Introduction

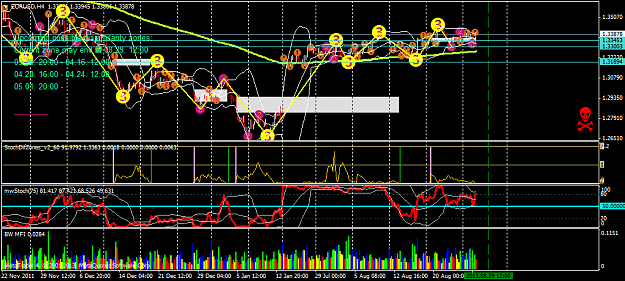

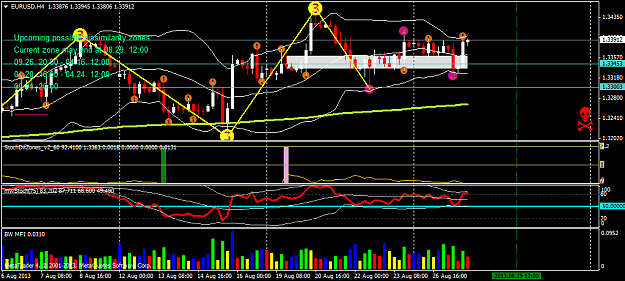

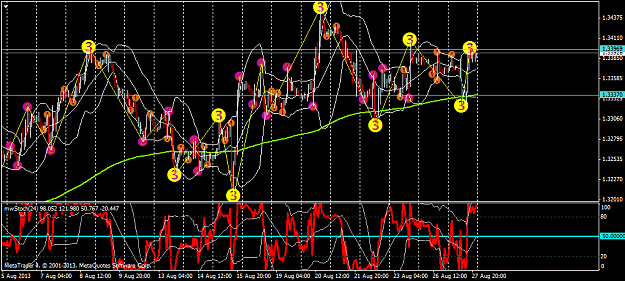

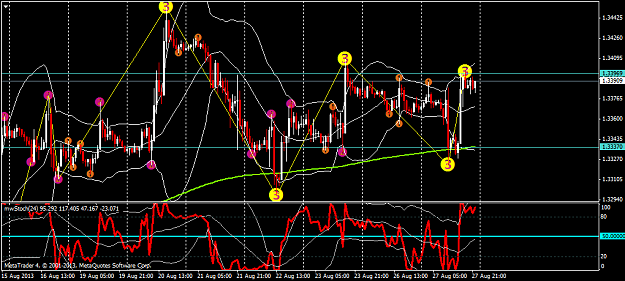

This is a trading journal on my application of the ZigZag Bollinger Band Method (henceforth known as ZZBB) that was derived from the thread "The Similarity System" by Eurusdd. Eurusdd is the originator of the method along with its components. Through various discussions, observations and trades a new method has evolved which I wish to explore in this journal.

Objective

This journal actually represents attempt #2 in applying this method. The first attempt resulted in a $5K demo account increasing to $30K in 3 weeks (mainly thanks to FOMC news announcements), but the trades were placed using the ZZBB. I want to make sure that success was not a fluke and will post all my trades in this journal. Hence the stated objective is:

This is a trading journal on my application of the ZigZag Bollinger Band Method (henceforth known as ZZBB) that was derived from the thread "The Similarity System" by Eurusdd. Eurusdd is the originator of the method along with its components. Through various discussions, observations and trades a new method has evolved which I wish to explore in this journal.

Objective

This journal actually represents attempt #2 in applying this method. The first attempt resulted in a $5K demo account increasing to $30K in 3 weeks (mainly thanks to FOMC news announcements), but the trades were placed using the ZZBB. I want to make sure that success was not a fluke and will post all my trades in this journal. Hence the stated objective is:

- To turn a $5K demo account into a $50K demo account using only the ZZBB Method

Thread Rules

I don't wish to impose too many rules on this thread. I am not a mathematician or computer programmer - discussion on these topics should be directed to the other Similarity Threads here (links coming soon). I didn't aim to make this an interactive journal but I am allowing members to post with a cursory warning that if discussions get out of hand I will not hesitate to turn posts off.

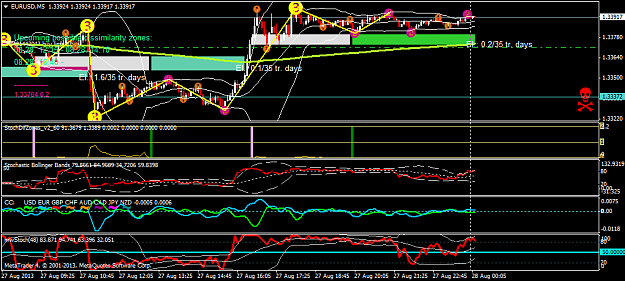

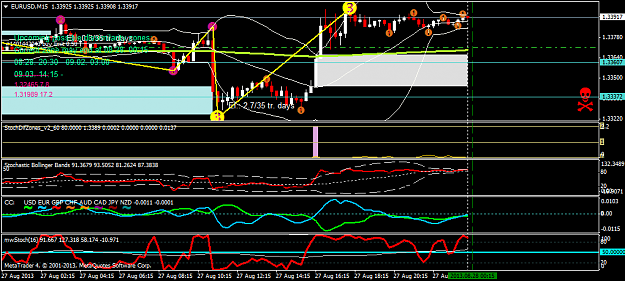

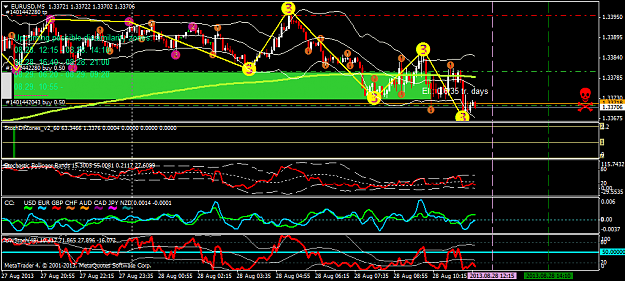

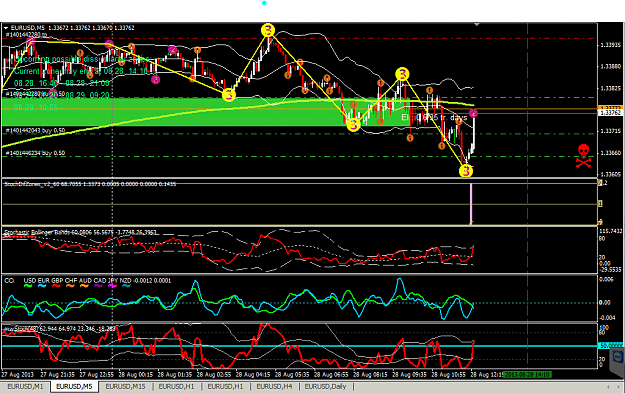

Trading Method

Attached is Version 1.0 of the method

Additional Steps to starting with the method

Attached File(s)

A pip is only worth it if you know how much you risked to earn it