Hi all,

I would be posting both historical and current Elliott Wave charts of major pairs(fx), stocks and futures here periodically as a reference and to teach or learn how to do better/proper Elliott Wave Counting.

I'm here to learn from those who know better and probably to teach those who would want to learn from my little repository...

For those who might be wondering what is Elliot Wave, please "Search the forum to get full glimpse of what it is and how best to use the signals/labels"

The first images in this thread are an example of what will be posted here(for those who don't know what Elliot Wave is "and don't want to search, yet").

Here is EURUSD(M1) formed on the 12/13/2018(14:09 GMT)

Here is EURUSD(M1) formed on 12/18/2018(10:58 GMT), the C Wave was so long that it almost tear apart the chart

Here is EURUSD(M1) formed on 12/19/2018(14:59 GMT), a trending moment for the abc to be shown in another chart angle

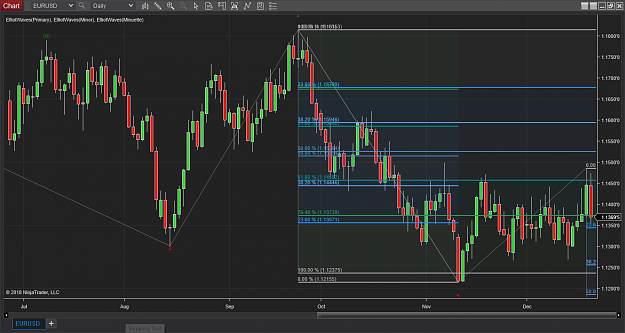

Here is EURUSD(Daily) forming since 3/1/2018, it's on it's move to wave "a"

after validating the 5th wave on 11/12/2018

Like everything in trading, even with the highest probability of success, it's meant to fail at one time or the other, even if not up to the success rate %, here is a EURUSD(M1) formed on 12/20/2018(17:23 GMT) that failed after the wave "b" traded past the start of the wave "a" which was meant to be a stoploss .

.

More would come in other currencies, stocks, futures and even commodities at random intervals, i will try keeping everyone posted and once again critics are allowed, but be damn serious about your criticism(not words like xxx's charts are better "I never said mine was the best").

If there's anyone more perfect in Elliot Wave Counting, please post here as well, we never can tell i might have missed some waves back there.

Thanks,

noobshow.

NB: My Charts won't be the best you've ever seen, criticism allowed(even strong one would be taken as a plus to my little knowledge) .

.

My Waves counting are automatically plotted, though this is a version 1 and more criticism would be taken note of to improve on the Program.

I would be posting both historical and current Elliott Wave charts of major pairs(fx), stocks and futures here periodically as a reference and to teach or learn how to do better/proper Elliott Wave Counting.

I'm here to learn from those who know better and probably to teach those who would want to learn from my little repository...

For those who might be wondering what is Elliot Wave, please "Search the forum to get full glimpse of what it is and how best to use the signals/labels"

The first images in this thread are an example of what will be posted here(for those who don't know what Elliot Wave is "and don't want to search, yet").

Here is EURUSD(M1) formed on the 12/13/2018(14:09 GMT)

Here is EURUSD(M1) formed on 12/18/2018(10:58 GMT), the C Wave was so long that it almost tear apart the chart

Here is EURUSD(M1) formed on 12/19/2018(14:59 GMT), a trending moment for the abc to be shown in another chart angle

Here is EURUSD(Daily) forming since 3/1/2018, it's on it's move to wave "a"

after validating the 5th wave on 11/12/2018

Like everything in trading, even with the highest probability of success, it's meant to fail at one time or the other, even if not up to the success rate %, here is a EURUSD(M1) formed on 12/20/2018(17:23 GMT) that failed after the wave "b" traded past the start of the wave "a" which was meant to be a stoploss

More would come in other currencies, stocks, futures and even commodities at random intervals, i will try keeping everyone posted and once again critics are allowed, but be damn serious about your criticism(not words like xxx's charts are better "I never said mine was the best").

If there's anyone more perfect in Elliot Wave Counting, please post here as well, we never can tell i might have missed some waves back there.

Thanks,

noobshow.

NB: My Charts won't be the best you've ever seen, criticism allowed(even strong one would be taken as a plus to my little knowledge)

My Waves counting are automatically plotted, though this is a version 1 and more criticism would be taken note of to improve on the Program.