It's Free for all.

YouTube

Upon member Request, I Open this group

https://discord.gg/c9MddeCHKh

I don't sell anything.

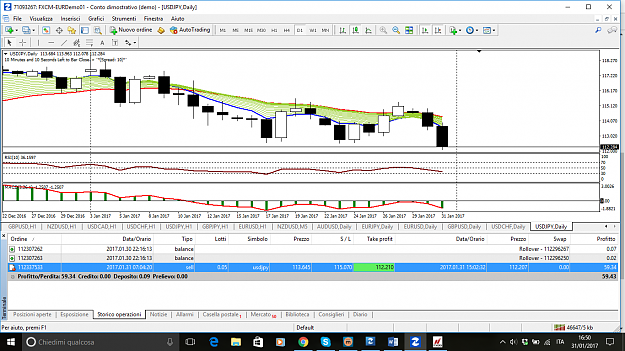

Take a screenshot and share your trading thoughts It will improve your trading a lot.

here is a little software for screenshots

https://app.prntscr.com/en/

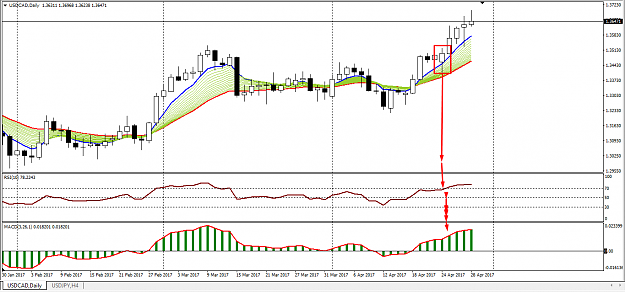

This is the system I developed and share on the internet in 2013.

Many websites have published this system as it and they have added their thought.

System concept:

1. Trading the Trend

2. Focus on the short-term so the stop remains manageable.

3. Improve win rate with the help of MTF.

4. Not opening buy at too much high.

5. Not opening sales at too much low.

6. Stop trying to catch a Falling knife like other newbies wanted to do.

7. Moving average stop working in a sideway market so trying to have a clear understanding when there is a sideways market.

The 2013 system is already a good one, Trade with it. you will see good results with proper practice.

2023 Update

1. it is very much the same as the 2013 system.

2. Tried to clarify the entry point more precisely.

3. Add a histogram indicator.

4. Added daily, weekly, and Monthly open lines.

5. Added Market structure PDF for a better understanding of the market. ( shared it here )

6. Started using 6 and 21 GMMA with RSI filtered. ( Already I share this in my profile) so that I can turn off MA when I want.

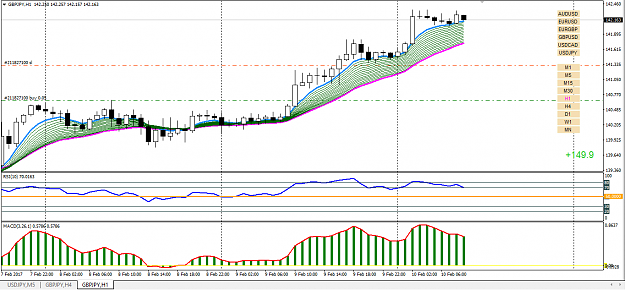

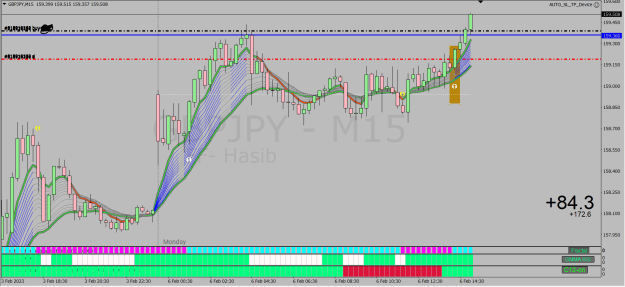

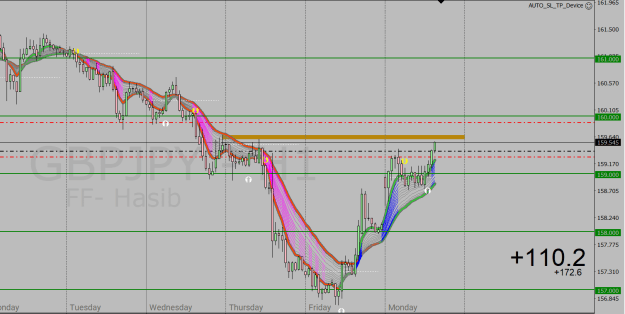

7. Started trading one pair GJ only.

2023 version of the system, I have already shared a few tools here and there.

