Hello guys and gals

Making my own thread to demonstrate my way of trading GBP/USD intraday.

I'm going to start with only one setup which I call 'Setup 1'. The name of the game is to enter trades where retail traders put their stop losses. These setups occur every day sometimes multiple times.

As we are trading futures market order flow, we must have some access to this data. Some providers are: Sierra charts, NinjaTrader, ClusterDelta (I use the latter, ClusterDelta)

I'll introduce Setup 2 & 3 in later posts. Let's just keep it simple for now. This setup has been tested by me and others for years.

The beauty of this setup is you don't have to screen watch. Just do your prep, set alerts at the Key Levels because we're only trading there. Once you're alert hits, then it's time to look for the entry. There are NO INDICATORS apart from FVG (Nephew Sam) on TradingView.

Some nomenclature first.

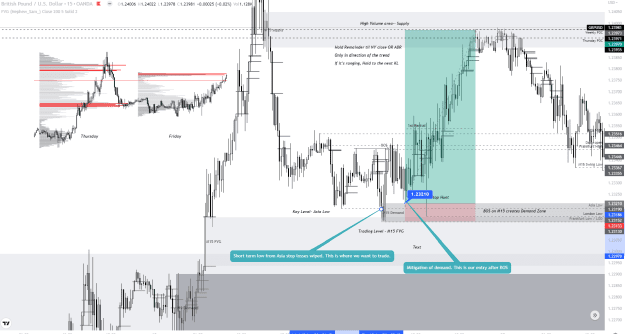

Key Levels. These are: [Asia High and Low. Frankfurt High and Low. London High and Low. New York High and Low] (these can be marked during the session, as long as they are at least m5 swing highs or lows) Previous Day's High and Low. Previous Weekly High and Lows. H4, H1, M15 Swing High and Swing Lows. Weekly Point of Control. Previous Days Point of Control. Daily Open (midnight UK time). Note we're also marking up session highs and lows from previous days

Trading Levels. These are: Supply & Demand levels (M5-H4). FVGs (M5 to H4). Clear SnR (H1 or above)

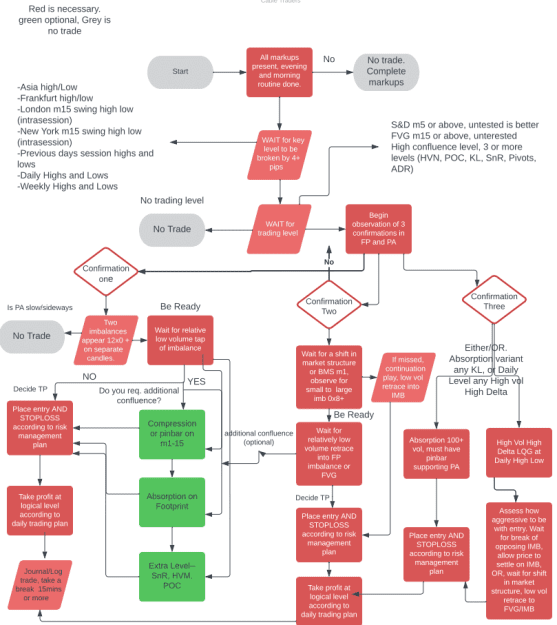

So, price must first sweep one of the Key Levels (set alerts at these so you don't screen-watch all day), then tap one of the Trading Levels.

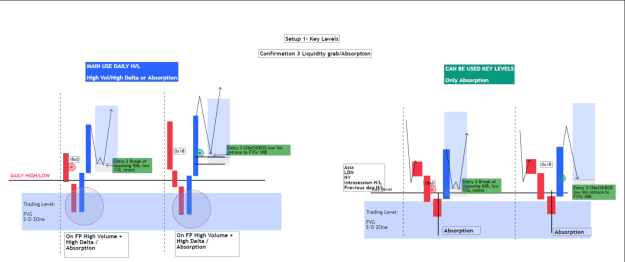

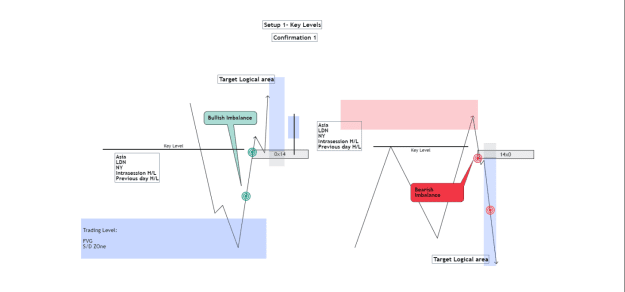

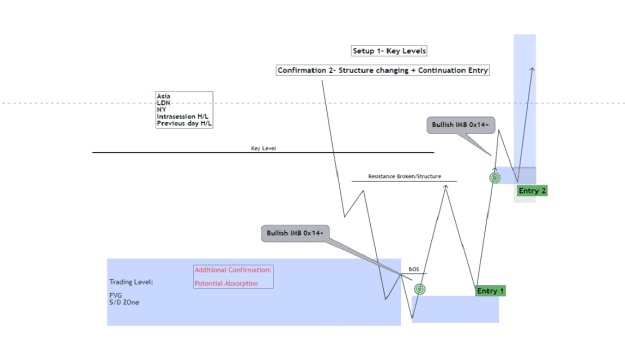

After that, we wait for confirmation. Refer to the attached Diagrams.

