Although not trying to reopen old wounds from this thread, I would like to know are there any traders

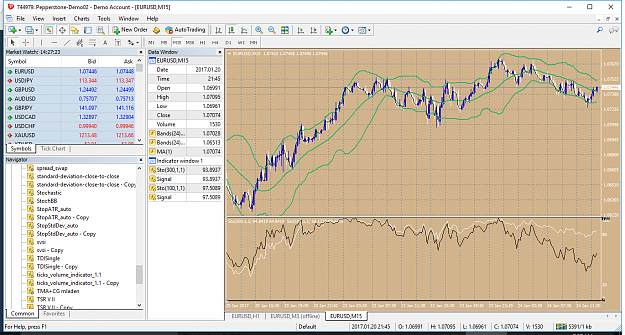

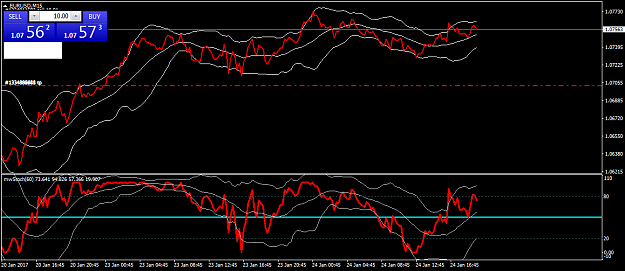

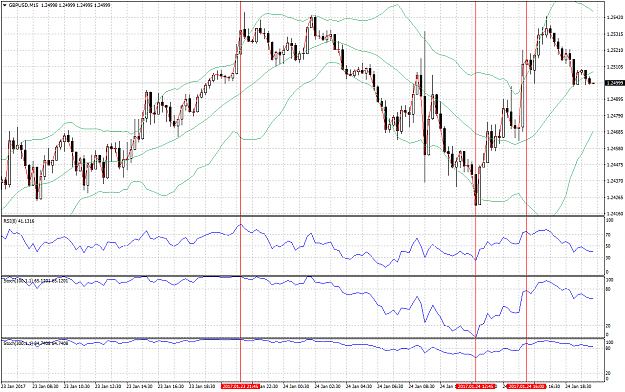

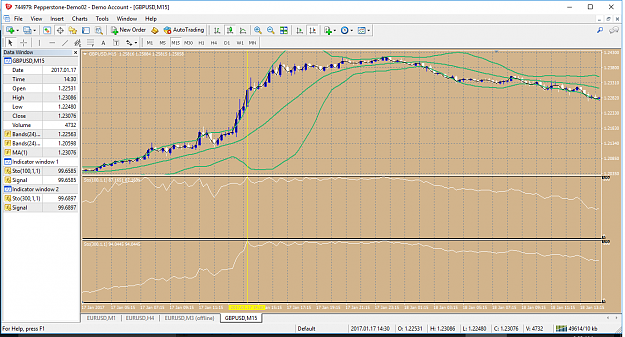

using any parts of the Similarity thread. What I am most interested in are you using Similarity as

stated using Bollinger Bands, Stochastic & Zig Zags. If so would you share you settings & any success

& failure you experienced. Not wanting to nose into your method, but just your views & info your willing

to share is appreciated.

I do have a motive behind this request. I read the thread two times & did extract several gems to add to

my current trading method & want to see if anyone else did the same. Those extracted gems are NOT the core

of my current method, but used alone they have merit. For me the negative to Similarity is all the lines from

the indicators you have on the chart, but those lines have merit if you use them correctly. Just that I like

clean charts for the most part. It took me two weeks of reading & rereading along with note taking, but those

gems can be found. There are two currency pairs that I trade my version of Similarity on & that info can be found

if you look. That version is what I put together. It is NO Holy Grail of Trading, but has merits. You decide.

To the NEW Traders coming onboard this ship of trading there is one method posted on this forum that it would

certainly behoove you to find & immerse yourself into its contents. NO, NOT going to tell you the name. The

Trader who started this thread is well known & his info is solid if the rules are followed. Being TooSlOW & taking

your time to learn to trade can be a good thing. This was off topic, but just had to share. Seek & ye shall find.

BTW: New Trader you have been given a clue on the thread I am speaking of. Its in the body of this thread.

All that are willing to share in reference to the Similarity thread thank you.

_____________________________

using any parts of the Similarity thread. What I am most interested in are you using Similarity as

stated using Bollinger Bands, Stochastic & Zig Zags. If so would you share you settings & any success

& failure you experienced. Not wanting to nose into your method, but just your views & info your willing

to share is appreciated.

I do have a motive behind this request. I read the thread two times & did extract several gems to add to

my current trading method & want to see if anyone else did the same. Those extracted gems are NOT the core

of my current method, but used alone they have merit. For me the negative to Similarity is all the lines from

the indicators you have on the chart, but those lines have merit if you use them correctly. Just that I like

clean charts for the most part. It took me two weeks of reading & rereading along with note taking, but those

gems can be found. There are two currency pairs that I trade my version of Similarity on & that info can be found

if you look. That version is what I put together. It is NO Holy Grail of Trading, but has merits. You decide.

To the NEW Traders coming onboard this ship of trading there is one method posted on this forum that it would

certainly behoove you to find & immerse yourself into its contents. NO, NOT going to tell you the name. The

Trader who started this thread is well known & his info is solid if the rules are followed. Being TooSlOW & taking

your time to learn to trade can be a good thing. This was off topic, but just had to share. Seek & ye shall find.

BTW: New Trader you have been given a clue on the thread I am speaking of. Its in the body of this thread.

All that are willing to share in reference to the Similarity thread thank you.

_____________________________