Morning Technical Newsletter - Stock, Oil Markets Moved by Trader Hopes

NEWS:

CLICK HERE

Stock, Oil Markets Moved by Trader Hopes

Oil prices were higher on Tuesday, buoyed by renewed trader optimism that the United States will reach a trade deal with China, and by continued production cuts by OPEC and its oil-producing partners. U.S. WTI futures were trading at $48.53 per barrel, up 0.02 percent, and Brent crude futures were up 0.03 percent, to $57.35 per barrel. Though the movements were modest, they reflected traders’ hope that a trade deal would be met in the near future. On Monday afternoon, U.S. Commerce Secretary Wilbur Ross said that Beijing and Washington could reach a trade deal that “we can live with”, following the first day of meetings between the countries’ trade representatives. The negotiations will continue on through Tuesday.

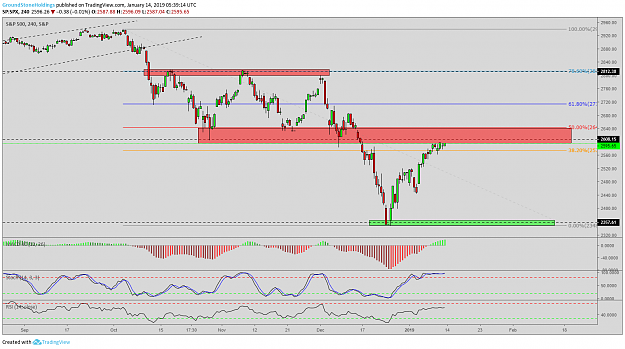

Asian stocks were trading mixed, with Chinese markets lower on fears that the deal might not be in China’s best interests. The Shanghai Composite was down 0.20 percent as of 1:50 p.m. HK/SIN, and the Shenzhen Composite was down 0.18 percent. Japan’s Nikkei 225 rose 1.28 percent by the early afternoon, and Australia’s ASX 200 gained 0.69 percent. All three major Wall Street indexes closed higher on Monday following the first day of trade talks in Beijing.