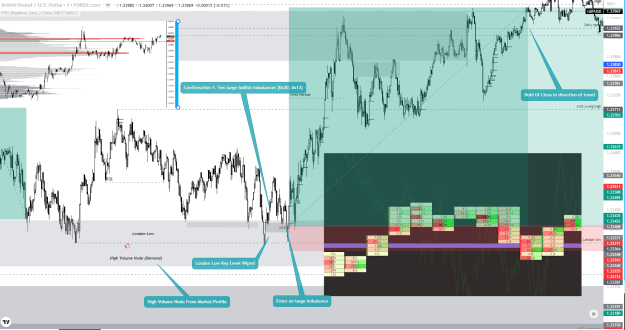

Confirmation 1: This is for rapid V shaped reversals which occur quite commonly. We wait for multiple bullish imbalances on the futures footprint (12x0 or above) for buying, or bearish imbalances for selling then enter on the tap of one of these (this may be quite fast) - OR, for an aggressive entry, enter on the break of an opposing large imbalance (20x0 or above)

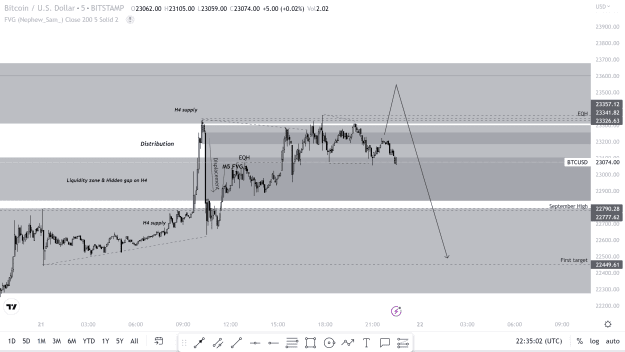

Confirmation 2: Wait for a break of structure on m5 (in a pinch, m1 BOS is fine) and wait for a retrace into any imbalance created on the move on a low volume pullback. Ideally this will be on an FVG.

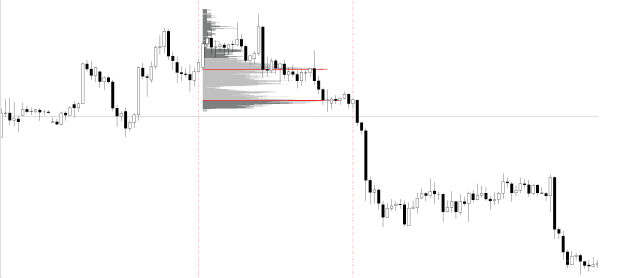

Confirmation 3: We wait for Absorption (volume 100+, ideally 200+ on the futures footprint and pinbar on m1). Enter immediately when this occurs.

Position Management

Enter two positions. First position is closed on the next key level. IF the market is trending, hold the second position to close in the direction of the trend OR 5 Day ADR (whichever is first). IF the market is ranging, close the second position on the next Key Level. Stop losses below the last short term low or, below the newly created SnD zone. IF trading from a footprint imbalance, you can use a 3-4 pip stop loss.

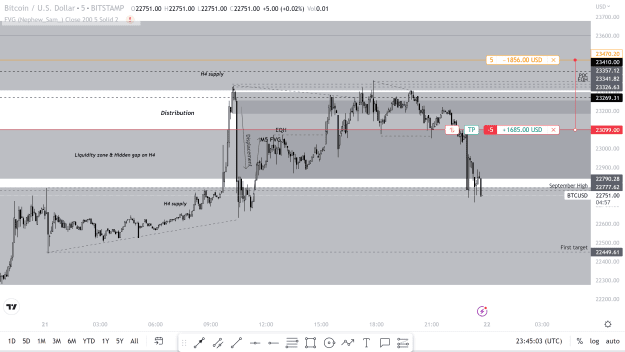

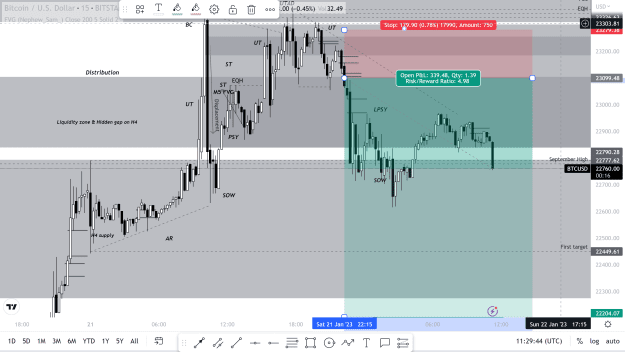

I have attached the 3 entry models for this setup, along with a process flow diagram and an example from Thursday that was taken with live funds. Note we wipe a daily POC in m15 supply so this is also a short trade during the asia session. Price usually reverses at Key Levels.

