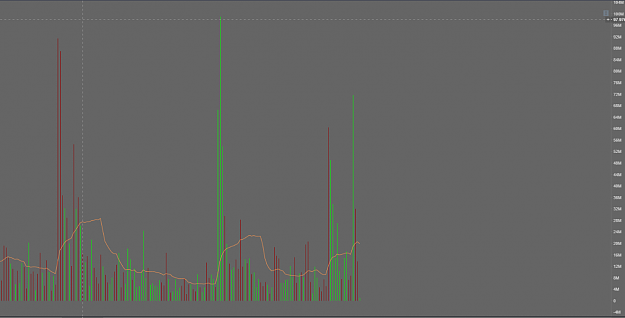

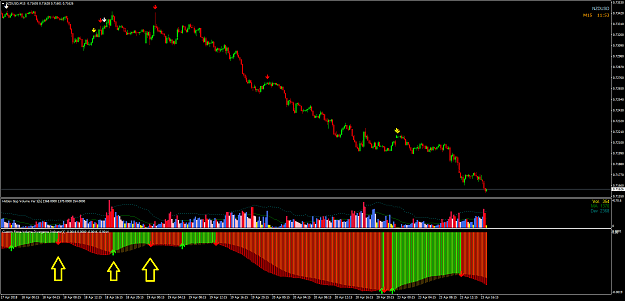

I think this is tick volume, thanks for your input I will look into delta ratios ?

- Joined Dec 2015 | Status: Member | 1,509 Posts

Do more of that which succeeds and less of that which does not - Dennis Gar

- Joined Dec 2015 | Status: Member | 1,509 Posts

Do more of that which succeeds and less of that which does not - Dennis Gar

- Joined Dec 2015 | Status: Member | 1,509 Posts

Do more of that which succeeds and less of that which does not - Dennis Gar

- Joined Dec 2015 | Status: Member | 1,509 Posts

Do more of that which succeeds and less of that which does not - Dennis Gar

- Joined Dec 2015 | Status: Member | 1,509 Posts

Do more of that which succeeds and less of that which does not - Dennis Gar

- Joined Dec 2015 | Status: Member | 1,509 Posts

Do more of that which succeeds and less of that which does not - Dennis Gar

- Joined Dec 2015 | Status: Member | 1,509 Posts

Do more of that which succeeds and less of that which does not - Dennis Gar