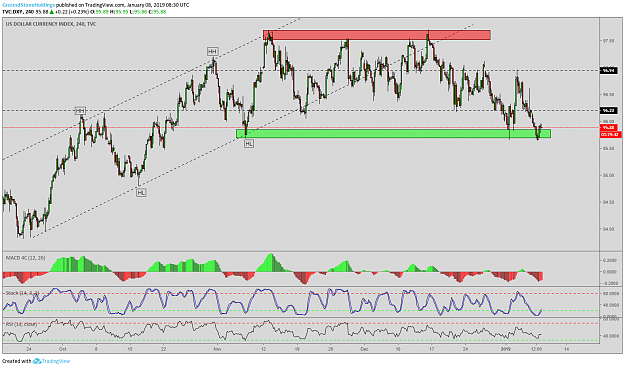

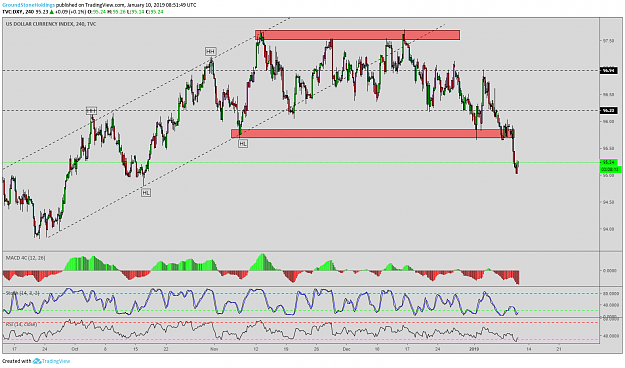

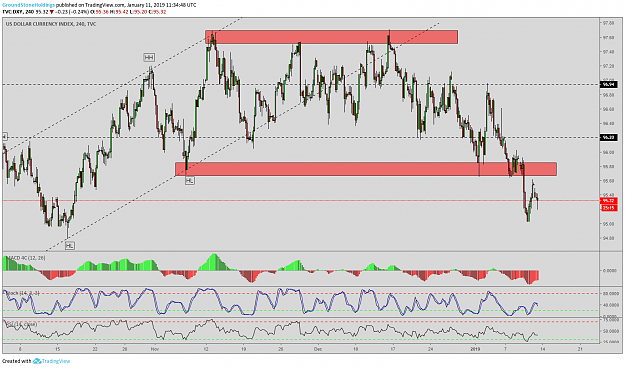

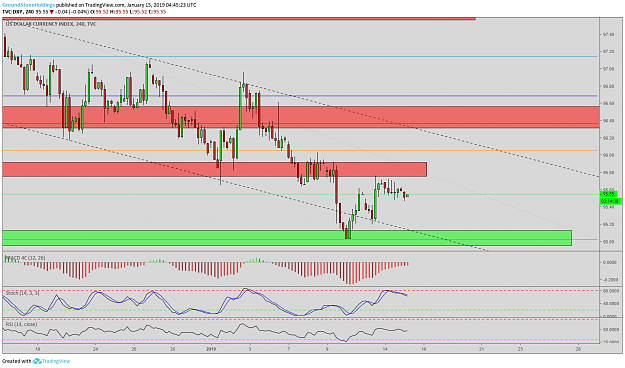

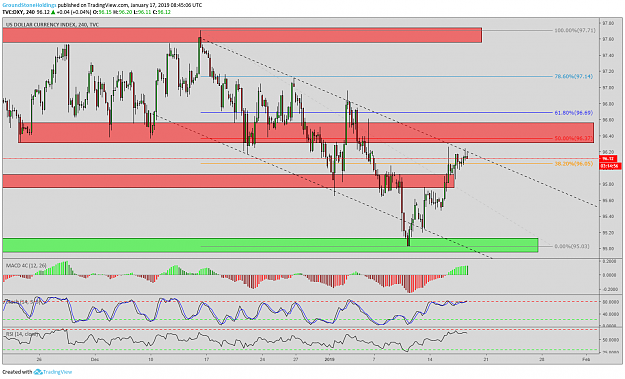

The dollar index was up 0.22 percent to 95.88 .DXY, as traders found new reasons to favor the dollar. The greenback advanced against the yen, gaining 0.11 percent to 108.81. The dollar also gained against the euro, pound and Australian dollar. Also supporting the dollar were some words from the Federal Reserve indicating that the U.S. central bank may only raise interest rates once in 2019. The dollar index has eased around 2 percent since mid-December, though the dollar still managed to end 2018 up 4.3 percent.

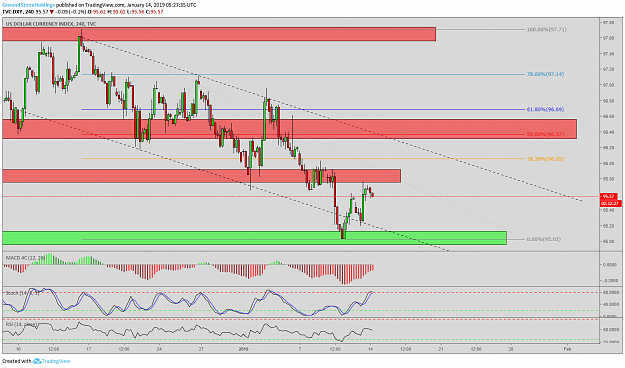

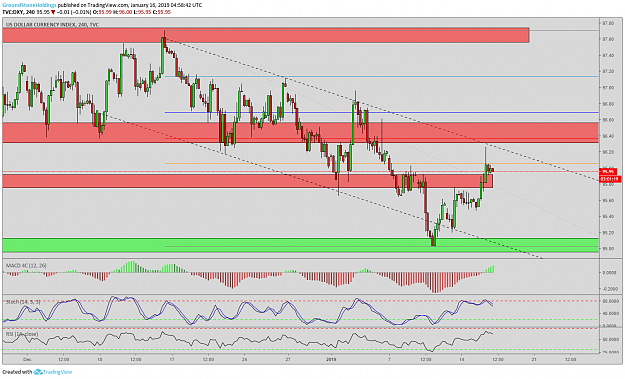

DXY:

