I asked this question myself, and also tried to back it up with some little simulations.

I was able to trade according to the rule of the selected strategy for quiet some time. Then I started to play around doing things that weren't proven. The profit I was able to made, start disappearing until it got to the point of complete account wipe out.

I made this little simulation in excel, because i want to see...

Will I be able to stay profitable in the Forex market?

This is what the simulation told me...

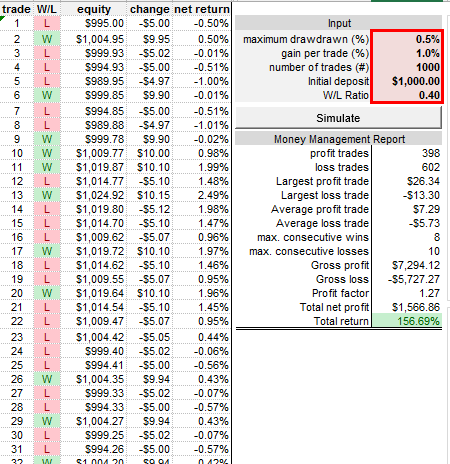

The simulation I made will random the outcome of the trades based on the predefined Win/Loss Ratio. Which purely depend on the trading approach (strategy) of the traders themselves.

The result above shows the trader who strictly followed the money management rules, and chose to only risk 0.5% of the capital in trade (assuming the trader only open 1 order at a time, hence DD of 0.5%) and set take profit level according to the Risk/Reward ratio of 2. Even if the trader managed to win only 38% of the time, the trader is still be able to make a total net return of over 100% in a long run.

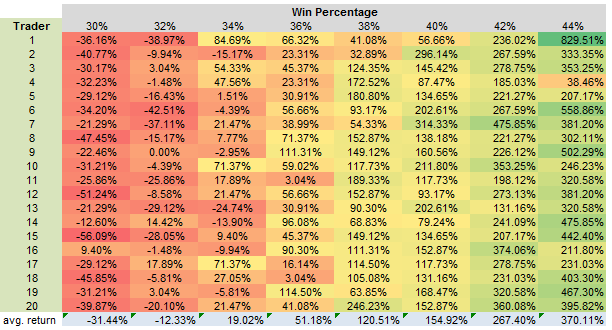

Based on the same simulation input data. I have also made a statistics preview of over 20 traders that shows the outcome of the strategies that given different win percentage.

The simulator had taught me about the power of money management, and the necessity of the ability to stay consistence with the chosen trading strategy.

If any of you feels like to play around with the number, just grab the excel file and play around with the input values. The statistics you have to implement it by yourself.

I was able to trade according to the rule of the selected strategy for quiet some time. Then I started to play around doing things that weren't proven. The profit I was able to made, start disappearing until it got to the point of complete account wipe out.

I made this little simulation in excel, because i want to see...

"what if" I am able to be consistence with the money management over long period of trading lifetime (>1000 trades).

"what if" The rule i set myself to begin with, doesn't change... and stay what it should, over the whole trading lifetime.

Will I be able to stay profitable in the Forex market?

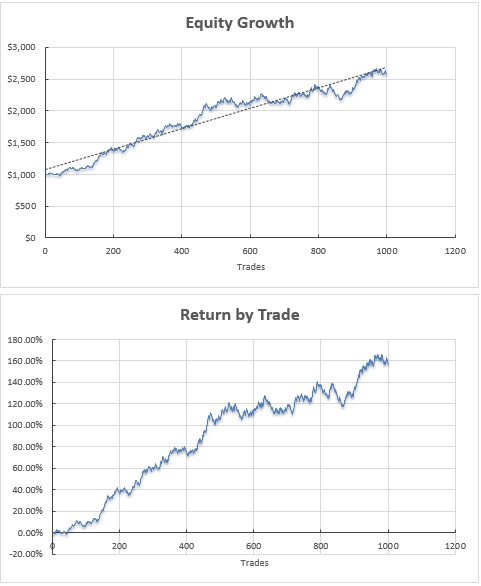

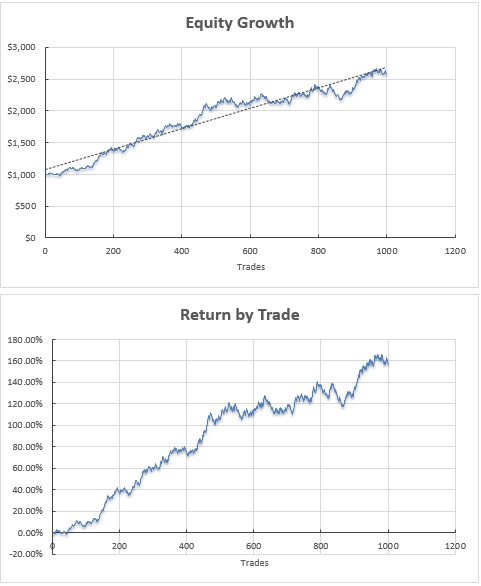

This is what the simulation told me...

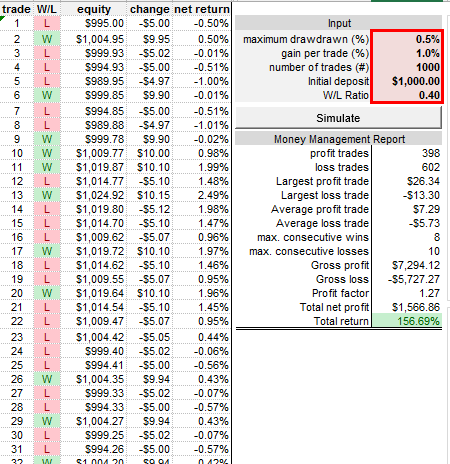

Attached Image

Attached Image

The simulation I made will random the outcome of the trades based on the predefined Win/Loss Ratio. Which purely depend on the trading approach (strategy) of the traders themselves.

The result above shows the trader who strictly followed the money management rules, and chose to only risk 0.5% of the capital in trade (assuming the trader only open 1 order at a time, hence DD of 0.5%) and set take profit level according to the Risk/Reward ratio of 2. Even if the trader managed to win only 38% of the time, the trader is still be able to make a total net return of over 100% in a long run.

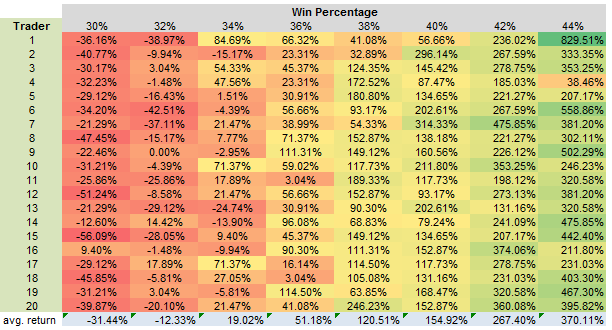

Based on the same simulation input data. I have also made a statistics preview of over 20 traders that shows the outcome of the strategies that given different win percentage.

Attached Image

The simulator had taught me about the power of money management, and the necessity of the ability to stay consistence with the chosen trading strategy.

QuoteDislikedNow that the money management is out of the way, it is time to find a strategy that given at least 34% win rate.

If any of you feels like to play around with the number, just grab the excel file and play around with the input values. The statistics you have to implement it by yourself.

Attached File(s)