OK thread, Happy (belated) New Year to you all, hope your time was rewarding.

I realise things have been incredibly quiet in here of late, but no I have not "run off with the programmer" (LOL).

Many thanks to Dreamwalker for keeping the ball rolling and posting his results - congrats to you, good sir! Some great pips banked there!

What I have been doing is hosting friends, preparing to host family for a three week stay, searching for a new place to live, coding, testing and tweaking, and generally not getting much sleep!

During all of this I have come to the realisation that everything I have been working on, for now anyway, is too complicated and needs to be simplified. But do not fear, this is NOT a backward step. On the contrary, I have something in store for you all which is even better than what has already been presented to date.

The problem with the current strategy is in its' implementation - after coding we were getting confusing signals and things were just not working the way I had them working in my head. To be honest, it still needs a lot of work, and I would like to offer you something simpler and just as powerful, (if not more so!)

The adjusted strategy is based on everything explained here already, but has fewer rules and better results. My programmer is busy coding and we are nearing the release date for an early version for testing. Once this is ready, I will post a Youtube-style video explaining everything to make it easier to digest than a whole bunch of formulas.

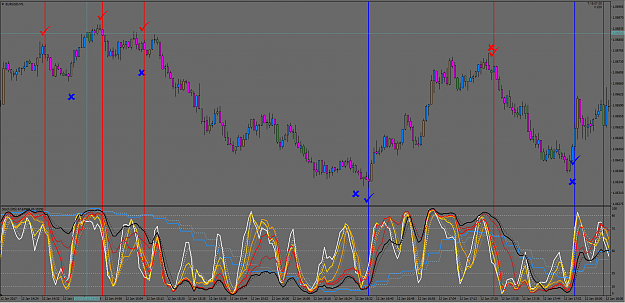

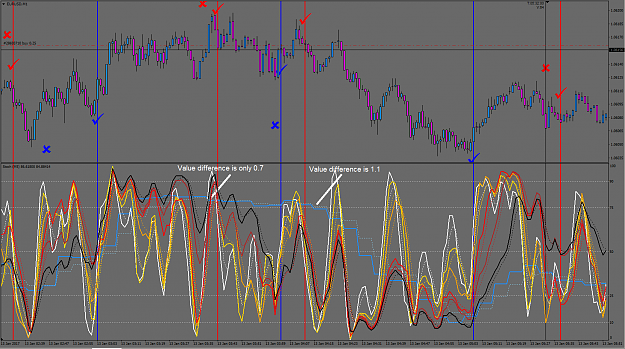

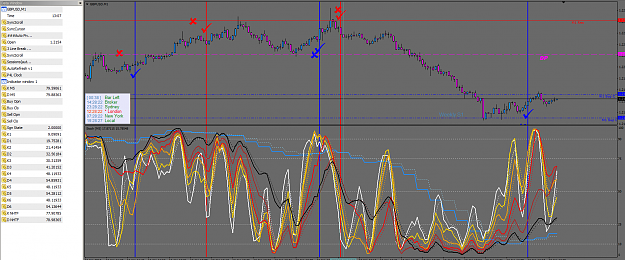

To give you a quick overview, rather than using 19 Stoch lines, I am now only using 6. All 6 will have their K AND D lines showing. These lines will be made up of the 6 Fibonacci numbers from 5 through to 55, with a 34/3/3 from the next highest time frame as a trade filter. It earns pips like a boss.

Essentially, when there is a change in direction from the higher time frame stoch (a simple K / D cross) in conjunction with all lower time frames stochs moving in the same direction AND above / below their respective D signal lines, it is an entry signal. There are some additional criteria which I will explain in the video.

But there will be NO MORE LWMA, NO MORE Bollinger Bands, NO MORE setup alerts etc. Just one alert to enter and one to exit. Far simpler and far more profitable.

See screenshot for an indication of how easy and powerful this is. Arrows are entries and crosses are exits.

There has admittedly been the standard problem of how to deal with repainting when dealing with a MTF indicator, but we are close to finalising a solution which should mean that this is no longer an issue.

PLEASE NOTE: I HAVE NOT ABANDONED MY INITIAL IDEA FOR THIS THREAD - I STILL HOPE TO HAVE A SOLUTION AVAILABLE IN THE FUTURE FOR THAT STRATEGY. This is an interim idea which will offer you pips until I get the more complicated stuff finalised.

To our joint success this year!

Kirk.

I realise things have been incredibly quiet in here of late, but no I have not "run off with the programmer" (LOL).

Many thanks to Dreamwalker for keeping the ball rolling and posting his results - congrats to you, good sir! Some great pips banked there!

What I have been doing is hosting friends, preparing to host family for a three week stay, searching for a new place to live, coding, testing and tweaking, and generally not getting much sleep!

During all of this I have come to the realisation that everything I have been working on, for now anyway, is too complicated and needs to be simplified. But do not fear, this is NOT a backward step. On the contrary, I have something in store for you all which is even better than what has already been presented to date.

The problem with the current strategy is in its' implementation - after coding we were getting confusing signals and things were just not working the way I had them working in my head. To be honest, it still needs a lot of work, and I would like to offer you something simpler and just as powerful, (if not more so!)

The adjusted strategy is based on everything explained here already, but has fewer rules and better results. My programmer is busy coding and we are nearing the release date for an early version for testing. Once this is ready, I will post a Youtube-style video explaining everything to make it easier to digest than a whole bunch of formulas.

To give you a quick overview, rather than using 19 Stoch lines, I am now only using 6. All 6 will have their K AND D lines showing. These lines will be made up of the 6 Fibonacci numbers from 5 through to 55, with a 34/3/3 from the next highest time frame as a trade filter. It earns pips like a boss.

Essentially, when there is a change in direction from the higher time frame stoch (a simple K / D cross) in conjunction with all lower time frames stochs moving in the same direction AND above / below their respective D signal lines, it is an entry signal. There are some additional criteria which I will explain in the video.

But there will be NO MORE LWMA, NO MORE Bollinger Bands, NO MORE setup alerts etc. Just one alert to enter and one to exit. Far simpler and far more profitable.

See screenshot for an indication of how easy and powerful this is. Arrows are entries and crosses are exits.

There has admittedly been the standard problem of how to deal with repainting when dealing with a MTF indicator, but we are close to finalising a solution which should mean that this is no longer an issue.

PLEASE NOTE: I HAVE NOT ABANDONED MY INITIAL IDEA FOR THIS THREAD - I STILL HOPE TO HAVE A SOLUTION AVAILABLE IN THE FUTURE FOR THAT STRATEGY. This is an interim idea which will offer you pips until I get the more complicated stuff finalised.

To our joint success this year!

Kirk.

Trade to Live - Don't Live to Trade

10