Intraday target: $96.20

Long-term target: $100

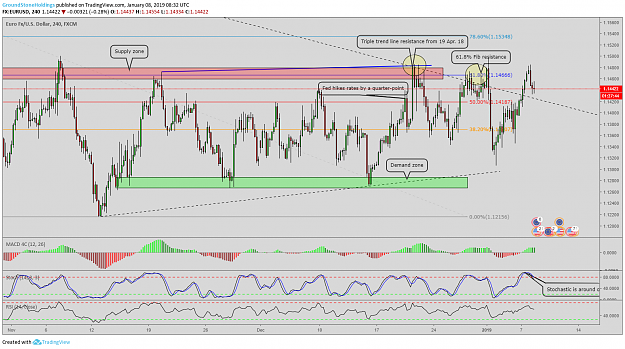

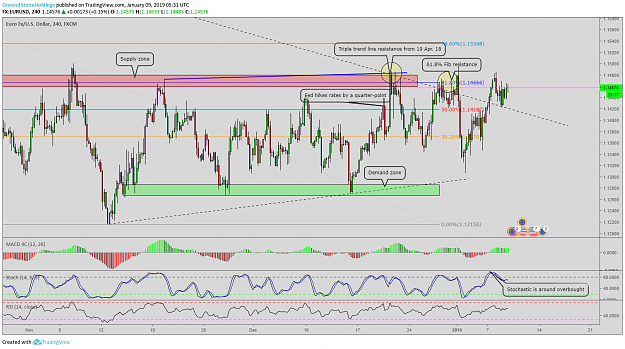

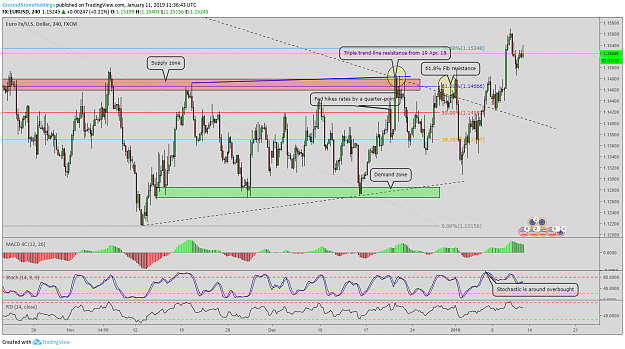

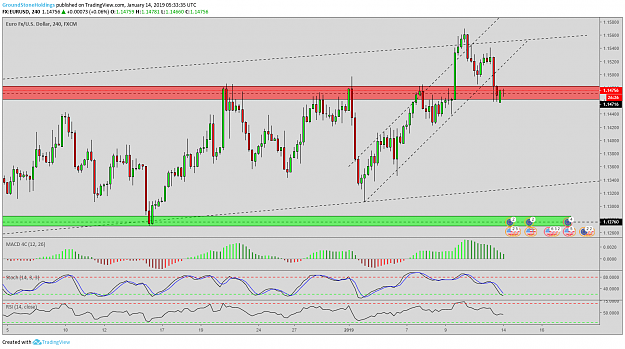

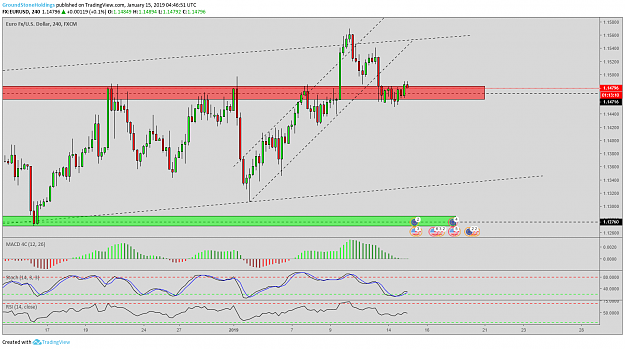

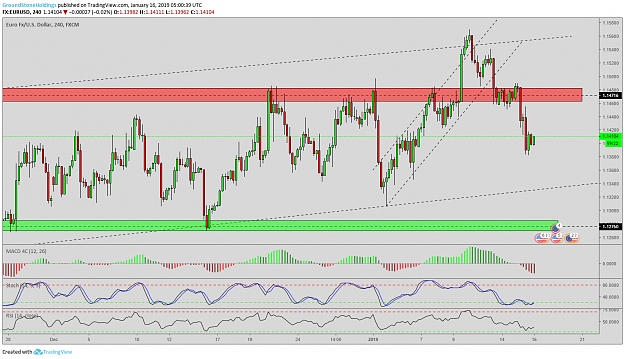

EUR/USD:

Intraday target: 1.1400

Long-term target: 1.0800

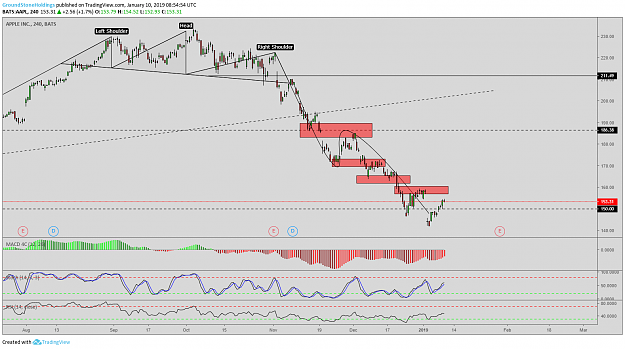

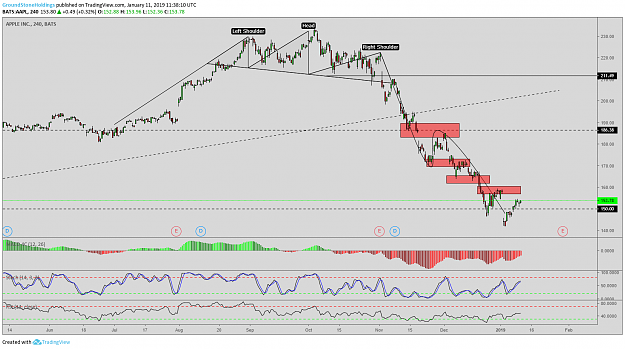

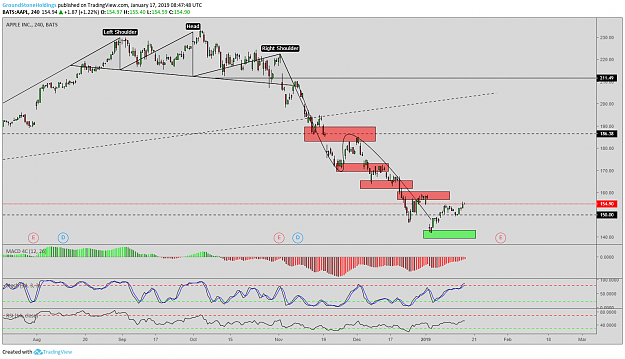

APPLE:

Intraday target: $140

Long-term target: $100

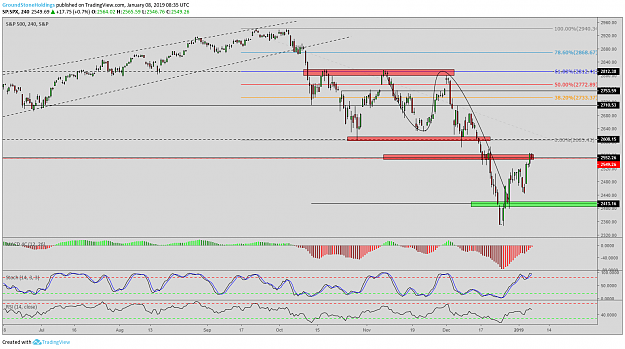

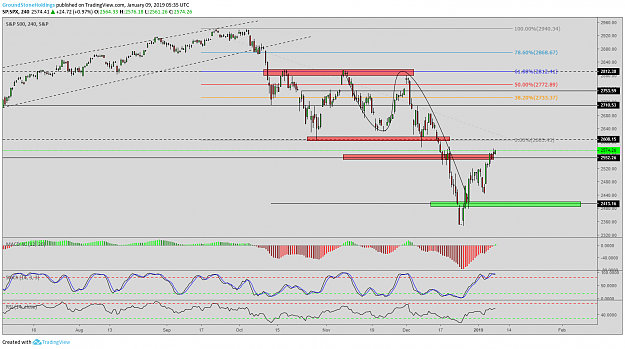

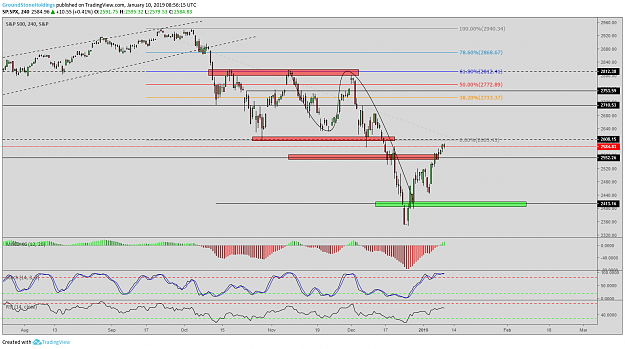

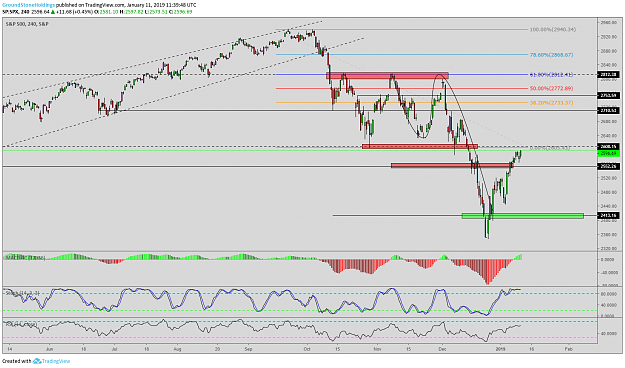

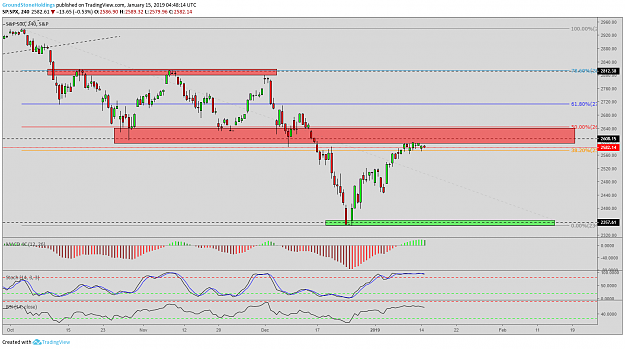

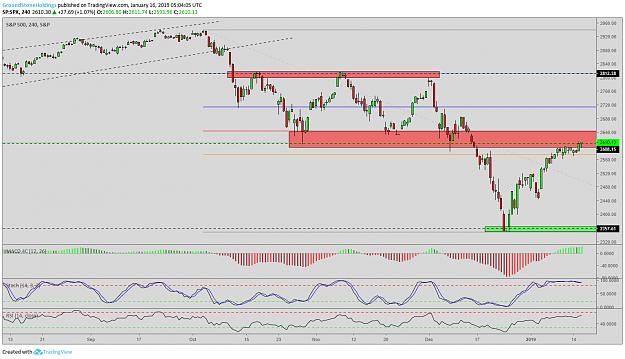

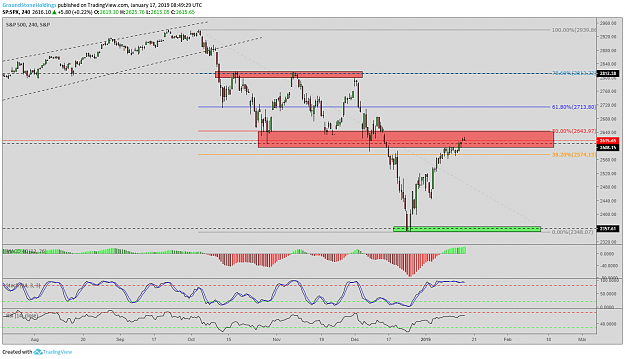

SPX:

Intraday target: $2413

Long-term target: $2000

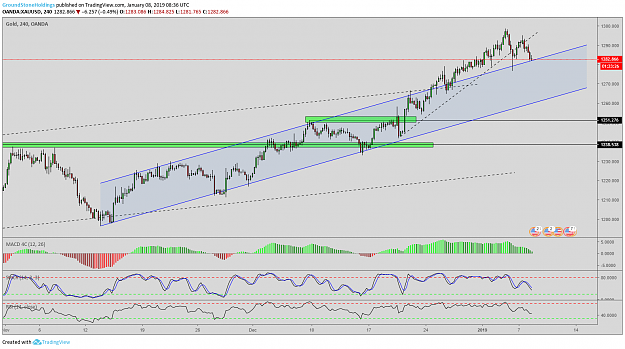

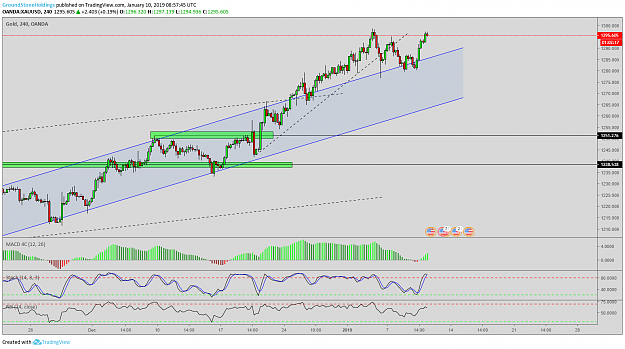

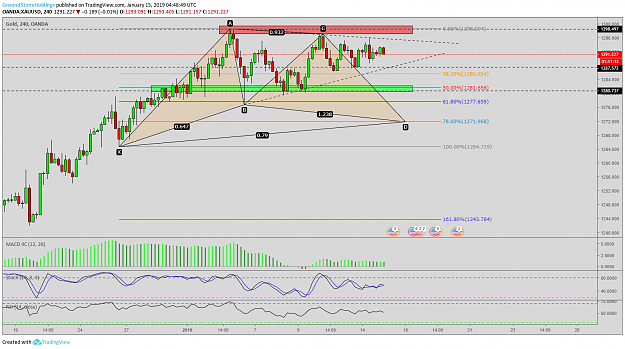

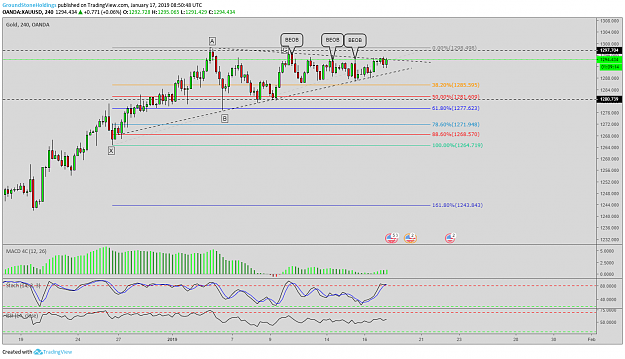

GOLD:

Intraday target: $1280

Long-term target: $1183

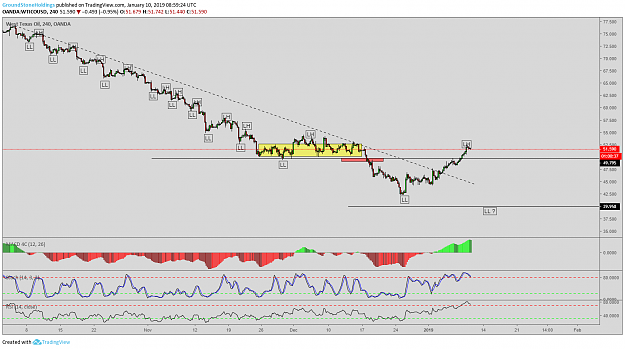

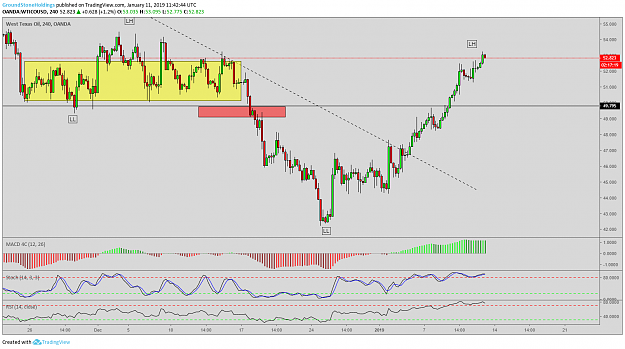

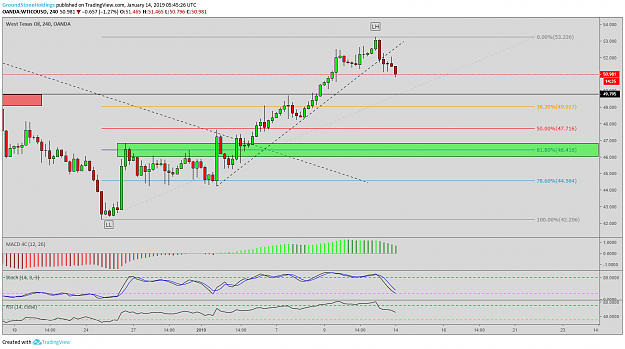

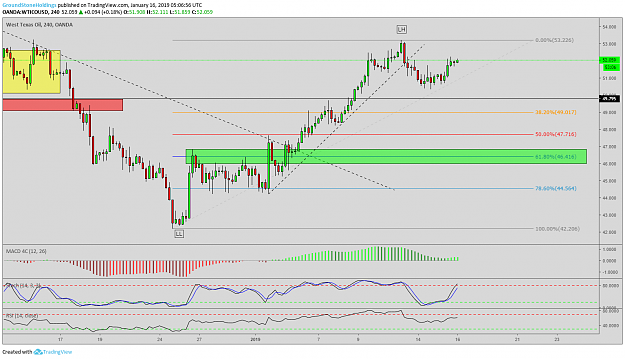

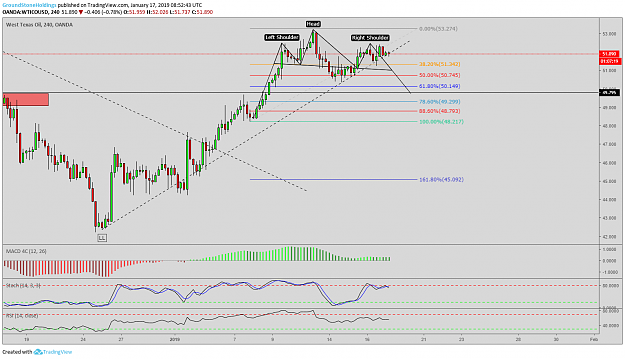

WTICOUSD:

Intraday target: $46.00

Long-term target: $27.00

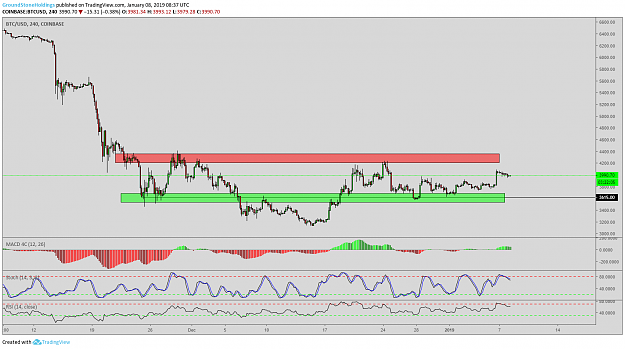

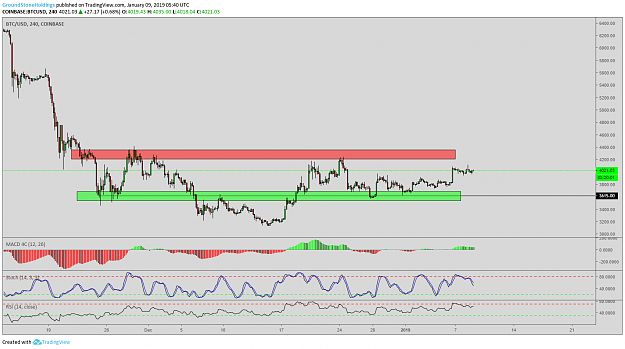

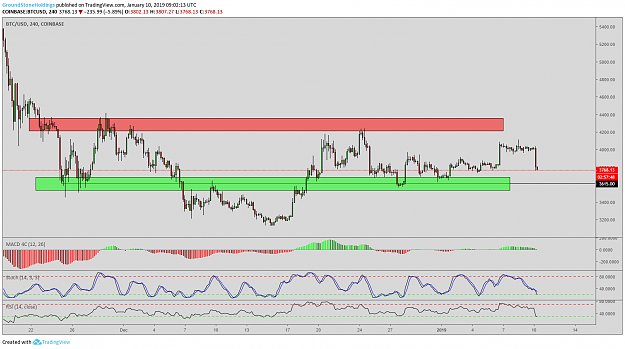

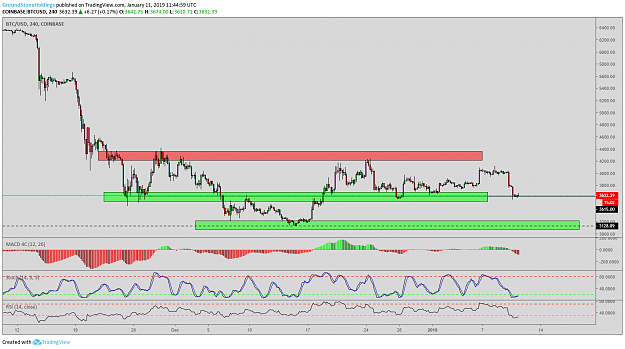

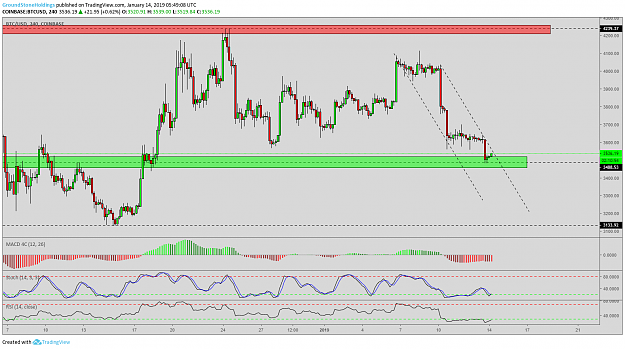

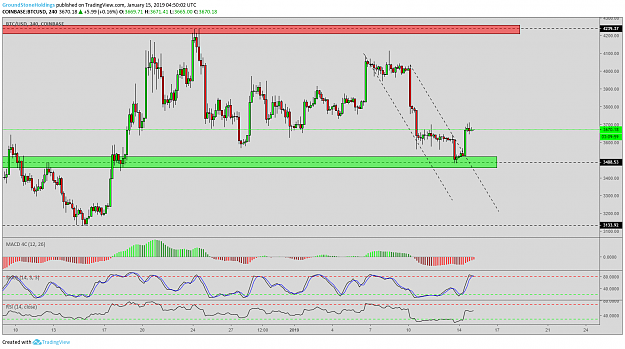

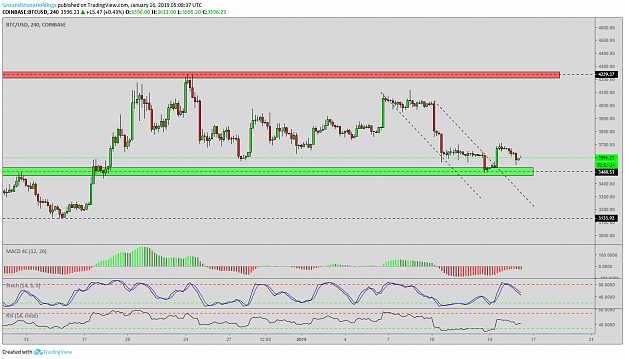

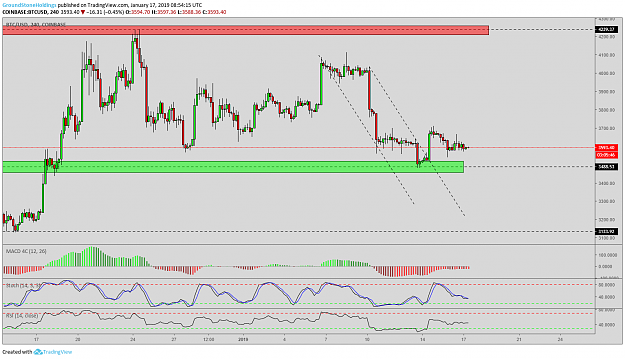

BITCOIN:

