Hi traders,

I hope you all had a magnificent week and before we all take our time off for the weekend, let’s go through some of the recent FTMO updates as well as through your posts and queries.

Quick good news for trading platforms: on Saturday, 13th of November, crypto traders will get more room to operate in as the usual market break will be reduced to 8 AM to 10 AM platform time (GMT+2) for MetaTrader4 and MetaTrader5 platforms. On cTrader, the market break remains unchanged (8 AM – 2 PM GMT+2 as per the specifications).

When it comes to our current point of focus, we’ve been lately improving the efficiency of our back-office operations as well as developing the long-term projects that we will be able to announce in the following months.

Speaking of the use of our work time, I’ve realized that we have never properly addressed here our Blog in which we actually engage multiple colleagues as well as some of our traders. If you have spare time, you can go through our articles about e. g. Trading systems, Psychology, or regular written interviews with traders that passed our Evaluation Process.

Let’s switch on to your posts. I have noticed that many of you were pleased about Vitore receiving his FTMO Account, so let me join in and congratulate you too. Also, there are some details that I would like to add, so kindly find my responses below.

Hello Nsak3y, thank you for your words of appreciation, however, I would like to point out that at no point have we stepped out of the usual common process. We have contacted Vitore with the description of the suspicious trading practices that may not be applicable in the real market with the amendment that we’re awaiting his response.

After a back and forth email communication and analysing Vitore’s trading approach, we have admitted & declared that we had not recorded any malicious intention and proceeded with processing the new FTMO Account.

The whole process was rather standard and may occur again in the future.

Hello driven18, I appreciate your words of courage aimed at Vitore, but let me also emphasize that our decision is based solely on the internal email communication with the client and manual account analysis, not public callouts and open discussions on social media/forums. After all, as you can see, by the time I responded to Vitore last week, the case was already closed.

Hi Omarbabaw, the resolution of the attached screenshot is unfortunately insufficient. Could you please further elaborate your question?

Hello Vitore, I spoke to my colleagues responsible for the platform management and the historical data upload on cTrader has been queued. The reason behind the missing data is not a closure of trading on the particular instrument (gold has always been a very popular trading instrument, we could not afford to close it for 4 months). During the past, we have swapped/added in new liquidity providers (and re-uploaded the historical price data) several times, so I assume the gap is most likely related to that.

Also, I can see Koop has already responded to your second question, but nonetheless, I would like to confirm that the initial fee is being refunded along with your first Profit Split and it does not matter if your first few weeks or even months would not be profitable.

There is no minimum profit you’d need to score, although we usually can not process withdrawals below $20 as the fees most banks charge for international transactions would overtop the actual payout.

Hello PaulMF, this point is included in our T&Cs especially for cases unrelated to the actual trading activities (where we, on the other hand, are able to be exact).

We’re therefore talking about e. g. publicly harming the good name of our company, false reviews, threats towards our employees, etc. As I’m sure you understand, these activities can not be clearly described in our T&Cs one by one, hence we’ve added the mentioned clause 6.8.

Another, this time rather quick update is history. Thank you for your additions everybody, I have to admit that I was pleased with the positive energy a lot of you have expressed towards a new FTMO Trader.

I'll see you all next Friday, cheers!

-Vitek

I hope you all had a magnificent week and before we all take our time off for the weekend, let’s go through some of the recent FTMO updates as well as through your posts and queries.

Quick good news for trading platforms: on Saturday, 13th of November, crypto traders will get more room to operate in as the usual market break will be reduced to 8 AM to 10 AM platform time (GMT+2) for MetaTrader4 and MetaTrader5 platforms. On cTrader, the market break remains unchanged (8 AM – 2 PM GMT+2 as per the specifications).

When it comes to our current point of focus, we’ve been lately improving the efficiency of our back-office operations as well as developing the long-term projects that we will be able to announce in the following months.

Speaking of the use of our work time, I’ve realized that we have never properly addressed here our Blog in which we actually engage multiple colleagues as well as some of our traders. If you have spare time, you can go through our articles about e. g. Trading systems, Psychology, or regular written interviews with traders that passed our Evaluation Process.

Let’s switch on to your posts. I have noticed that many of you were pleased about Vitore receiving his FTMO Account, so let me join in and congratulate you too. Also, there are some details that I would like to add, so kindly find my responses below.

Disliked{quote}-It is really good to hear that everything has been sorted. It further serves as a testament to FTMO's credibility and trust among traders. That being said, I sincerely hope that FTMO will use this experience as a driver to consider corrective efforts to ensure that this does not happen again. As a trader and business owner, I would not want to start my long-term partnership on this kind of bad footing. {quote}-Cheers. No sense in beating a dead horse at this point, so I will leave it be. Thanks, again, for taking time out of your day. Have...Ignored

After a back and forth email communication and analysing Vitore’s trading approach, we have admitted & declared that we had not recorded any malicious intention and proceeded with processing the new FTMO Account.

The whole process was rather standard and may occur again in the future.

Disliked{quote} You did not give up. I can appreciate this. If you would of given up, you would of never gotten your account back. As we say in Russian,"Molodets". Good Luck to you.Ignored

DislikedHi Vitek, trading Gold now I noticed there're 4 months of data missing in the price history on cTrader, more specifically Oct 31, 2019 - Mar 2, 2020. Do you plan to fix it? It affects back testing and may also affect some indicators such as yearly-based pivot points or VWAP (I use both and they are both completely off because of this error in data). Btw. I'm thinking about how such thing would even be possible? Was trading of Gold with FTMO down for such a long time? Thank you!Ignored

Also, I can see Koop has already responded to your second question, but nonetheless, I would like to confirm that the initial fee is being refunded along with your first Profit Split and it does not matter if your first few weeks or even months would not be profitable.

There is no minimum profit you’d need to score, although we usually can not process withdrawals below $20 as the fees most banks charge for international transactions would overtop the actual payout.

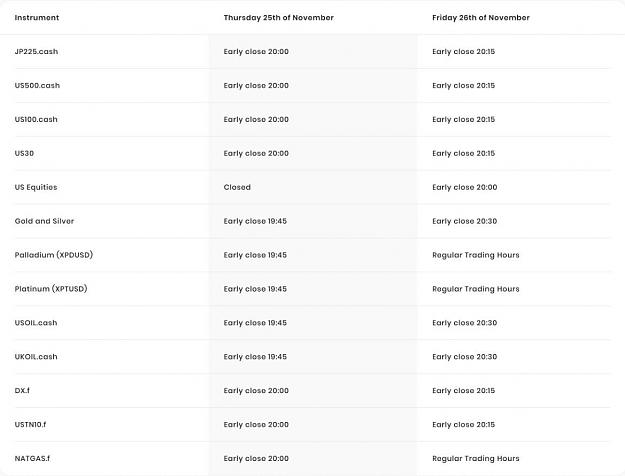

Disliked{quote} Hi Vitore, They reserve their right to do whatever they want, whenever they want: {image} Remember that they are unregulated and won't have to respond to any finance industry standards.Ignored

We’re therefore talking about e. g. publicly harming the good name of our company, false reviews, threats towards our employees, etc. As I’m sure you understand, these activities can not be clearly described in our T&Cs one by one, hence we’ve added the mentioned clause 6.8.

Another, this time rather quick update is history. Thank you for your additions everybody, I have to admit that I was pleased with the positive energy a lot of you have expressed towards a new FTMO Trader.

I'll see you all next Friday, cheers!

-Vitek

4