

You probably have a trading style already that you enjoy and makes sense.

You've seen the manipulation in the markets. Your stops get hit. You lose more than you win. You want to quit that frustrating and boring day job and become a Full Time Trader but there is something that you're just missing.

I know, it hurts. Like many trader, I've also been there before I had the aha moment.

I know what it's like to take profits too fast. To let losses run. To watch my account slowly bleed out. To have back to back loses and start revenge trading.... and then to be afraid to hold on to winning trades. After all, I've blown 2 accounts over the last 16 years trading.

That all changed when I finally figured out how the market actually worked and I'm here to share that with you.

You'll see over and over and over in these posts how I call what happens BEFORE it actually happens.

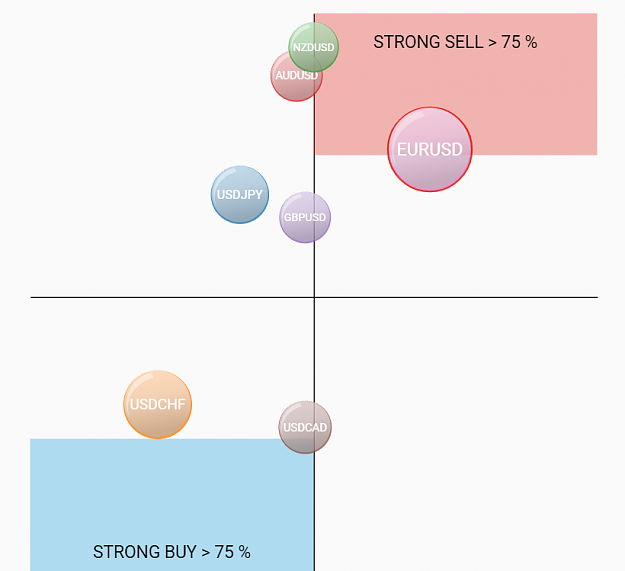

The Crystal Ball ... the Holy Grail... is Sentiment + Market Structure.

It's the strongest edge in the Spot FX Market and I've been using it for years to ride the Market Maker's coat tails for profit.

Learn how the Market Makers manipulate the Markets by targeting Retail's resting orders (STOPS).

Learn How Market Makers specifically use behavioral finance to target retail traders psychology and play tug-of-war with retail's emotions. It is possible to catch tops and bottoms once you know how.

If you don't want to blow up your account and want to grow your capital then you need professional Sentiment Analysis Tools to give you the added edge needed to win this game.

If you want to win more trades then you need to align all of your trades opposite of the retail herd.

If you want the confidence of getting into trades and holding onto winning trades then use Sentiment + Market Structure.

If you want Emotional Control then you need tools to tell you that you're on the right side of the trade before you ever get in.

If you want to quit your day job and become a professional trader then you'll need to think like a professional trader. Start hunting the over-loaded and over-leveraged retail liquidity.

Is it possible to think differently and trade the opposite to become profitable instead? Yes.

In this thread we will explore over time how stops are hunted for both entry and exit so that you can get in at wholesale and get out at retail.

We will explore how sentiment can be a strong driver of price absent a news catalyst... and how Market Structure really works and why.

You'll learn how Sentiment gives a clear directional bias that you can exploit week after week.

We will explore Liquidity Gaps, Liquidity Gap Fills, and Trapped Traders.

If you're already consistently profitable, keep doing what you're doing.

For everyone else, the journey of thinking differently is about to begin.

Let's make money together,

Charles

P.S.

** UPDATE 4/17/2020 ***

Track Sentiment yourself with the Sentiment Trading Excel Spreadsheet - Find out more - https://sentifx.com/sentiment-trading-excel-spreadsheet/

*** UPDATE 2/26/2020 ***

Sentiment Analysis MT4 indicator is available as a one time purchase - Find out more - https://sentifx.com/sentiment-indicator/

Relative Sentiment MT4 indicator is available as a one time purchase - Find out more - https://sentifx.com/relative-sentiment-indicator/

Sentiment Analysis Tool is available as a one time purchase - Find out more - https://sentifx.com/sentiment-analysis-tool/

LifeTime Membership is available - gain access to all current and future indicators and courses - Find out more - https://sentifx.com/subscribe/

*** UPDATE 12/11/2019 ***

For those technical folks out there - here is quantitative proof that Sentiment Trading has Edge:

https://sentifx.com/sentiment-trading-quantitative-proof-1/

*** UPDATE 12/1/2019 ***

+ Courses Available are SentiFX Onboarding, Beginner, and Market Structure Deep Dive.

