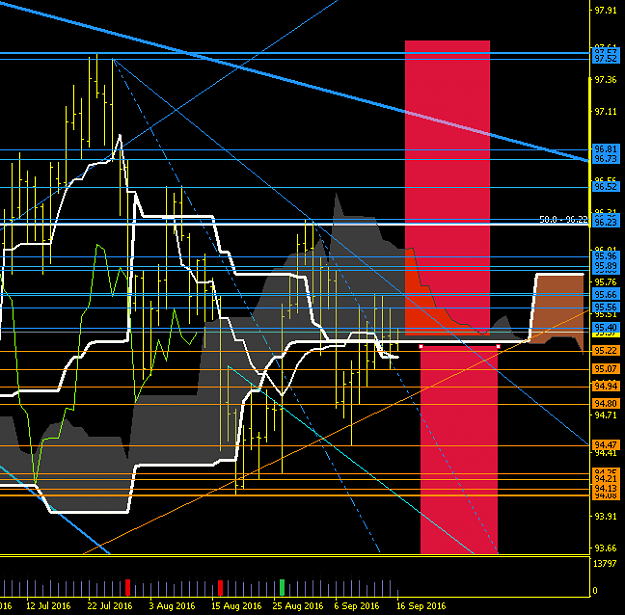

Disliked{quote} Also let me add a thing, the fact that GB went down immediately, without even a test or a TAG of the huge cluster higher is a clear sign of a liquidation. Stronger money will never leave behind a so weak reference without a test above it. This does not mean it cannot last. As always it means it is weak. Very weak. The only possible sign of something is changing with this, it's the possibility of a pit gap down late today. I mean, if this liquidation will last downside below yesterday pit low and price will not be able to come back up, creating...Ignored

Best

D.P.

Hunting High and Low