I will post examples of this setup every day, usually excluding Mondays as this day tends to be hard to trade.

I look forward to trading along with everyone! This setup should work on any pair but, I have tested it only on GU and EU. GU remains my favorite pair.

Note we also use Intramarket Analysis Mainly DXY to help determine bias. More on this later.

Edit: I've attached my Evening and Morning checklists. These should be completed every day. If you spend more time on prep than execution, it will pay dividends.

THIS is the GOLDEN RULE. DO NOT STARE AT THE SCREEN ALL DAY! Set alerts and go about your day. Keep half an eye on the charts on your mobile device and set alerts. You will profit more if you follow this simple rule. Don't spend more than 20 minutes in front of the screen. Follow the pomodoro method. After some time, the setups will jump out at you.

The other GOLDEN RULE of the thread please don't post any comments like 'its a sell' or 'its definitely a buy day' unless it's backed up with some analysis and charting, as it can throw others off in their confidence. This isn't aimed at anyone it's just a general rule.

Last Note. Generally trade with the trend, but it works counter trend too if you're careful. I have other setups for countertrend,.

Making my own thread to demonstrate my way of trading GBP/USD intraday.

I'm going to start with only one setup which I call 'Setup 1'. The name of the game is to enter trades where retail traders put their stop losses. These setups occur every day sometimes multiple times.

As we are trading futures market order flow, we must have some access to this data. Some providers are: Sierra charts, NinjaTrader, ClusterDelta (I use the latter, ClusterDelta)

I'll introduce Setup 2 & 3 in later posts. Let's just keep it simple for now. This setup has been tested by me and others for years.

The beauty of this setup is you don't have to screen watch. Just do your prep, set alerts at the Key Levels because we're only trading there. Once you're alert hits, then it's time to look for the entry. There are NO INDICATORS apart from FVG (Nephew Sam) on TradingView.

Some nomenclature first.

Key Levels. These are: [Asia High and Low. Frankfurt High and Low. London High and Low. New York High and Low] (these can be marked during the session, as long as they are at least m5 swing highs or lows) Previous Day's High and Low. Previous Weekly High and Lows. H4, H1, M15 Swing High and Swing Lows. Weekly Point of Control. Previous Days Point of Control. Daily Open (midnight UK time). Note we're also marking up session highs and lows from previous days

Trading Levels. These are: Supply & Demand levels (M5-H4). FVGs (M5 to H4). Clear SnR (H1 or above)

So, price must first sweep one of the Key Levels (set alerts at these so you don't screen-watch all day), then tap one of the Trading Levels.

After that, we wait for confirmation. Refer to the attached Diagrams.

Confirmation 1: This is for rapid V shaped reversals which occur quite commonly. We wait for multiple bullish imbalances on the futures footprint (12x0 or above) for buying, or bearish imbalances for selling then enter on the tap of one of these (this may be quite fast) - OR, for an aggressive entry, enter on the break of an opposing large imbalance (20x0 or above)

Confirmation 2: Wait for a break of structure on m5 (in a pinch, m1 BOS is fine) and wait for a retrace into any imbalance created on the move on a low volume pullback. Ideally this will be on an FVG.

Confirmation 3: We wait for Absorption (volume 100+, ideally 200+ on the futures footprint and pinbar on m1). Enter immediately when this occurs.

Position Management

Enter two positions. First position is closed on the next key level. IF the market is trending, hold the second position to close in the direction of the trend OR 5 Day ADR (whichever is first). IF the market is ranging, close the second position on the next Key Level. Stop losses below the last short term low or, below the newly created SnD zone. IF trading from a footprint imbalance, you can use a 3-4 pip stop loss.

I have attached the 3 entry models for this setup, along with a process flow diagram and an example from Thursday that was taken with live funds. Note we wipe a daily POC in m15 supply so this is also a short trade during the asia session. Price usually reverses at Key Levels.

I will post examples of this setup every day, usually excluding Mondays as this day tends to be hard to trade.

I look forward to trading along with everyone! This setup should work on any pair but, I have tested it only on GU and EU. GU remains my favorite pair.

Note we also use Intramarket Analysis Mainly DXY to help determine bias. More on this later.

Edit: I've attached my Evening and Morning checklists. These should be completed every day. If you spend more time on prep than execution, it will pay dividends.

THIS is the GOLDEN RULE. DO NOT STARE AT THE SCREEN ALL DAY! Set alerts and go about your day. Keep half an eye on the charts on your mobile device and set alerts. You will profit more if you follow this simple rule. Don't spend more than 20 minutes in front of the screen. Follow the pomodoro method. After some time, the setups will jump out at you.

The other GOLDEN RULE of the thread please don't post any comments like 'its a sell' or 'its definitely a buy day' unless it's backed up with some analysis and charting, as it can throw others off in their confidence. This isn't aimed at anyone it's just a general rule.

Last Note. Generally trade with the trend, but it works counter trend too if you're careful. I have other setups for countertrend,.

Attached File(s)