I will not share it publicly since it is the same as the 2013 version.

Trade this system with full confidence and test it yourself in the market you will gain confidence.

when I discuss Guppy's Multi-Moving Average (GMMA) don't get confused I have been inspired by Guppy but GMMA and My system have some differences if you test it you will understand. I use 6 to 21 ema one ma sets instead of 2 MA sets. Because I like to trade swings.

How to Be a Better Trader

Analyzing and reviewing your trades is essential for improving your forex trading performance. Here are ten trade review rules to help you evaluate your trades effectively:

YouTube

Upon member Request, I Open this group

https://discord.gg/c9MddeCHKh

I don't sell anything.

Take a screenshot and share your trading thoughts It will improve your trading a lot.

here is a little software for screenshots

https://app.prntscr.com/en/

This is the system I developed and share on the internet in 2013.

Many websites have published this system as it and they have added their thought.

System concept:

1. Trading the Trend

2. Focus on the short-term so the stop remains manageable.

3. Improve win rate with the help of MTF.

4. Not opening buy at too much high.

5. Not opening sales at too much low.

6. Stop trying to catch a Falling knife like other newbies wanted to do.

7. Moving average stop working in a sideway market so trying to have a clear understanding when there is a sideways market.

The 2013 system is already a good one, Trade with it. you will see good results with proper practice.

2023 Update

1. it is very much the same as the 2013 system.

2. Tried to clarify the entry point more precisely.

3. Add a histogram indicator.

4. Added daily, weekly, and Monthly open lines.

5. Added Market structure PDF for a better understanding of the market. ( shared it here )

6. Started using 6 and 21 GMMA with RSI filtered. ( Already I share this in my profile) so that I can turn off MA when I want.

7. Started trading one pair GJ only.

2023 version of the system, I have already shared a few tools here and there.

I will not share it publicly since it is the same as the 2013 version.

Trade this system with full confidence and test it yourself in the market you will gain confidence.

when I discuss Guppy's Multi-Moving Average (GMMA) don't get confused I have been inspired by Guppy but GMMA and My system have some differences if you test it you will understand. I use 6 to 21 ema one ma sets instead of 2 MA sets. Because I like to trade swings.

How to Be a Better Trader

Analyzing and reviewing your trades is essential for improving your forex trading performance. Here are ten trade review rules to help you evaluate your trades effectively:

- Review your trade setup: Assess the quality of your trade setup based on your trading strategy's criteria. Determine if the trade met your entry rules and if there were any additional factors that influenced your decision.

- Analyze the market context: Consider the overall market conditions at the time of the trade. Review the prevailing trend, support and resistance levels, economic news releases, or any other relevant factors that may have impacted the trade's outcome.

- Evaluate risk management: Assess your risk management practices, including your position sizing, stop-loss placement, and take-profit levels. Determine if your risk-to-reward ratio was appropriate and if you followed your risk management rules.

- Examine trade execution: Analyze how well you executed the trade. Assess whether you entered and exited the trade according to your plan or if there were any execution errors or delays that may have affected the outcome.

- Review trade duration: Consider the duration of the trade and whether it aligned with your initial expectations. Determine if you exited too early or held on for too long, based on your analysis and strategy.

- Monitor emotions: Reflect on your emotional state during the trade. Assess whether emotions, such as fear, greed, or impatience, influenced your decision-making process. Identify any patterns or areas for improvement in managing your emotions.

- Analyze trade outcomes: Evaluate the outcome of the trade, whether it resulted in a profit or a loss. Determine if the outcome was aligned with your expectations and if there were any unexpected price movements or market events that affected the trade.

- Keep a trading journal: Maintain a detailed trading journal to record all relevant trade information, including entry and exit points, reasoning behind the trade, and your emotional state. This journal will help you track patterns, identify strengths and weaknesses, and make data-driven improvements.

- Identify patterns and trends: Look for recurring patterns, trends, or common mistakes in your trades. This analysis can help you identify areas for improvement, such as consistently missing entry signals, exiting trades prematurely, or failing to follow your trading plan.

- Adjust your trading plan: Based on your trade review, make necessary adjustments to your trading plan, risk management strategies, or trading rules. Continuously refine and adapt your approach based on your trade analysis to enhance your future trading performance.

Trade review should be an ongoing process to continually learn and grow as a trader. By implementing these trade review rules, you can gain valuable insights into your trading decisions and improve your overall trading effectiveness.

Attached File(s)

MA provides the market's current direction and strength.