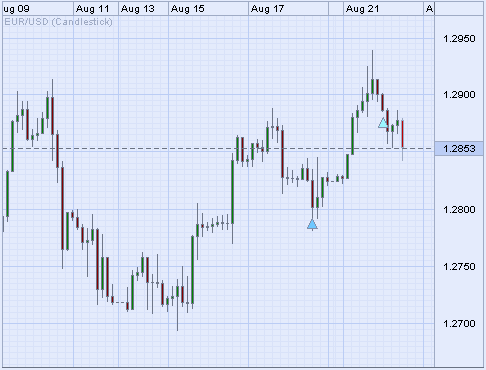

I entered in short dollar positions during Friday's New York session on both eur/usd (2729 @ 1:2) and aud/usd (7577 @ 1:2). I'm calling the last two trading days' dollar rally bs. There was nothing substantial there - Philly Fed, Consumer Sentiment and China's 27bp hike really meant nothing in the end. This backed by extremely low volumes, even for summer.

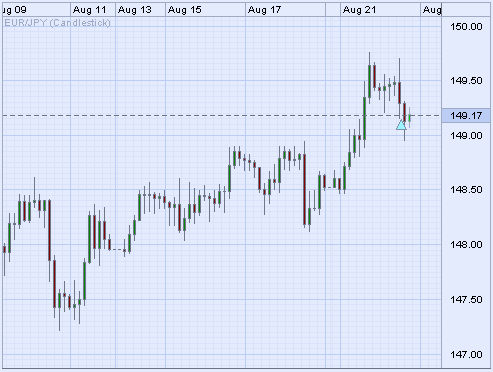

The market just doesn't seem "right" to me. Something is going on and I think the fundamentals have changed - I just don't know it yet. We've been stuck in a tight range all summer and autumn is likely to bring about the inevitable break-out.

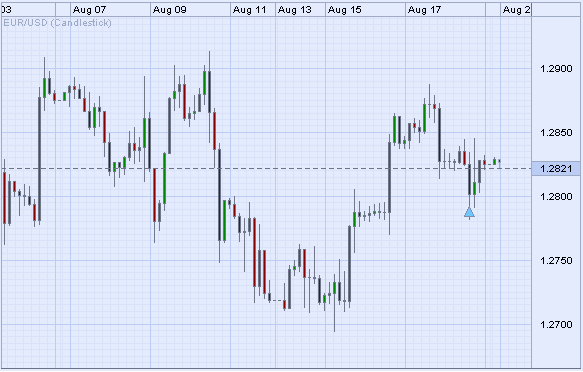

The fact that I'm positioned short dollars has more to do with the fact that I found good entry points - 2800 being a level where good sized bids are placed;

18 Aug 2006 13:03 GMT

BULLET: EURO-DOLLAR: Gets a modest pop to $1.2815 area as by.

EURO-DOLLAR: Gets a modest pop to $1.2815 area as buying by a U.S.

investment name ripples through the market, returning the pair to atop

$1.2800. Offers expected to cap around the area of overnight highs.

Provided by: Market News International

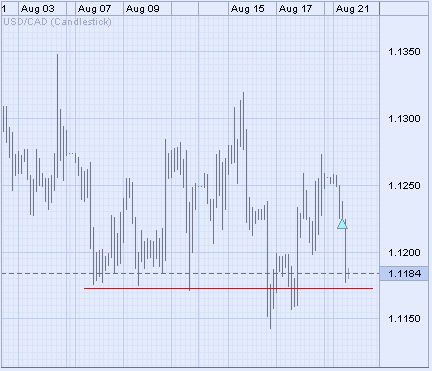

On the aussie; the chart shows that there were stops washed out 7560 and then we got the immediate pop higher. After trading in a 150 pip range for almost a month this might be the stop washout that was needed to let the market move higher. *As a side note these stop washouts tend to precede big moves*

The market just doesn't seem "right" to me. Something is going on and I think the fundamentals have changed - I just don't know it yet. We've been stuck in a tight range all summer and autumn is likely to bring about the inevitable break-out.

The fact that I'm positioned short dollars has more to do with the fact that I found good entry points - 2800 being a level where good sized bids are placed;

18 Aug 2006 13:03 GMT

BULLET: EURO-DOLLAR: Gets a modest pop to $1.2815 area as by.

EURO-DOLLAR: Gets a modest pop to $1.2815 area as buying by a U.S.

investment name ripples through the market, returning the pair to atop

$1.2800. Offers expected to cap around the area of overnight highs.

Provided by: Market News International

On the aussie; the chart shows that there were stops washed out 7560 and then we got the immediate pop higher. After trading in a 150 pip range for almost a month this might be the stop washout that was needed to let the market move higher. *As a side note these stop washouts tend to precede big moves*

Attached Image