I just wanted to post a couple of articles & research on the topic of Market Waves & Cycles, from an Auction Market perspective.

Market Waves are NOT Cycles

Donald L. Jones

Copyright CISCO Futures March 25, 2005

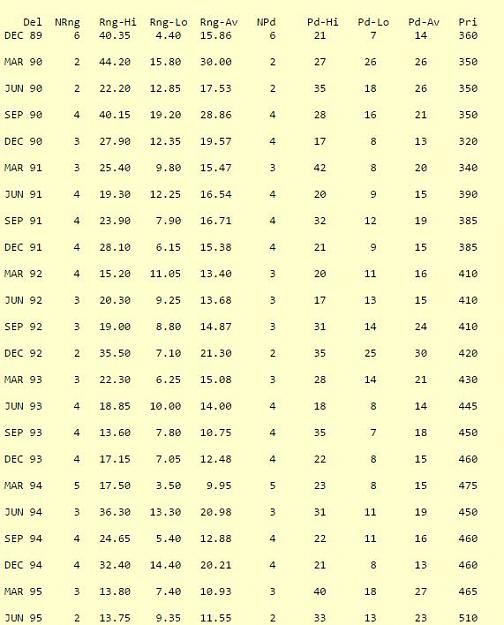

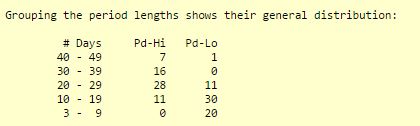

A hope of many technical analysts is that markets have a cyclic component that can be used for predictive purposes. Belief in an underlying periodicity is implicit in moving average smoothing, since the moving average is expected to act as a filter. The same is true of oscillators, where two moving averages of different time frames are subtracted to find differences. The fact that oscillator differences often move smoothly and change fast in highly directional markets is taken as evidence that the resulting curves provide information that can be traded. An underlying but unspoken assumption of virtually all technical analysis is that market data is well conditioned (small errors in the data produce small errors in the result). In fact, as will be shown below, the fundamental assumption of essentially equidistant peaks in a set of market data is incorrect, and thus market data is poorly conditioned for most of technical analysis.

It is theoretically true (Fourier analysis) that several waves of varying amplitudes and periods can be combined to provide a display that looks like market flow (with rises, falls and periods of low amplitude). Unfortunately, it is also true that market flow can and does come from a complex, self-regulating process (aggregate decisions of a large number of traders). This process cannot be described by any known mathematical distribution. Specifically ruled out is the fourier process, the market is not (so far as anyone can tell) a combination of sine waves.

Many elements of normal life are cyclic; the 24 hour day, seasons, weather, ice ages and other natural phemonena. Some economic phenomena such as booms and busts are thought to follow some sort of wave, such as the Kondratieff 30 to 60 year wave. In markets, much has been made of the Elliott five wave up and three wave down proposition. While phemonena such a Elliott waves become apparent after the fact, proponents seem unable to agree on the present. Even if you could tell which leg of an Elliott wave you are in, that knowledge would be hard to use in day-to-day trading where your outlook is rarely more than just a few minutes or days.

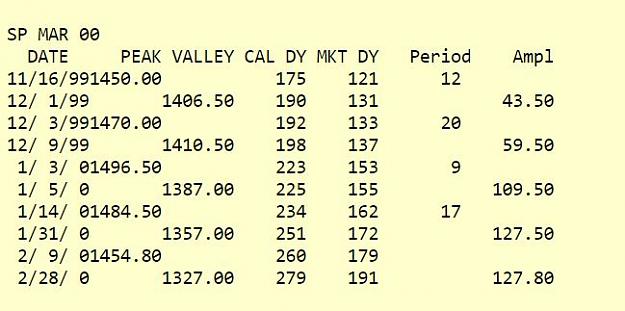

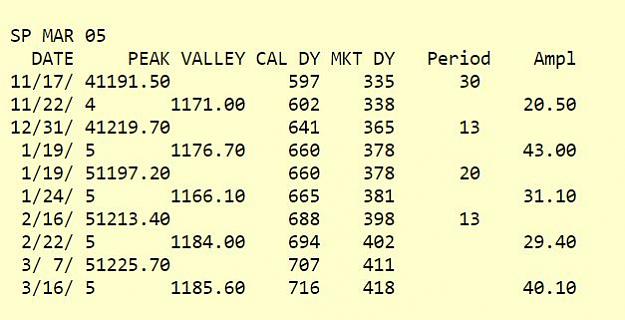

Markets always display wave-like motion. Prices move up and down with some regularity, describing local highs and lows. This movement reflects the changes in the way the composite of all traders, their feedback, value the market. While clearer on longer term charts, the local highs and lows describe periods that vary from wave to wave. Prediction of the next high or low cannot be made in any reliable way. Incidentally, prediction is not a requirement of successful trading

Because the source of market motion cannot be tied to any known distribution, a market surely cannot be described by a set of sine waves or helped in any real analytical sense by smoothing.

Market Waves are NOT Cycles

Donald L. Jones

Copyright CISCO Futures March 25, 2005

A hope of many technical analysts is that markets have a cyclic component that can be used for predictive purposes. Belief in an underlying periodicity is implicit in moving average smoothing, since the moving average is expected to act as a filter. The same is true of oscillators, where two moving averages of different time frames are subtracted to find differences. The fact that oscillator differences often move smoothly and change fast in highly directional markets is taken as evidence that the resulting curves provide information that can be traded. An underlying but unspoken assumption of virtually all technical analysis is that market data is well conditioned (small errors in the data produce small errors in the result). In fact, as will be shown below, the fundamental assumption of essentially equidistant peaks in a set of market data is incorrect, and thus market data is poorly conditioned for most of technical analysis.

It is theoretically true (Fourier analysis) that several waves of varying amplitudes and periods can be combined to provide a display that looks like market flow (with rises, falls and periods of low amplitude). Unfortunately, it is also true that market flow can and does come from a complex, self-regulating process (aggregate decisions of a large number of traders). This process cannot be described by any known mathematical distribution. Specifically ruled out is the fourier process, the market is not (so far as anyone can tell) a combination of sine waves.

Many elements of normal life are cyclic; the 24 hour day, seasons, weather, ice ages and other natural phemonena. Some economic phenomena such as booms and busts are thought to follow some sort of wave, such as the Kondratieff 30 to 60 year wave. In markets, much has been made of the Elliott five wave up and three wave down proposition. While phemonena such a Elliott waves become apparent after the fact, proponents seem unable to agree on the present. Even if you could tell which leg of an Elliott wave you are in, that knowledge would be hard to use in day-to-day trading where your outlook is rarely more than just a few minutes or days.

Markets always display wave-like motion. Prices move up and down with some regularity, describing local highs and lows. This movement reflects the changes in the way the composite of all traders, their feedback, value the market. While clearer on longer term charts, the local highs and lows describe periods that vary from wave to wave. Prediction of the next high or low cannot be made in any reliable way. Incidentally, prediction is not a requirement of successful trading

Because the source of market motion cannot be tied to any known distribution, a market surely cannot be described by a set of sine waves or helped in any real analytical sense by smoothing.

Markets are not efficient, rather they are effective - Jones