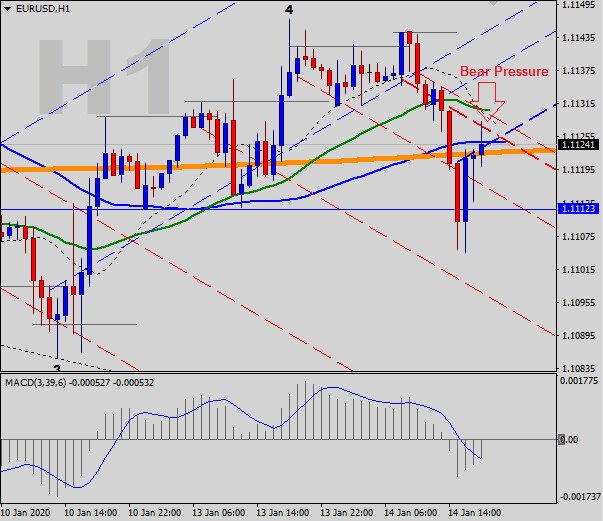

DislikedDaily Charts 1. Forming Head & Sholders 2. Still below trendline Still active my sell entry (If Day candle close above 1.1150 I will close my sell) {image} {image}Ignored

3

LIVE Trades Only : EURUSD & GBPUSD 122 replies

Strategy behind 1 EA (buy only) and 1 EA (sell only) 2 replies

Trading EURUSD only 43,752 replies

Eurusd-5m Trading Only 109 replies

Script to change EA to long only/ short only at a price level? 1 reply

DislikedDaily Charts 1. Forming Head & Sholders 2. Still below trendline Still active my sell entry (If Day candle close above 1.1150 I will close my sell) {image} {image}Ignored

DislikedWell US data out.... nothing to get too much excited abt...so staying short... ..... no new entry...Happy Trading

Ignored

watch out for the magnet 3bn expiry .... investor could try to hold the price...or move up...... but as you know nothing is certain...![]()

NB: these are vanilla options so ..active till expiry time.

Happy Trading

Disliked{quote} I think so too.. 1.1125/30 can become heavy resistance.. We will see.. Now we better first focus on the "now"Stay Green

Ignored

Disliked{quote} You were right so far EURUSD down before the US market opened. Lets see what will happen the rest of the day. {image}Ignored

Disliked{quote} Well the move down was probably a wave 3 based on M15.. Assuming for wave 3's there is often a retracement between 33% to 66% I am guessing that 1.1120/30 would be a decent place to look for wave 4 to end, in other words to look for new (or additional) sell opportunities.. Time will tell.. Stay GreenIgnored

DislikedNew Pending Order, Sell Limit: 1.1123 Lot: x SL: 1.1141 TP: Open Stay GreenIgnored

Disliked{quote} I think so too.. 1.1125/30 can become heavy resistance.. We will see.. Now we better first focus on the "now"Stay Green

Ignored

DislikedRisking a little long here at 1.1108. SL 20 pips. Should probably have waited for 1.1090 or a little below. Very risky. Please don't try this at home. Remember that WWE superstars are well-trained.Ignored

Disliked{quote} Booked 1/3 and moved SL to entry for the rest. It seems Ata has applied the brakes on the bull.Ignored

DislikedHi Guys, Buy trade taken at 1.11327 just above my daily pivot s/loss 20 pips. Cheers. {image}Ignored

Disliked{quote} Hi Guys, I still maintain my longs, rinse and repeat. It could go either way at this point in time. This is what swing trading is all about. I either get it right or wrong. There are stop hunts when we trade these levels. To those of you that have unsubscribed from me during this apparent down move. Good, this method is not for you!. I look at risk reward. If my trail stops are taken out I move on. There will be a time when my reward will compensate for my small losses. Nobody can predict market movement and we only rely on our edge. I should...Ignored