Disliked{quote} Using realized Pnl to offset risk is a proven money management strategy, so i am not opposed to it. However, risk is everything, especially in algorithmic trading, so my entire focus would be on the 10% of the time the strategy doesn't end positively. Profits are meaningless if i don't know the risk parameters.Ignored

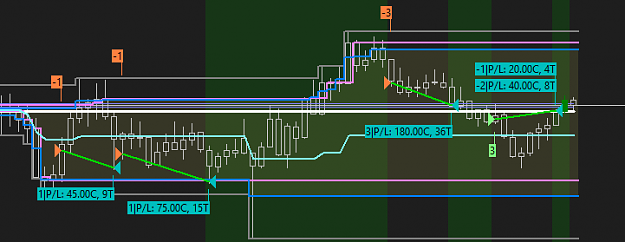

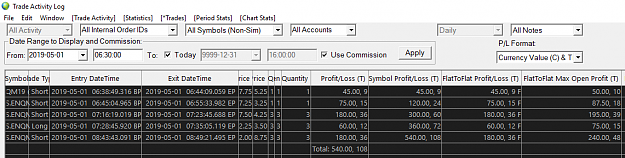

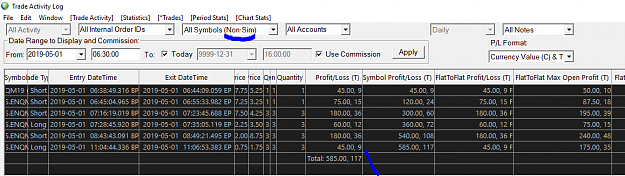

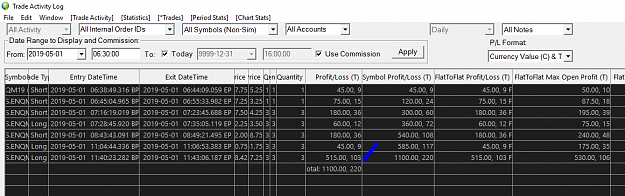

Example: Talking in ranges as that is what the retail crowd understands.... if the current range at entry is only 50 ticks, and you have already had a realized loss of 2x25 ticks, 3rd trade regardless of the setup is a far more increased risk than the first two... unless it is a breakout trade with increasing range. This principle is pivotal to have the market structure take risk out of the equation just by setting a x% of range as risk to make y% of range... just as one example. Ofc I am oversimplifying this but for someone as impulsive as I am with aggressive stacking, such a underlying framework helps me in being disciplined. I force exit on the next tick every new trade manually or auto when any such "out-of-bounds' conditions are met.

I can take a pause in my journey and try the RR route you are proposing. I got no problems with that but I would prefer to get the entire recipe scripted item by item in sequence from start to finish listing all the necessary actions required per strategy. Before starting, I like to define the end point in actual and concrete numbers to validate against what would constitute a "positive outcome strategy with a concrete and quantifiable edge" ? Makes sense? Worst case, our readers will learn from this interaction :-)

Staying in my lane...