+ We Have Email and Slack Alerts in place that notify you of the CORE Sentiment Signals (Shifts from Buys to Sells and Sells to Buys, Retail Switching Sides, Retail at Extremes)

+ We also have Email and Slack Alerts to notify you via Email/Slack ALL Market Structure Changes for the Pairs you Follow.

If you've traded the markets for any amount of time, you will likely feel like someone is out there hunting your stops. You may feel like your trades are constantly being targeted.

Guess what - your stops are being hunted. Not just your stops, but all of the over-leveraged retail traders stops as well.

The Markets are Manipulated by those with deep pockets. The Market Makers and Banks have access to the order book. They can see the liquidity at each pip and push price to those levels to exit their trades with huge profit.

You hear that 90-95% of retail traders fail, but have you asked why? Is there something about the way that retail traders think that is causing consistent losses over time? I believe so.

If you're anything like me, you love trading. Trading is your passion, your hobby, your side business. Trading is your life.

You probably have a trading style already that you enjoy and makes sense.

You've seen the manipulation in the markets. Your stops get hit. You lose more than you win. You want to quit that frustrating and boring day job and become a Full Time Trader but there is something that you're just missing.

I know, it hurts. Like many trader, I've also been there before I had the aha moment.

I know what it's like to take profits too fast. To let losses run. To watch my account slowly bleed out. To have back to back loses and start revenge trading.... and then to be afraid to hold on to winning trades. After all, I've blown 2 accounts over the last 16 years trading.

That all changed when I finally figured out how the market actually worked and I'm here to share that with you.

You'll see over and over and over in these posts how I call what happens BEFORE it actually happens.

The Crystal Ball ... the Holy Grail... is Sentiment + Market Structure.

It's the strongest edge in the Spot FX Market and I've been using it for years to ride the Market Maker's coat tails for profit.

Learn how the Market Makers manipulate the Markets by targeting Retail's resting orders (STOPS).

Learn How Market Makers specifically use behavioral finance to target retail traders psychology and play tug-of-war with retail's emotions. It is possible to catch tops and bottoms once you know how.

If you don't want to blow up your account and want to grow your capital then you need professional Sentiment Analysis Tools to give you the added edge needed to win this game.

If you want to win more trades then you need to align all of your trades opposite of the retail herd.

If you want the confidence of getting into trades and holding onto winning trades then use Sentiment + Market Structure.

If you want Emotional Control then you need tools to tell you that you're on the right side of the trade before you ever get in.

If you want to quit your day job and become a professional trader then you'll need to think like a professional trader. Start hunting the over-loaded and over-leveraged retail liquidity.

Is it possible to think differently and trade the opposite to become profitable instead? Yes.

In this thread we will explore over time how stops are hunted for both entry and exit so that you can get in at wholesale and get out at retail.

We will explore how sentiment can be a strong driver of price absent a news catalyst... and how Market Structure really works and why.

You'll learn how Sentiment gives a clear directional bias that you can exploit week after week.

We will explore Liquidity Gaps, Liquidity Gap Fills, and Trapped Traders.

If you're already consistently profitable, keep doing what you're doing.

For everyone else, the journey of thinking differently is about to begin.

Let's make money together,

Charles

P.S.

** UPDATE 4/17/2020 ***

Track Sentiment yourself with the Sentiment Trading Excel Spreadsheet - Find out more - https://sentifx.com/sentiment-trading-excel-spreadsheet/

*** UPDATE 2/26/2020 ***

Sentiment Analysis MT4 indicator is available as a one time purchase - Find out more - https://sentifx.com/sentiment-indicator/

Relative Sentiment MT4 indicator is available as a one time purchase - Find out more - https://sentifx.com/relative-sentiment-indicator/

Sentiment Analysis Tool is available as a one time purchase - Find out more - https://sentifx.com/sentiment-analysis-tool/

LifeTime Membership is available - gain access to all current and future indicators and courses - Find out more - https://sentifx.com/subscribe/

*** UPDATE 12/11/2019 ***

For those technical folks out there - here is quantitative proof that Sentiment Trading has Edge:

https://sentifx.com/sentiment-trading-quantitative-proof-1/

*** UPDATE 12/1/2019 ***

+ Courses Available are SentiFX Onboarding, Beginner, and Market Structure Deep Dive.

+ We Have Email and Slack Alerts in place that notify you of the CORE Sentiment Signals (Shifts from Buys to Sells and Sells to Buys, Retail Switching Sides, Retail at Extremes)

+ We also have Email and Slack Alerts to notify you via Email/Slack ALL Market Structure Changes for the Pairs you Follow.