Intraday target: $3615

Long-term target: $2000

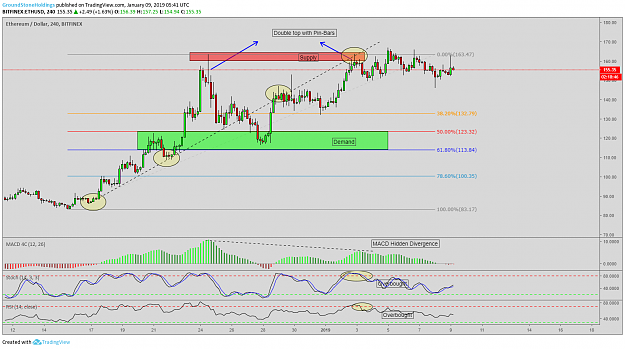

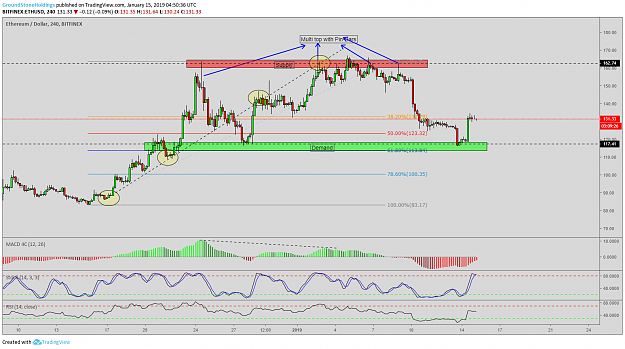

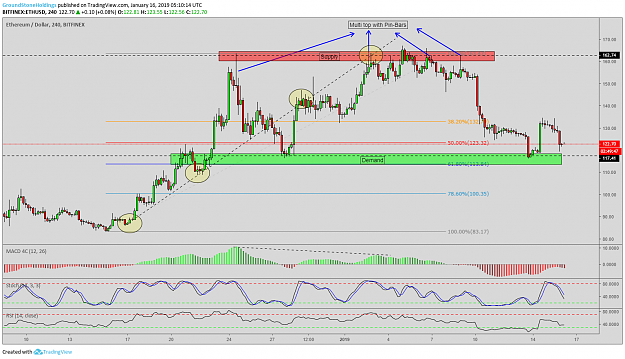

ETHEREUM:

Intraday target: $130

Long-term target: $60

NEWS:

CLICK HERE

Stock, Oil Markets Moved by Trader Hopes

Oil prices were higher on Tuesday, buoyed by renewed trader optimism that the United States will reach a trade deal with China, and by continued production cuts by OPEC and its oil-producing partners. U.S. WTI futures were trading at $48.53 per barrel, up 0.02 percent, and Brent crude futures were up 0.03 percent, to $57.35 per barrel. Though the movements were modest, they reflected traders’ hope that a trade deal would be met in the near future. On Monday afternoon, U.S. Commerce Secretary Wilbur Ross said that Beijing and Washington could reach a trade deal that “we can live with”, following the first day of meetings between the countries’ trade representatives. The negotiations will continue on through Tuesday.

Asian stocks were trading mixed, with Chinese markets lower on fears that the deal might not be in China’s best interests. The Shanghai Composite was down 0.20 percent as of 1:50 p.m. HK/SIN, and the Shenzhen Composite was down 0.18 percent. Japan’s Nikkei 225 rose 1.28 percent by the early afternoon, and Australia’s ASX 200 gained 0.69 percent. All three major Wall Street indexes closed higher on Monday following the first day of trade talks in Beijing.

The dollar index was up 0.22 percent to 95.88 .DXY, as traders found new reasons to favor the dollar. The greenback advanced against the yen, gaining 0.11 percent to 108.81. The dollar also gained against the euro, pound and Australian dollar. Also supporting the dollar were some words from the Federal Reserve indicating that the U.S. central bank may only raise interest rates once in 2019. The dollar index has eased around 2 percent since mid-December, though the dollar still managed to end 2018 up 4.3 percent.

DXY:

Intraday target: $96.20

Long-term target: $100

EUR/USD:

Intraday target: 1.1400

Long-term target: 1.0800

APPLE:

Intraday target: $140

Long-term target: $100

SPX:

Intraday target: $2413

Long-term target: $2000

GOLD:

Intraday target: $1280

Long-term target: $1183

WTICOUSD:

Intraday target: $46.00

Long-term target: $27.00

BITCOIN:

Intraday target: $3615

Long-term target: $2000

ETHEREUM:

Intraday target: $130

Long-term target: $60