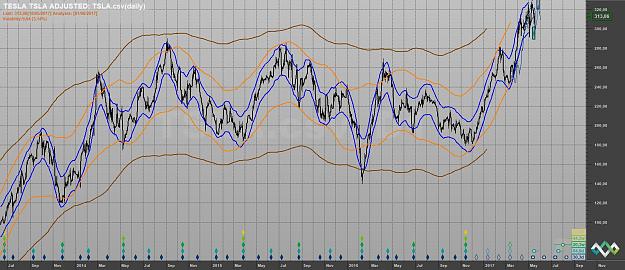

This thread is opened to discuss the pro's and con's of the Envelopes Methodology based on the work of Jim Hurst and Brian Millard

Hurst and Millard used Envelopes based on Centered Moving Averages and fixed width parameters

Gann will help us to determine the right parameters (Law of Vibration)

Comments and questions are welcome

Others related subjects of interest as:

- Forks (Andrews, Tillman)

- Volume (Levine MIDAS Theory)

- Congestion Areas (Wyckoff)

- Envelopes

- Moving Averages

- Speed and Acceleration (Gann Angles)

will be adressed

Good readings

Important side note : I do not use MT4 - I have no EA available - I use TradingView:

For those among you who would use Envelopes "à la Hurst" on Tradingview, see here :

Courtesy of Terry Pascoe; You can thank him;

Terry gives us the possibility to calculate the Inverse Moving Average

https://www.tradingview.com/script/3...rse-Half-Span/

Envelopes indicators by Terry Pascoe (TradingView)

Morning Alain, this is a link to my current indicator.

MML indicator - : https://www.tradingview.com/script/A...th-Lines-Dark/

FLD indicator - https://www.tradingview.com/script/6c5lRGEg-FLDs/

Channels/CMAs indicator - https://www.tradingview.com/script/2...hannels-Alain/

Underlying cycles indicator - https://www.tradingview.com/script/k...erlying-Cycle/

Top Bottom Finder 'TBF) Courtesy of Terry Pascoe https://www.tradingview.com/script/G...Bottom-Finder/

Hurst and Millard used Envelopes based on Centered Moving Averages and fixed width parameters

Gann will help us to determine the right parameters (Law of Vibration)

Comments and questions are welcome

Others related subjects of interest as:

- Forks (Andrews, Tillman)

- Volume (Levine MIDAS Theory)

- Congestion Areas (Wyckoff)

- Envelopes

- Moving Averages

- Speed and Acceleration (Gann Angles)

will be adressed

Good readings

Important side note : I do not use MT4 - I have no EA available - I use TradingView:

For those among you who would use Envelopes "à la Hurst" on Tradingview, see here :

Courtesy of Terry Pascoe; You can thank him;

Terry gives us the possibility to calculate the Inverse Moving Average

https://www.tradingview.com/script/3...rse-Half-Span/

Envelopes indicators by Terry Pascoe (TradingView)

Morning Alain, this is a link to my current indicator.

MML indicator - : https://www.tradingview.com/script/A...th-Lines-Dark/

FLD indicator - https://www.tradingview.com/script/6c5lRGEg-FLDs/

Channels/CMAs indicator - https://www.tradingview.com/script/2...hannels-Alain/

Underlying cycles indicator - https://www.tradingview.com/script/k...erlying-Cycle/

Top Bottom Finder 'TBF) Courtesy of Terry Pascoe https://www.tradingview.com/script/G...Bottom-Finder/

Attached File(s)